- Fink 🧠

- Posts

- 🔔 Why Does AUDJPY Rise & Fall With Stock Indices?

🔔 Why Does AUDJPY Rise & Fall With Stock Indices?

Today's Opening Belle is brought to you by Utrust 👇

Accept payments in Bitcoin, Ethereum, and major digital currencies

Another day, another leg lower in Aussie Yen...

Since the middle of November, the pair has lost over 4.7% / 400 pips.

Soooo, why are traders picking on the Aussie?

The Australian economy has been picking up after lockdowns, so what's going on?

Currencies don't always reflect the economic fundamentals of a country.

Analysts like to throw around 'fair value' models and gimmicks like the Big Mac Index.

Currencies like to frequently ignore them.

Context is always key.

Some models and correlations are more useful than others.

For example, AUDJPY is tightly correlated with US stock indices...

Sounds weird when you first hear it, but the correlation is strong 👇

Top panel is AUDJPY overlaid with SPX (S&P 500)

Lower panel is the correlation coefficient

There's clearly a positive correlation.

Why would these two markets be correlated?

Both are heavily influenced by overall risk sentiment.

Think of a market cycle 👇

Typically, each cycle ends with a recession/crisis and during this Risk Off period, investors:

Don't want to take on new risky positions

Will sell riskier investments as fears about the economic future pile up

Buy safer investments and accept lower returns until the worst has passed

This unwinding of riskier trades drives flows back into funding currencies such as the Japanese yen.

Sponsored: Easily receive crypto payments with Utrust 👇👇👇

utrust

Why is the yen a funding currency?

Japanese bond yields have been low and stable for the past few years now.

Japan's 10y bond has offered a paltry yield of 0.18% at best since 2016, and frequently dipped into negative yield territory.

Low interest rates = cheap borrowing

Because it's cheap to borrow in Japan, investors will borrow in the cheaper currency (yen) and then buy a higher yielding asset in a different currency.

In a Risk Off period, those debts need to be repaid so the reverse happens.

Let's stay conservative and use 10y Australian government bonds as an example.

Currently yielding 1.67%

Not the most exciting trade, but there's a differential to capture.

Borrow in yen for next to nothing

Buy Aussie bonds

Pocket the difference (spread)

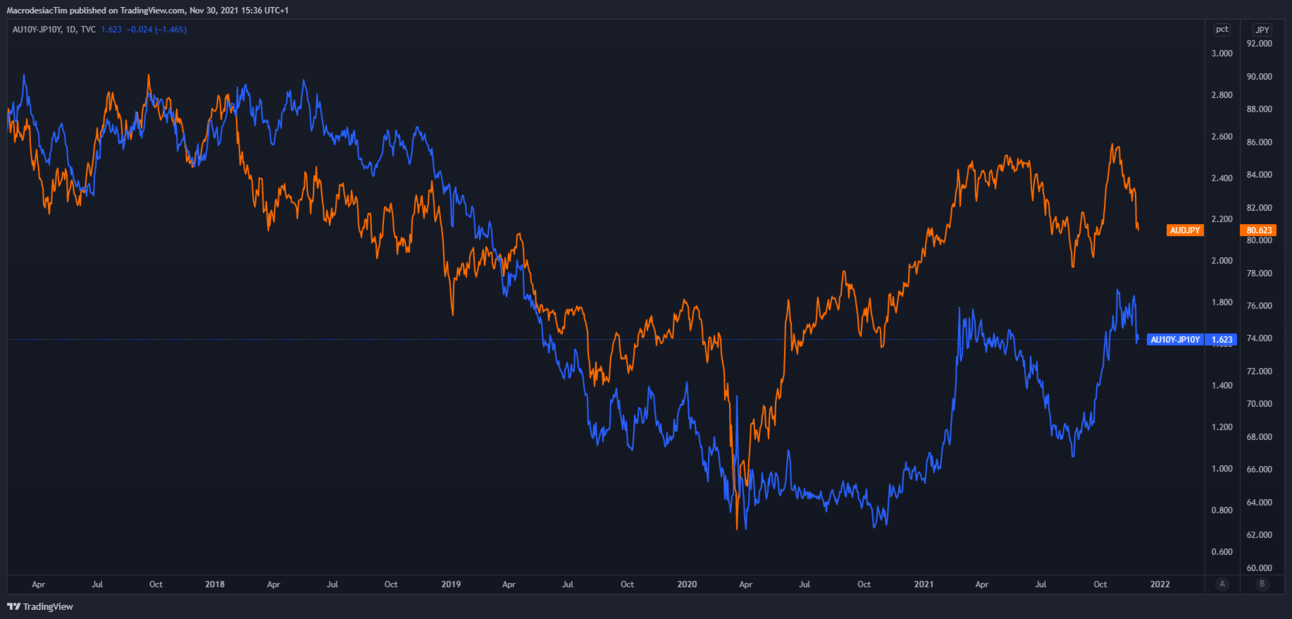

And that's what we see here 👇

The orange line is AUDJPY.

The blue line is the difference (spread) between Australian & Japanese 10Y bond yields.

As the spread narrows (Risk Off) AUDJPY heads lower

As the spread widens (Risk On) AUDJPY heads higher

As we can see though, this doesn't explain everything. In 2020. AUDJPY rallied even before the bond spread widened.

This is where economic activity plays its part

Back to the market cycle 👇

In 2020, the transition from start of crisis management to Risk On seemed to happen overnight.

The Australian Dollar is very sensitive to global economic conditions, especially production.

Consumer demand was high. Manufacturing activity shot through the roof, which meant high demand for commodities such as iron ore and copper, both of which are key Australian exports.

When economic activity is booming, corporate earnings tend to increase along with buybacks, both of which are positive for stock prices.

Economic activity fuels overall risk sentiment, which benefits 'activity' currencies such as the Australian dollar and company profits.

Which is why US stock indices and AUDJPY often rise and fall together.

Don't know what financial news stories are important and what is complete bullsh*t? Hop onto our filtered news channel.

It's completely free 👇👇👇

And if you really want to get to grips with how global markets and economics work, with trade ideas to give you actionable context, then come and join us as a premium member where you're likely going to get a nice Market IQ boost. 👇

Check out our reviews on TrustPilot 👇👇👇