- Fink 🧠

- Posts

- 💵 What drives stock prices and valuations?

💵 What drives stock prices and valuations?

In partnership with Utrust, the only crypto payments gateway your business needs 👇

Quick reminder 🙌

💸 Transaction fees can be 10x lower;

🌍 No cross-border fees;

⚡️ Faster payments & settlements;

🛡 No chargebacks (fraud);

💯 No payment limits (ex. cards have limits);

🔐 Works with any wallet, your keys your money (Satoshi’s vision);

🔜 Merchant Yield. https://t.co/XcemXjNcRJ— Utrust (@UTRUST) October 6, 2022

What drives stock prices and valuations? It's the eternal question among investors and traders. If any have discovered the answer, they've kept it to themselves (for obvious reasons).

It’s tempting to think that Renaissance Technologies Medallion Funds have found the secret sauce though. Look at these returns! 👇

A 2019 study found that from 1988 to 2018, Medallion returned an annualized +63.3%. Just dwell on that figure for a second. Let it sink in...

I doubt that many people have thought hard about the power of compounding when it comes to wealth creation. This is a brilliant, if somewhat extreme example, of just how that works.

Imagine that you had invested $1000 in the Medallion funds in 1988.

By the end of year one that investment grows to $1633

In year two it's grown to $2666.89...

And by the end of year three it's worth $4354.70!

In year four it's grown to just over $7111 and... (drum roll please)

By year 11 that $1000 has grown to $359,000.

It gets better...

In year 16 it’s worth just over $1.5 million. By year 25 you're sitting on $211 million. You'll be a billionaire in year 30 and richer than Elon Musk halfway through year 39 of your investment.

A bit of a mind-bender and obviously more of a thought experiment than a real-world example. Real returns would vary from year to year.

In any case, if rumours are to be believed there's a limit on how much money one can invest and keep in the Medallion funds.

They're effectively only open to staff members and founders of Renaissance Technologies. None of whom are about to share their recipe for success even if they know it.

It's hard to grasp how much money the funds have made over time. If you're interested in finding out more about Renaissance Technologies and its founder Jim Simons then 'the man who solved the market' is a good place to start.

Another hard to grasp concept that plays an increasingly important role in the way stocks trade (and how investors and traders behave towards them), is that of intangibles.

Tangibles are easy enough to get our heads around. Items such as industrial plants, factories, office space and equipment, stock, cash in the bank, investments and so on.

Intangibles on the other hand are sort of... fuzzy. An obvious example of an intangible asset is goodwill - the way that consumers, customers, suppliers, and competitors think about, and feel towards a business.

Who is your first call for a product or service? Who do you recommend to friends and family?

Goodwill and other intangibles such as brand recognition and brand loyalty are integral to the value attached to equity.

Why is that the case? Let’s think about what equity in a business is.

Equity is the excess value over and above the tangible assets, cash and investments, within a business.

Equity investors have no claim on the assets of a firm, tangible or otherwise. They get a vote, sometimes, and maybe a dividend if they're lucky.

The ordinary shareholders, or equity investors, in a company have only bought into the 'idea' of the enterprise, along with its potential to raise capital and ability to execute a business plan.

I doubt that many investors and traders have really stopped to think about that distinction. In the event of a company liquidation, equity holders are near the bottom of the list.

Equity holders are typically last in line when it comes to debt seniority. In the event of insolvency, the debt holders will be repaid first and then the equity holders will receive any remaining funds after all the debts have been repaid.

Equity holders typically receive the least priority when it comes to payments.

Because of the non-physical nature of business today, those start-ups that have been heavily backed by PE and Venture Capital funds, and many the companies that have been listed on the world's stock exchanges, the intangibles have become ever more important and relevant even if we aren't always aware of them.

Work by academics at the University of Texas published earlier this year looked at the relationship between corporate earnings and stock valuations from the 1980s to the present day.

What they found suggested that the influence that earnings data exerts over share prices has been diminishing. Instead, the influence of sentiment on price action has been increasing, something that I have long suspected to be the case.

The authors didn't look at other asset classes but my gut feeling is that in FX and highly traded commodities, fundamentals have taken even more of a back seat to animal spirits.

The academics tried to predict stock price variation based on earnings data by looking at the average relationship between earnings and stock market returns.

They performed linear regression studies (something else that’s quite hard to grasp) and looked at the influence of sentiment. which they characterised as symptomatic EPS.

Anyway, the fruits of their labour can be seen in the chart below... 👇

The influence of specific company earnings data related to returns has effectively flat-lined since the turn of the century, whilst the portion of return attributable to overall sentiment has risen almost continuously since the dot com bust.

Though the authors of the research can't specifically identify the reason for this their intuition is that the growth in intangible assets has a big part to play.

