- Fink 🧠

- Posts

- 🔔 China's axe hangs over European fashion stocks

🔔 China's axe hangs over European fashion stocks

Today's Opening Belle is brought to you by our partners, Equos and Utrust.

Looking for a crypto exchange? Give Equos a try (they've also just released an exchange token too, similar to BNB and FTT.

And want to incorporate crypto payments into your business? Definitely use Utrust.

We only work with partners we know, trust and have a strong product.

No exceptions.

China tensions ratcheting up

The EU, UK, U.S and Canada jointly imposed sanctions on officials in China over the human rights abuses in Xinjiang earlier this week, and China hit back with sanctions of their own, especially aimed towards Europe...

The sanctions have cast doubt on the ratification of the EU-China investment deal (CAI) and China 's social media has suddenly come alive with calls to boycott the boycotters:

H&M actually announced their decision to stop buying cotton from the region a year ago so the timing of this social media storm is 'interesting'...

Hong Kong is basically China now 👇

Whichever way you slice it there seems to be no going back...

Glad to meet @SecBlinken in Brussels today.

EU-U.S. relations are back. We agreed on stronger cooperation on key issues, such as the EU-US dialogue on China, cooperation on security and defence matters, JCPOA and Russia.

Joint statement: https://t.co/azNPzudM5r pic.twitter.com/YoJA2SOVmK— Josep Borrell Fontelles (@JosepBorrellF) March 24, 2021

The allies are getting back together and China isn't even thinking about changing course...

We wrote about this last year 👇

And it looks increasingly like this decoupling and shifting of supply chains away from China is set to continue...

But what does the future hold?

This thread of snippets from a conversation with Former Deputy National Security Advisor Matt Pottinger is thought-provoking 👇

W/ the Xinjiang/MNC news, revisit Pottinger: "deliberate policy by Beijing now to force American businesses to choose. They can either represent US values and democratic norms, or they can do business in China and leave all of that behind" starts at 45:51 https://t.co/B1VyVwWQew— Dexter Roberts (@dtiffroberts) March 25, 2021

"If I were a ceo I would be working very hard to try to educate myself on this new geo-strategic reality and I would be doing a lot more careful risk assessment for all those factors and also for their supply chains"...— Dexter Roberts (@dtiffroberts) March 25, 2021

To what extent do CEO's worry about reputational risk?

Principles over profits? 🤔

Time will tell...

