- Fink 🧠

- Posts

- Commodities set to take a breather? We reckon 'yeah'

Commodities set to take a breather? We reckon 'yeah'

Perhaps if you are blind, deaf and dumb, you could be excused from ignoring the mammoth commodities rally over the past year and a bit.

Let's refresh our heads at what's happened.

Seriously, that is a pretty ridiculous rally there.

From the low in March '20, the commodities index has increased by 126%!

Back in May, we mentioned the commodities super-cycle and how it may come to an end (also mentioned it last year when it had just started in relation to our GBPJPY trade)...

Now, we're really starting to think that we have come to a bit of a precipice.

Let's look at some of the data that's giving us a shout towards this view.

Chiense new orders have been in a bit of a downtrend through 2021...

And has infact turned negative just recently.

Now, I have a nice little leading indicator for global EPS (earnings per share) growth stemming from South Korean exports.

I want to show you this chart before we get into that, though.

Naturally what we have to be careful of here is that we have a reading of two different metrics, one in nominal $ (South Korean exports) and then one as an index (Chinese New Orders).

But we can perhaps deduce here that there is some lead on the movement of Chinese New Orders versus South Korean export growth, especially when we look at more extreme movements.

I mean, right now, New Order growth is negative, whilst South Korean exports have pushed even higher.

Let's now think of some second order effects here...

If China isn't receiving new orders...

Then what does that mean for demand on an aggregate level?

Our thinking here is that we have had a massive inventory fill through the summer to prepare for Christmas - basically, people have bought so much shite that they don't need to buy anymore and or...

They have given up since supply chains are still a bit messed up.

Let's isolate the latter reason though.

Look at this series of Tweets...

Got 5 containers in today couple weeks ahead of schedule

Probably nothing— JMac (@jmccart10) November 1, 2021

Top in container rates? 👀👀👀👀

Or will Xmas cause a ridiculous blow out higher? pic.twitter.com/B5MvABzG1o— David Belle (@davidbelle_) October 12, 2021

Yep, that was the top in container prices IMO https://t.co/17LMlf94Dc— David Belle (@davidbelle_) October 14, 2021

CONTAINER PRICE KLAXON 🚨🚨🚨🚨🚨🚨🚨

Container rates declined 2% WoW.

Supply side issues alleviating. https://t.co/W2VJUBT859 pic.twitter.com/5Qmvh25Ui5— David Belle (@davidbelle_) October 28, 2021

I think there is stronger reasoning to place our bets on the first reason (people have already bought all the shite they need), when faced with some of the evidence from the above Tweets.