Two things occur to me here. Firstly that is alpha in “them there hills” which could be harvested in two ways - one is identifying stocks and sectors that prevailing sentiment and its narrative favours.

October was a prime example of this 👇

The other is in identifying stocks with solid earnings and revenue data in excess of market expectations that aren’t immediately rewarded by the market relative to the overall index, sector or other peer groups.

The other takeaway is that we need to have a better understanding of intangibles and how to account for them in our market models, whether mental or computerised.

For those who want to dig deeper into the latter, I recommend this research note

Alpha and opportunity

Coming back to looking for alpha it seems fairly obvious that growth stocks are the factor that is likely to contain the most intangible investments.

For example, software doesn't really exist physically these days. You can't kick the tyres of a purely digital service, in the same way that you can, say, check the machines in an engineering company.

That in turn suggests that value stocks won't contain many intangibles outside of the relatively well-understood areas of goodwill, brand value etc.

Quants at BofA have identified 'a regime change in the markets'. In their words:

“When the Fed fought inflation in the 1970s, it took several attempts to hike rates to get inflation in check..... We’ve analyzed factors and market performance in the months leading to the last rate hike (by the Fed) and after the last hike.”

“Value’s performance vs Growth was mixed leading into the final hike but once the Fed was done, Value consistently led Growth for the next 12 months.”

We aren't there yet. We're still above downturn territory 👇

However, investor positioning still heavily favours growth over value...

Although on some metrics growth and value have become more aligned, in others they remain poles apart.

What does this mean in practical terms?

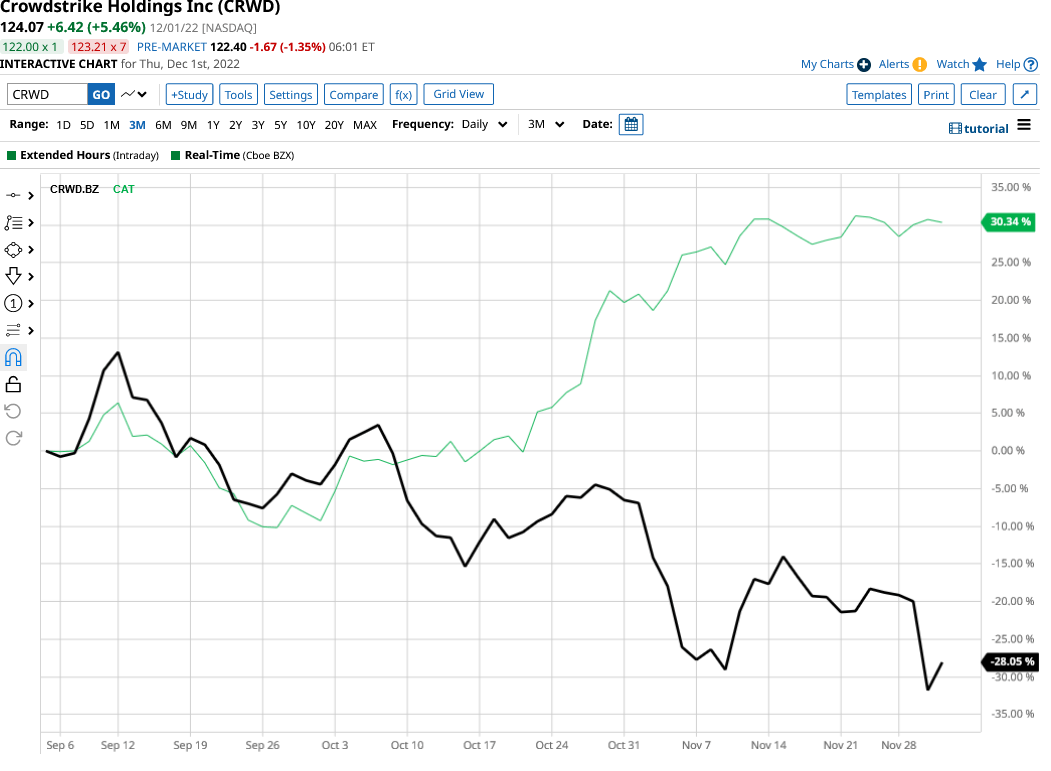

Well, a picture can speak a thousand words - so here is one, that contains the percentage price change for two very different stocks...

Crowdstrike (CRWD) in black, which as a network security company is a growth stock full of intangibles and very highly rated. And Caterpillar (CAT) in green, which, is essentially an old economy value stock exposed to materials and mining (see sector performance table above)

With the gift of 20/20 hindsight, it would have made a lovely pairs trade. That’s the kind of rotation or re-rating that might be on offer to equity traders in the coming months.