- Fink 🧠

- Posts

- Here Comes The Inflation

Here Comes The Inflation

Hit it!

Nah, na na na nah

Na na na nah, na na nah, na na nah

Na na na nah

Here comes dee in-flay-shun (murderer)

Who knew a classic song could be re-purposed in so many BRILLIANT ways?

Inflation is set to be the main talking point of the week ahead, with the U.S. CPI release on Wednesday.

Whilst I can scream into a vortex that current inflation pressures are driven by supply issues & base effects, point out the many reasons it will be transitory, the market couldn't give two flying f*cks about my opinion...

Inflation will be high, it will stick, the Fed will have to do something to bring it under control and they should probably curb some of this irresponsible speculative excess while they're at it!

All of which may be true, as much as I disagree...

Then we have these takes...

If you spotted that these talking heads are two of the BEST Bitcoin contrarian indicators, congratulations!

Are they wrong about this too?

Yes and no...

What they're pointing out is the default central bank position!

They are constantly 'cornered' or 'trapped' by these issues.

It is literally their job to keep walking that tightrope between the 'right' amount of inflation/maximum employment and too much of anything that threatens financial stability.

Damned if it does/damned if it doesn't is just part of their daily grind.

So why would they backtrack now?

Inflation Vs The Fed

Maybe I'm wrong...

Perhaps those many hours I've spent watching Fed officials pontificate about inequality, the outsized pandemic impact on lower income & minorities, the many reasons why inflation will be transitory and the fact that they believe employment can be much higher than previously believed without causing excessive inflation (Phillips Curve is DEAD) will all be wasted...

They'll bottle it.

Fiscal spending and economic overheating will put them in a bind.

The fear that this time really IS different will overcome them and they'll hike rates by 2% in a single meeting just to bring the tiniest amount of relief from this rampant inflation...

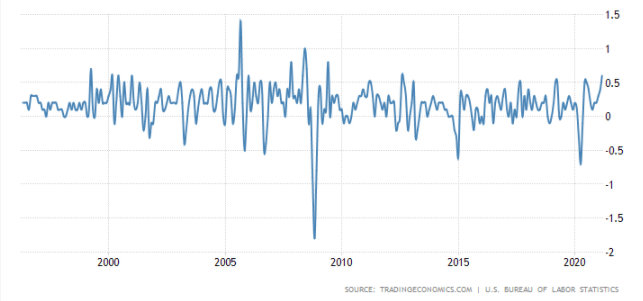

After all, we are expecting an enormous MoM print of 0.2%...

U.S. MoM inflation Rate

But that's not really the point, inflation is all about belief.

If expectations are correct, the headlines will scream about the 3.6% YoY print, and the 2.3% core might get some attention too.

We're in the eye of the inflation storm and this is just the beginning...

Over to Nordea:

Even if the Fed is trying to deflate the importance of short-term inflation numbers, next week’s CPI print could nevertheless be of importance.

The consensus forecasts of CPI at 3.6% y/y and core CPI 2.3% y/y are logical, but we see marked upside risks over the coming months.

Our trusted old CPI model, which we admittedly doubt despite working brilliantly for nearly 20 years, says that 5-6% inflation is more than possible.

And this economist has a model that predicts 12% inflation by the end of the year...

19/n

What this simulation tells us is that we should see a very, very sharp increase in US inflation in the coming months and inflation could be heading above 12% by the end of the year.— Lars Christensen (@MaMoMVPY) April 29, 2021

A LOT of people are suddenly inflation believers...

There's no doubt that inflation is REAL, and measured inflation will be coming in hot.

Commodities are absolutely flying and Chinese manufacturers have apparently declared Force Majeure...

It's hard to stay confident in a deflationary outcome when this kind of stuff is happening and lumber is pricing through the roof...

Get it?

Was a joke about homebuilding.

Why aren't you laughing?

Anyway, ask yourself one question.

Is this going to be our 'new normal'?

A world of skyhigh shipping costs and commodity producers grabbing their customers balls and squeezing...

Goodfellas gave us a preview of the 'new normal'

Is this going to be our post pandemic world? 👆

I'll take the other side on this, although I can definitely see the Fed being seriously tested by some high inflation prints this year.

We are likely to see the definitions of transitory stretched to the limit.

Transitory

Not permanent/temporary ✅

Lasting only for a short period of time 😬

But we can't ignore the ridiculous state of the labour market, and Fridays NFP of 266k was waaaay below even the most pessimistic assessment...

This disappointment has led some to speculate that wages will HAVE TO increase rapidly...

Job openings are RECORD hard to fill

Hiring not impressive (NFP a clear disappointment)

Bottom-line: Get ready for bigger sign-on bonuses and higher wages! pic.twitter.com/iafIOATMoE— AndreasStenoLarsen (@AndreasSteno) May 7, 2021

For me, this is simply too... simplistic.

A Pew Research Center survey this year found that 66 percent of the unemployed had “seriously considered” changing their field of work, a far greater percentage than during the Great Recession.

People who used to work in restaurants or travel are finding higher-paying jobs in warehouses or real estate, for example.

Or they want a job that is more stable and less likely to be exposed to the coronavirus — or any other deadly virus down the road.

Consider that grocery stores shed over 49,000 workers in April and nursing care facilities lost nearly 20,000.

...it’s notable that the manufacturing sector has bounced back strongly, yet the industry has only added back about 60 percent of the jobs lost.

This suggests many factories are ramping up automation in a way that allows them to do more with fewer workers.

When companies, especially fast-food restaurants, complain they can’t find workers, the common retort is, “Why don’t these companies raise pay?”

In fact, there is evidence that restaurants are raising pay. The average hourly rate in the hospitality sector is up roughly $1 compared to the pre-pandemic going rate.

But the bigger issue appears to be that warehouses have hiked wages by more than a dollar and now pay $26 an hour on average — far more than the roughly $18 average in hospitality.

The whole article is worth a read, and really highlights how difficult it is to draw any conclusions on the labour market this early in the recovery.

There are still another 5 months until the enhanced unemployment benefits expire in September too.

Then there's the question of companies being so eager to hire that they'll pay everyone more (you can't just hike wages for the newbies or the existing staff will walk) at the same time as commodities and other inputs are increasing exponentially and a corporate tax increase is on the horizon...

Everyone's going to be sticking their oar in, from economic commentators to politicians and business leaders.

It's going to be messy, and will probably stay the same for the next few months so I'm going back to the old 'bond guys are the smartest' playbook.

Let's follow that liquidity...

We're now back into the early 2020 range (box is 2019 high to low, red lines are 2020 pre-Covid) 👇

And there was ZERO appetite to buy the U.S. 10Y below 1.5% yield on Friday...

We've seen dollar downside while yields have caught up elsewhere and real yields have taken a pounding which has been good for gold...

And there's a treasury auction a few hours after the CPI data this week.

$41 billion of 10Y at 6PM BST (and $27 billion of 30Y the following day)...

If yields do push higher from here, we should start to see USD upside again, as those rate differentials widen and real yields become less negative again...

This week will be a huge test for bond appetite at current yields.

Where yields go, the USD should follow.