- Fink 🧠

- Posts

- 💵 Only The Best Ideas

💵 Only The Best Ideas

In partnership with Utrust, the only crypto payments gateway your business needs 👇

Quick reminder 🙌

💸 Transaction fees can be 10x lower;

🌍 No cross-border fees;

⚡️ Faster payments & settlements;

🛡 No chargebacks (fraud);

💯 No payment limits (ex. cards have limits);

🔐 Works with any wallet, your keys your money (Satoshi’s vision);

🔜 Merchant Yield. https://t.co/XcemXjNcRJ— Utrust (@UTRUST) October 6, 2022

Buy and hold is a sham. Everything's a scam. Buy cans of spam. Stick to the day job? Yeah alright, probably best.

Some lovely synergy on the interwebz yesterday. I'm frequently amazed by how misunderstood the investing world is. First up, some drivel 👇

The “buy and hold” strategy that Wall St sells you is a sham.

Yes during certain periods of time it may work. Most of the time it doesn’t and you are most likely losing your purchasing power over the longer term.

Give this a listen. Good stuff. pic.twitter.com/Oy6ocdMQZR— QE Infinity (@StealthQE4) January 9, 2023

Narrator: "It wasn't good stuff"

While it's true that whatever Wall Street is selling might not be exactly what it purports to be (and there are no guarantees that it's aligned with your best interests), that doesn't mean it's a sham!

Sort of like Diet Coke. When you really stop and think about it, what's the point of Diet Coke?

If you're dehydrated, water's the best bet. Maybe even go with Lucozade or some sports drink that brings the electrolytes back up.

If you want an energy boost, then drink Red Bull or Monster. Or coffee.

Diet Coke is basically the wrong choice of drink in every scenario other than "I want Coke without sugar".

And investing is the same, right. There needs to be a purpose to it, a point, an end goal.

If you just buy one stock, hold it forever and hope for the best, there's every chance it won't work out, (or at best the returns will be sub-optimal). 👇

The Veteran's a huge fan of JPMorgan's Agony & Ecstasy research precisely because of stats like these 👇

Roughly 40% of all stocks have suffered a permanent -70%+ decline from their peak value.

For Technology, Biotech and Metals & Mining, the numbers were considerably higher.

Or you can look at Jeremy Siegel's research on the Nifty Fifty era 👇

Stocks for the Long Run determined companies that routinely sold for P/E ratios above 50 consistently performed worse than the broader market (as measured by the S&P 500) in the next 25 yearswith only a few exceptions.

That's no reason to panic. Many of those companies are still household names today. They just don't trade at the same premium they once did.

So, don't buy and hold then?

The answer is always the same: IT DEPENDS

Most of the time, what Wall Street sells isn't buy and hold. It's buy, hold, buy more, hold, repeat.

Actually just keep sending us money every month and we'll buy more stocks with it on your behalf. In an index fund, so you're massively diversified across sectors and/or durations. Which is great.

Especially in an infinite bull market... 👇

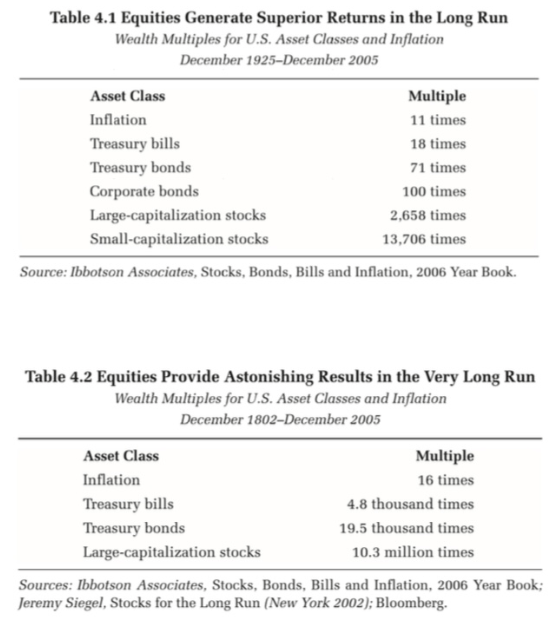

Maybe you get more personalised advice/management and diversify your investments beyond stock indices. Add some government bonds too, a bit of company debt, some small-cap stocks...

Source

Allocate 1% of the portfolio to gold just because that's what people do...

All of which is the point. These types of strategy are optimised for moderate wealth growth over time, not for I'm the GOAT stock-picker returns!

It's literally investment compounding. Reinvest dividends, add savings, keep buying. Also known as...

Dollar-Cost-Averaging (DCA).

Very boring, very vanilla, but it generally works. Keep investing, ride out the dips, don't try to time anything, and let everything work itself out so you can have a big pot of cash to draw down on when you retire.

The following chart from Nick Maggiulli illustrates the simulation results for someone who invests $10,000 a year for 30 years:

However, it's often easy to get distracted by finding the next big thing (i.e. excitement)... 👇

There's nothing wrong with that either. But if that's what you're after, you don't want to be diversified!

There's always a tradeoff.

You want relatively stable returns over time? Diversify.

You want to aim bigger and outperform the market? Focus on the best trade ideas. Go for the concentration risk. Embrace it fully, a higher risk, higher return strat.

Andrew Carnegie, Stan Druckenmiller and Warren Buffet have all been associated with this quote:

"Put all your eggs in one basket and then watch that basket"

It's an entirely different investment profile. Many will argue that stock-picking and active management is a fool's game. That active managers frequently underperform their benchmark.

Which is where that synergy comes in. This paper hit my inbox yesterday (via @InvestmentTalkk's weekly) 👇

Many have interpreted the fact that skilled professionals fail to beat the market by a significant amount as very strong evidence for the efficiency of the stock market.

This paper asks a related simple question. What if each mutual fund manager had only to pick a few stocks, their best ideas? Could they outperform under those circumstances?

We document strong evidence that they could, as the best ideas of active managers generate up to an order of magnitude more alpha than their portfolio as a whole, depending on the performance benchmark and the type of stocks and funds in question.

Instead of focusing on that concentration risk (only the best ideas), fund managers tend to dilute the excellence down, presumably because the concentration risk is deemed too risky, or because they're motivated to bring as much cash as possible under management (AUM) to generate more fees.

If your portfolio is only three relatively small stocks, each new injection of investor capital from investors brings the fund closer to the maximum share of the companies they can own... Liquidity constraints will quickly become a problem, capping the size your chosen concentrated risk fund could reach.

Summing up, it's not all a scam, a sham, or anything negative. It is what it is.

Incentives and motives matter. Let's at least start there if we're going to have an honest discussion about the 'right' things people should do with their savings.