🔥 Hot and 🚫 Not

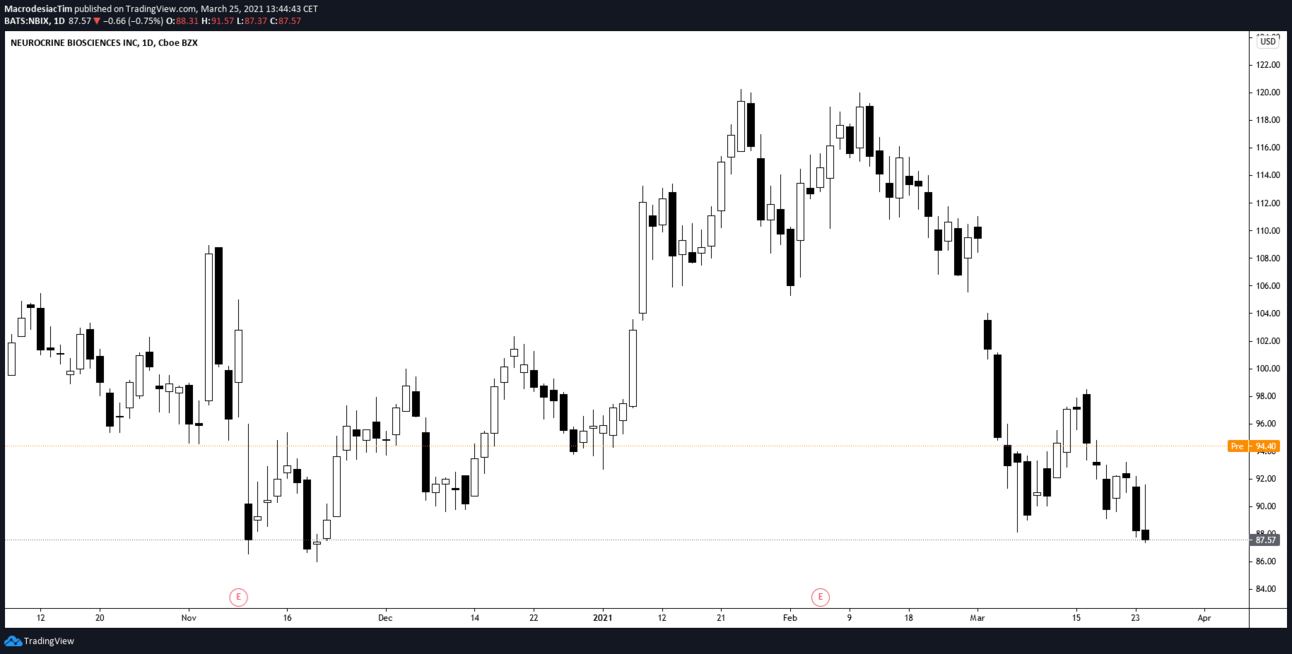

🔥 Neurocrine Biosciences

NBIX +8% in pre-market after the announcement that they will replace O-I Glass in the S&P MidCap 400...

Neurocrine Biosciences, Inc. is a neuroscience-focused, biopharmaceutical company. It discovers, develops and intends to commercialize drugs for the treatment of neurological and endocrine related diseases and disorders.

A glance at the list of therapeutic interventions they're working on...

anxiety, depression, alzheimer's disease, insomnia, stroke, malignant brain tumors, multiple sclerosis, obesity, and diabetes

Wow. Should keep them busy!

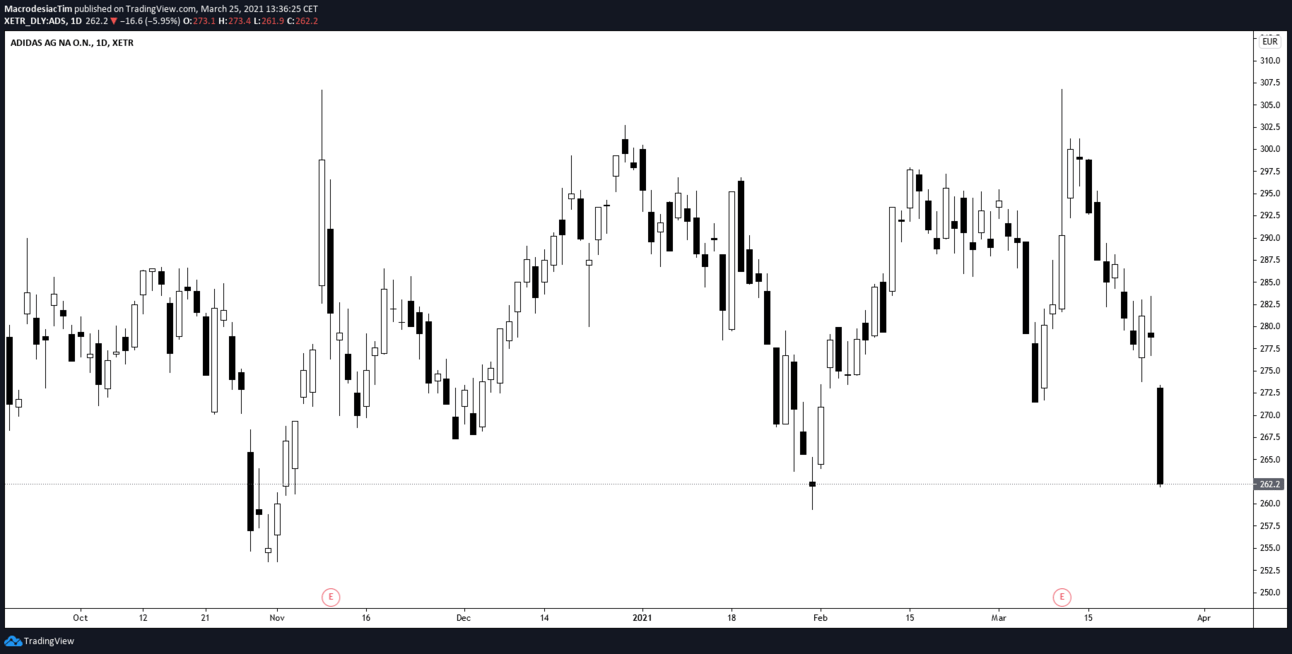

🚫 European Fashion Stocks

The China backlash sent shares of Adidas, Inditex and H&M tumbling, with Adidas (-5.8%) the biggest losers on the day...

Yep, the Swiss National Bank kept their deposit rate at -0.75% again at today's meeting and they will continue intervening to weaken the Franc....

The SNB still considers the Swiss franc to be "highly valued" and say they are "ready to intervene on the foreign exchange market if necessary, taking into account the situation for all currencies"

“Foreign exchange market interventions and the associated expansion of the balance sheet are currently a necessary monetary policy instrument and have nothing to do with currency manipulation.”

That line (and a few other factors) all feature in today's premium piece

Give it a read here 👇