- Fink 🧠

- Posts

- 🔔 Big Banks Are Making Big Profits

🔔 Big Banks Are Making Big Profits

Earnings season really getting into the swing this week, and the banks kick things off as always 👇👇👇

The first two banks to report were Goldman Sachs and JPMorgan.

Both had monster quarters and big profits...

Let's dive in...

JPMorgan revenues came in at $31.4bn, beating estimates of $30.04bn, and Earnings Per Share (EPS) was a big beat at $3.78 vs estimates of $3.05.

Trading revenue was $6.79 billion, falling 30% from a blockbuster quarter a year ago but better than executives had forecast. Investment banking fees rose 25%. Stock underwriting revenue rose 9%, and debt underwriting rose 26%. Fees from advising on mergers and acquisitions rose 52%.

$4.1 billion in fixed income trading

$2.69 billion equities trading revenue.

$3.4 billion in investment banking revenue

$2.3 billion release of loan loss reserves

And this last one is an absolutely key factor (& ties in with the U.S. Consumer mentioned last week) 👇👇👇

CEO Jamie Dimon:

“Consumer and wholesale balance sheets remain exceptionally strong as the economic outlook continues to improve,”

“In particular, net charge-offs, down 53%, were better than expected, reflecting the increasingly healthy condition of our customers and clients.”

Healthy condition of our customers and clients = we are happy to lend to them...

And they are spending 👇👇👇

$JPM Mortgage $39.6Billion +64% YoY +1% QoQ, MSR/3rd party loans serviced 0.97%, MSR Revenue Multiple 3.59x. Auto Loans were up +61%YoY & up +11% QoQ.

Mortgages still strong.. some slow down coz lack of inventory.. but Auto continues to Rip, Rip… Rip. $XLF #Reflation— PlungeProtectionTeam (@gamesblazer06) July 13, 2021

Sponsored: Consumers ready to spend and you don't accept crypto yet?

Utrust have you covered 👇👇👇

How about Goldman Sachs?

Reuters summed it up well...

Wall Street's biggest investment bank capitalized on record global dealmaking activity

Revenues of $15.39bn beat the expected $12.43bn

EPS came in at $15.02 vs forecasts of $10.25...

Goldman was an adviser on many of the quarter’s largest deals, including AT&T Inc.’s combination of its WarnerMedia division with Discovery Inc., Medline Industries Inc.’s sale to a group of private-equity firms and Microsoft Corp.’s $16 billion acquisition of Nuance Communications Inc.

What's next for the banking sector?

A lot of the commentary focuses on a fall in core business due to low rates and low demand for loans, with trading revenues also expected to fall.

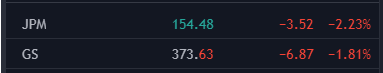

This is perhaps why the stocks are both down today even after such bumper results...

There are some key assumptions here too.

Trading revenues to fall makes sense, purely because they're coming from high levels.

Loan growth though, I'm not so sure.

If the Federal Reserve keep short-term interest rates low (don't panic-tighten in response to inflation) and are prepared to sit on the sidelines as employment recovers & the consumer begins to borrow again, then lending will look attractive.

A steeper yield curve would certainly help as banks borrow at short term rates and lend at longer term rates, pocketing the spread as their profits.

Thankfully, is is nothing like 2008, and bank lending shouldn't be a problem going forward... 🤞

Sponsored: Don't miss out on this great chat and giveaway! 👇👇

It's happening tomorrow! Sign up now for our exclusive fireside chat with @_jdkanani, CEO of @0xPolygon, and learn more about Polygon's listing on https://t.co/WyKvFsIlxb. The first 100 will win 5 $MATIC each! https://t.co/4OEM9F5Lse— EQONEX (@eqonex) July 13, 2021