- Fink 🧠

- Posts

- 🔔 Don't worry about that Economist cover...

🔔 Don't worry about that Economist cover...

EQONEX: Institutional-grade crypto exchange, built to support and enhance crypto adoption.

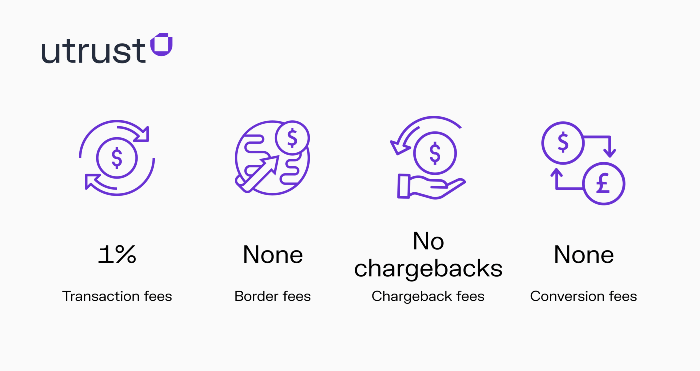

Utrust: Accept payments in Bitcoin, Ethereum, and major digital currencies

Let's start with this...

Decentralised finance is one of three tech trends disrupting finance—and it has the potential to rewire how the industry works. In our cover this week, we go down the “DeFi” rabbit hole https://t.co/j7G04qDCJ3 pic.twitter.com/UO2mp6ejVG— The Economist (@TheEconomist) September 16, 2021

Usually it's a great countertrend indicator (68% strike rate over the next 360 days), but there was something missing... 👇

Kinda ambiguous though. The raging bullish or bearish ones more interesting. This cover is pretty balanced.— ʎllǝuuop ʇuǝɹq (@donnelly_brent) September 17, 2021

Brent's bang on (and he's basically the authority on the matter as one of the authors of the study)

Once we see the DeFi's eating the world, end of the traditional banking system covers, then the signal will have more weight...

On that note, it doesn't seem like the regulators have a clue.

Gensler's testimony revealed how little the SEC understands and the lack of resources. They're 'short-staffed' and running way behind the pace of innovation.

If regulation is coming, a heavy-handed approach of naming everything a security is the likely starting point.

No doubt the legislation will be full of loopholes, and that's when the battle will truly begin...

SEC Chair Gensler on DeFi: "They're really decentralized in name only. There's a user agreement. There's something you're doing with this platform, there's a governance token, there's usually some fees."— Brian Cheung (@bcheungz) September 14, 2021

Ransomware is being targeted first, probably because it's an easy way to signal that they're doing 'something'...

There's not much substance 👇

The Biden administration is preparing an array of actions, including sanctions, to make it harder for hackers to use digital currency to profit from ransomware attacks, according to people familiar with the matter.

The government hopes to choke off access to a form of payment that has supported a booming criminal industry and a rising national security threat.

The sanctions are expected to single out specific targets, rather than blacklist the entire crypto infrastructure where ransomware transactions are suspected of taking place.

Sponsored: Do you even trade, bro? EQONEX are offering $50,000 of BTC prizes for the top 10 traders... Check it out! 👇

To make the EQO-D airdrop even better, we are organizing an EQO-D Trading Competition where the top 10 most profitable Perpetual traders will share a prize pool of $50,000 USD in #BTC.— EQONEX (@eqonex) September 14, 2021

Evergrande's still a thing (and will be for a while)...

It's definitely not Too Big To Fail 👇

State mouthpiece Hu Xijin says Evergrande is not TBTF

'Once the problem explodes, the enterprise cannot have the fluke of being "too big to fail". They must have the ability to save themselves in a market way'https://t.co/9D9tlXdmzY pic.twitter.com/6WFyTXnrzl— Tim (@VolaTim) September 17, 2021

Our views on this should be well-known by now, but just ICYMI...

Now, there's lots of fast-moving news around events like this and you'll see headlines/tweets like this... 👇

Quote tweets and replies are a fantastic reactionary sentiment check.

But is this 'new' information?

UBS have been covering Evergrande's fall for a year now.

After setting a neutral rating & target price of HK$15.20 last September, they downgraded and changed the target to $6 in January, then lowered it again to $3 in July!

They saw the liquidity crunch coming too...

With 77% of Evergrande’s liabilities due within 12 months, the developer may continue to cut property prices to stimulate pre-sales, which will substantially erode earnings and margins, the UBS analysts wrote.

Evergrande’s total liabilities -- which includes commercial bills and other short-term payables -- grew to a record 1.95 trillion yuan last year, even as the company reduced its pile of interest-paying debt.

Even published on Bloomberg...

More importantly, does this 'news' really add anything to the picture?

They're only stating the obvious that liquidation is a worse scenario than restructuring.

These commenters are full of doom regardless.

Sponsored: Easily receive crypto payments with Utrust 👇👇👇

utrust

The Generational Divide & The 'Great Wealth Transfer'

The United States is setting up for one of the greatest transfers of wealth we’ve even seen. #stocks #markets #economy #investing #financialservices pic.twitter.com/jaTkmsTfcW— Dan Weiskopf (@ETFProfessor) September 16, 2021

Ignoring the hyperbole, it's an interesting chart...

But does it show anything unexpected?

Generally speaking, older generations should have a greater share of wealth. They've been around longer to compound it!

As people retire, they'll begin to chip away at that wealth.

Basically, they still need to spend but they don't have the same incomes.

Eventually they die, and the wealth is inherited by the next generation(s).

Here's the big reveal...

The chart's completely misleading.

That greatest wealth transfer ever isn't just around the corner...

Even if it was, who would that wealth predominantly go to? 👇

Taxes, inequality & generational games

Yep, they're keeping it in the family!

Don't know what financial news stories are important and what is complete bullsh*t? Hop onto our news channel.

It's completely free 👇👇👇

And if you really want to get to grips with how global markets and economics work, with trade ideas to give you actionable context, then come and join us as a premium member where you're likely going to get a nice Market IQ boost. 👇

Check out our reviews on TrustPilot 👇👇👇