- Fink 🧠

- Posts

- 🔔 Catching Zombies Before They Zombify...

🔔 Catching Zombies Before They Zombify...

Today's Opening Belle is brought to you by Utrust 👇

Accept payments in Bitcoin, Ethereum, and major digital currencies

The Veteran's been Zombie hunting...

Not like that

He's been hunting for zombies that haven't quite made the transition yet. 👇

In a July 2021 blog post, the US Federal Reserve described “Zombie Companies” as those that are economically unviable and that survive by tapping the banks and capital markets.

The Fed found that historically these firms were often in manufacturing and retailing and that their numbers had been cyclical, based on the health of the underlying economy. Rising in recession and falling during expansions.

We have previously looked at the dogs of the S&P 500 here... 👇

But Tim and I wondered if it would be possible to try and identify potential future zombies and what we might learn from doing that.

So here goes!

The Fed concedes there is no standardized or formal definition for a Zombie Company (surprising as that may seem). Although in the age of the meme stocks perhaps that’s just as well.

After all, Hertz, Gamestop and AMC Entertainment are just three examples of dead stocks that sprang back to life thanks to an army of disenchanted but social connected retail investors.

However, as we are going on a Zombie hunt we should probably know what we are looking for.

In its research, the Fed looked for stocks that had negative real sales growth over the previous three years and which had a low-interest cover ratio i.e the ratio between bills, liabilities and the cash and assets with which to pay them.

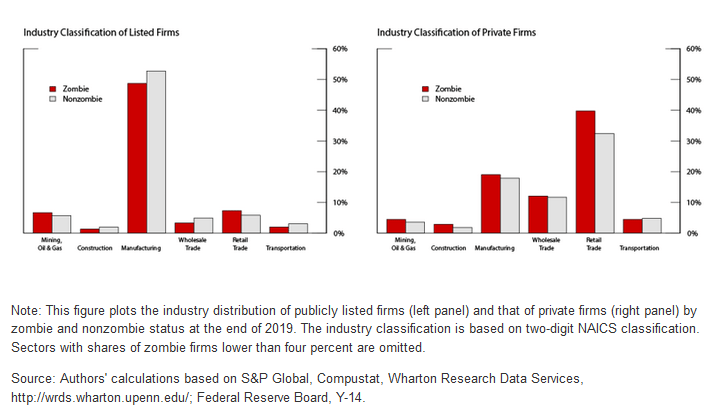

The percentage of US Zombie firms over time

The distribution of Zombies by industry in both listed and privately held firms

How shall we proceed?

Well let’s start with a stock universe and for simplicity let’s start with the S&P 500.

Taking those 500 odd stocks we can start to trim down the list of names by looking for those stocks that have experienced a prolonged period of flat or declining EPS (Earnings Per Share) which is the lifeblood of any viable business over the long term).

If your EPS growth is stagnant or falling consistently, then something is wrong with your business model, your products or your chosen marketplace.

Sponsored: Easily receive crypto payments with Utrust 👇👇👇

utrust

Screening the S&P for stocks with a 5 year EPS growth of less than 5% creates a list of 54 stocks.

Yes, that’s right more than 10% of the stocks in the worlds largest equity index, which is consistently making new all-time highs, are effectively experiencing negative real growth because inflation in the USA is running north of 6.0% pa.

Having created what we can think of as a long list from the S&P 500 constituents we can aim to whittle that down further by looking at another key metric associated with expansion: Sales growth.

If we apply a filter that looks for stocks with a 5-year sales growth of less than 2.00% we trim our list of candidates down to just 23 names.

To cut our list down further let’s look at some returns among the shortlisted stocks. We are not talking about market returns here, but rather internal returns in the business...

Specifically the return on investment or ROI which is simply the amount of money you could expect to receive for every dollar invested internally in the business.

If we screen for those businesses with an ROI of less than 10% we can reduce the list to just 14 names.

Now we can turn our attention to the finances of these businesses and look at the ratio of assets to liabilities: basically what they own and earn compared to what they owe and have to pay.

One way to do that is to look at the current ratio for each firm and compare that to the index average. As of the end of September this stood at 2.26.

The higher the number the better the health of a business on this metric especially if that number is at or above the prevailing average.

A list of the Potential Zombies that our investigations unearthed:

It seems counter-intuitive to see Pfizer in that list given Covid and the success of its vaccine. And in truth, it has probably turned a corner on that basis.

However, EPS has grown by just +2.20% over the last 5 years and sales fell by -3.0%. It has a current ratio of just 1.4 and a return on investment of just +7.60% so the virus arrived in the nick of time.

Not that a 281 billion dollar company bleeds to death overnight, rather it is usually a case of death by 1000 cuts unless somebody or something chops the head off.

Don’t take this list as gospel and don’t trade against it without doing further due diligence and research.

Hopefully, this post will serve as a starting point for your own Zombie hunt.

Don't know what financial news stories are important and what is complete bullsh*t? Hop onto our filtered news channel.

It's completely free 👇👇👇

Here's this morning's call:

And if you really want to get to grips with how global markets and economics work, with trade ideas to give you actionable context, then come and join us as a premium member where you're likely going to get a nice Market IQ boost. 👇

SPECIAL OFFER: Right, so we wanna get more people with us long term.

The simple fact is that providing a monthly subscription means too many who want instant gratification join Macrodesiac. We want you to learn FOREVER for pretty damn cheap... £299 FOREVER, instead of £399. Click here to get on for LIFE now

Check out our reviews on TrustPilot 👇👇👇