- Fink 🧠

- Posts

- 🔔 Dividends or Growth... Why not have Both?

🔔 Dividends or Growth... Why not have Both?

EQONEX: Institutional-grade crypto exchange, built to support and enhance crypto adoption.

Utrust: Accept payments in Bitcoin, Ethereum, and major digital currencies

The Veteran's taking over!

Last time out we looked at the reality of holding cash or near cash investments in a low interest rate, high inflation environment. 👇

And we discovered the uncomfortable truth about the difference between nominal (headline) and real (inflation adjusted) returns.

We looked at how investors had used capital gains from growth stocks to overcome or offset inflationary forces: double or even triple digit gains more than compensated for the effects of 4 or 5% inflation and its ability to undermine purchasing power.

We looked at the possibility that rising interest rates would undermine the performance of growth stocks and suggested that in those circumstances we needed another hedge against inflationary forces.

We discounted bonds simply because they have a negative real yield in the current environment. Though they might look attractive at the point where real yields turn positive i.e. the yield on 10 year treasuries is higher than the rate of inflation.

Instead, we looked at dividend paying stocks and compared the performance of a variety of S&P 500 indices and styles including High Dividend and Dividend Aristocrats and compared those to growth and the vanilla S&P 500.

Sponsored: Jump on EQONEX and start trading today with your EQO-D collateral. Compete and win your share of $50K in Bitcoin! 👇

If you've been allocated EQO-D, then you are eligible to join the EQO-D Trading Competition where you have the chance to win a share of $50K worth of #BTC!

Put your EQO-D into a sub account and start trading perpetuals on EQONEX today.https://t.co/gDKGn9IfJs$EQOS. pic.twitter.com/eBCFF0L7P1— EQONEX (@eqonex) October 1, 2021

But what if you're not ready to give up on growth?

Is there a way to finesse your strategy to encompass growth stocks that pay dividends too (and look likely to continue to do so)?

The answer of course is yes! But it takes some work...

In the table below we find a list of Nasdaq 100 stocks that have been screened on some basic fundamentals

They had to have a positive return on equity, positive 5 year revenue growth, positive 5 year earnings growth and of course a positive 5 year dividend growth...

Those factors and values are displayed in the colour coded stacked column chart above.

We could trim the list further, if for instance we didn't want to pay an excessive multiple of a factor such as price to book.

For example, Apple (AAPL) is trading 36.33 times according to my data.

Although, their ROE is 131.0%, 5 year earnings growth rate is 41.99%, and 5 year dividend growth rate is 60.0%...

Here's what the list looks like when we filter for a price to book value of 20 times or less

Now lets optimise some of those return statistics and screen out weak links in terms of ROE by filtering for returns of 20% or greater and do the same for 5 year revenue growth.

Doing that trims our list of stocks to the following:

How about performance?

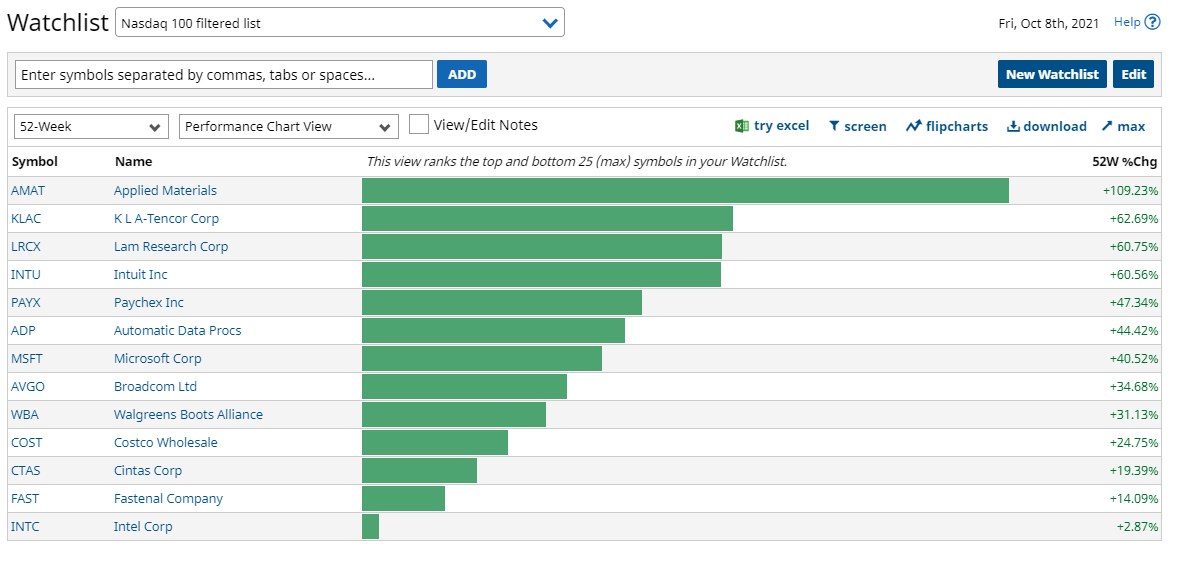

Here is the 52 week performance data for our refined list:

Intel (INTC) looks like the weak link here but it also offers 5 year revenue growth of 40.67% plus 5 year earnings growth of 127.47%, with 5 year dividend growth of 37.50% and a forward PE of just 11.74 times.

If we are being ruthless we might be inclined to cut that from our list as well.

Sponsored: Easily receive crypto payments with Utrust 👇👇👇

utrust

So, we have been through all of that data crunching and arrived at our shortlist but we have forgotten to look at the most important factor of all...

The dividend yield for the stocks themselves. This figure that will determine how effective the dividend element of our prospective inflation hedge will be

This cuts to the heart of the matter because the truth is that growth stocks are not great dividend payers; they are focused on growing the size of their business and prefer to let the markets worry about shareholder returns via capital appreciation.

If we filter our list once more looking for stocks with a dividend yield of +2.0% or greater, with positive track records in 5 year revenue, dividend growth and a positive return on equity or ROE, we end up with a list of just 11 companies.

And we will look at how we can broaden our horizons around growth with dividends in our next article!

Don't know what financial news stories are important and what is complete bullsh*t? Hop onto our filtered news channel.

It's completely free 👇👇👇

And if you really want to get to grips with how global markets and economics work, with trade ideas to give you actionable context, then come and join us as a premium member where you're likely going to get a nice Market IQ boost. 👇

Check out our reviews on TrustPilot 👇👇👇