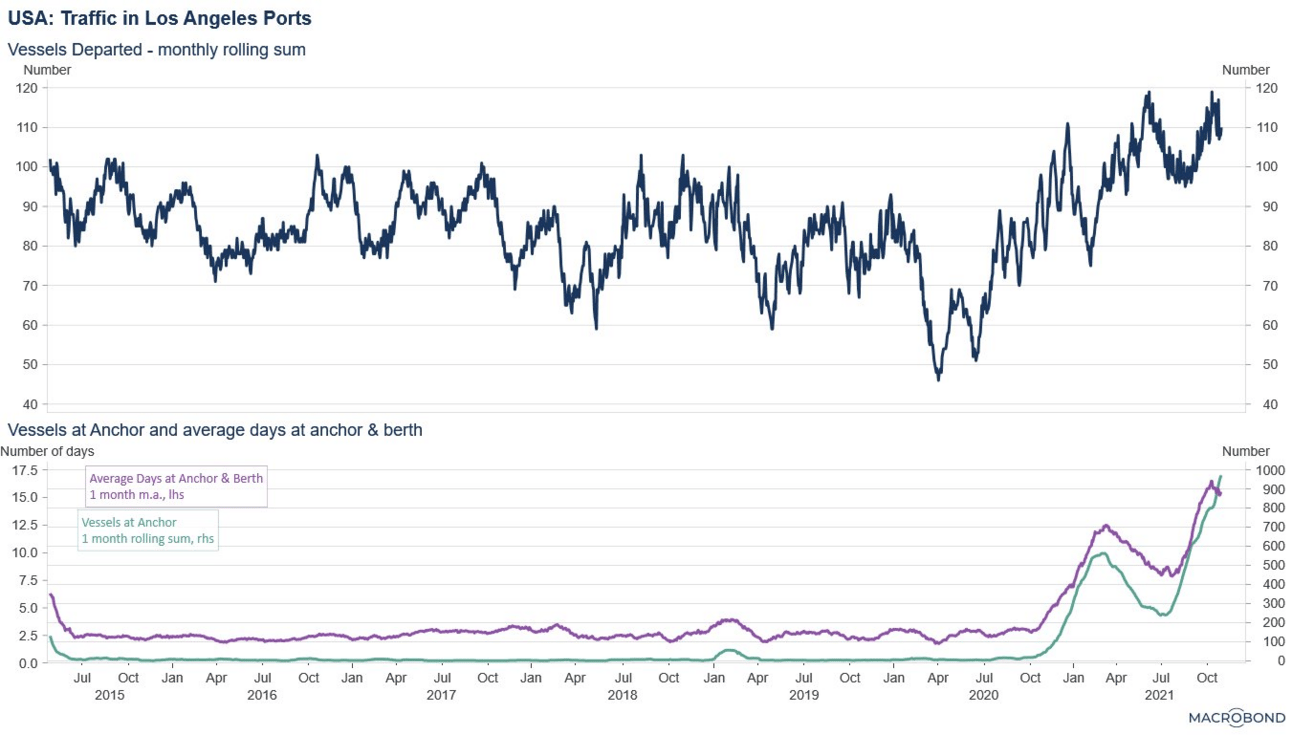

And just to reinforce this, I'll drop in the Port of LA traffic data for you to get excited over.

I love when we come to junctures like this...

Overextension in many markets and data points; past data points reinforcing what might happen next...

Whilst the media is still fixated on what has happened, that it will continue to happen, without any value add on how things may actually change.

Remember that South Korean exports are contracting...

And also note the difference between last year and prior economic downturns.

What's odd about last year is that export growth massive increased...

In prior crises, we saw a deep multi-year decrease.

I reckon that if we do start to see the longer drawn out effects as economies 'normalise', we will see this dip much further, especially if we consider that many have likely to have 'overdone' their consumption, coupled with the effects of a China slowdown.

Now look at how SP500 EPS has been contracting.

FactSet

Yes, base effects, of course.

But I do certainly think it's interesting that we are probably looking at a return back to a more 'mean' increase/decrease in SP500 EPS.

You're probably still wondering why I consider South Korean exports to be an important measure here, right?

Well, it's because a hell of a lot of their exports end up in the hands of the US consumer, whose firms dominate the equity markets and therefore corporate earnings (and naturally, China play a massive role here too).

More recently, we reckon the demand for products have been pretty inelastic.

People have been continuing to purchase at the same amount since outgoings have perhaps been lowered during lockdowns whilst being provided with stability from government schemes such as furloughs & business support...

More recently, people have been getting back to work, we've had a feed through of inflation into energy prices, food and other goods (still transitory), and more importantly, no more expectations of stimulus are coming.

Instead, the reverse is happening...

People are largely expecting higher rates of inflation and perhaps their respective central banks to act (again, team transitory).

Take a look at this chart of consumer expectations of inflation versus what the market expectations (breakevens) are...

The consumer is wildly expecting more inflation than the market based measure is.

Naturally then, this is likely to be a demand dampener going forward...

Which likely means that commodity prices will HAVE to fall to increase corporate profit margins.

Phew...

We got to the crux of it finally.

What does this mean then?

Well, in my view, we want to now be fading the big moves on commodity backed currencies.

I was too early on USDCAD (still in though - the joys of remaining nice and small initially so you can take some heat), and I think right about now into year end will be a great time to begin to fade some of these commodities that are hanging up here, as well that the currencies with a positive correlation to commodity prices (GBP, AUD, CAD, ZAR, NOK).

Here's the state of play on these currencies...

If I were a value investor, I'd be looking at these as half decent plays versus the dollar.

My preference remains with USDCAD, however.

The reason being is that I feel the Bank of Canada wish to be far too aggressive on rate hikes.

Their current credit to the non-financial sector versus GDP sits at roughly...

350%.

This puts them at one of the highest levels in the world.

For comparison, could you imagine the ECB doing this, leading to their nominal interest payments increasing by a pretty large amount?

This is the current contention in Canada between the government and central bank.

From GlobalNews.ca...

The parliamentary budget officer has previously estimated that a sudden rise of one percentage point in rates could increase public debt charges by $4.5 billion, growing to $12.8 billion more after five years.

“I think it will change the language that the government uses and there will be a pivot this year,” (Rebekah) Young (Scotiabank) said of the debt and rising rates.

“Current interest rate paths are going to start increasing and so it would take less of a shock to make those (debt) numbers start to look less palatable.”

This is the one grave concern at the moment across the world, but more specifically in Canada which does not have as dynamic an economy as many others in a similar (but less extensive) boat.

In a talk with the Canadian Chamber of Commerce Wednesday, Finance Minister Chrystia Freeland linked government finances to the decision to end pandemic aid for some workers and businesses.

“Your members are people who think about the debt, who think about the deficit,” she said. “I want to tell you guys, I do too. Please bear that in mind when you think about our (benefits) announcement last week.”

This I think is rather key.

There has been less talk of government finances being the reason to end pandemic aid in other economies, whilst this is at the forefront in Canada, for good reason after seeing those debt stats.

With this talk of Canada, it's also interesting to take a look at where oil is currently sitting...

Not really a fan of further upside here, especially when we consider where breakeven inflation currently lies in conjunction with this...

In my personal view, I really do believe that we're coming to a quite specific juncture where #TeamTransitory will be proven right.

Let's see where we go from here, but I have a quiet confidence that we will start to see some alleviation in commodity prices going forward.