- Fink 🧠

- Posts

- 🔔 IMF projects stronger global recovery

🔔 IMF projects stronger global recovery

Today's Opening Belle is brought to you by our partners, Equos and Utrust.

Looking for a crypto exchange? Give Equos a try (they've also just released an exchange token too, similar to BNB and FTT.

And want to incorporate crypto payments into your business? Definitely use Utrust.

We only work with partners we know, trust and have a strong product.

No exceptions.

Most advanced economies will emerge from the coronavirus crisis with little lasting damage, thanks to the relatively rapid rollout of vaccines and their willingness to increase sharply public spending and borrowing, according to the IMF.

“The US is really the only large economy whose [economic output] for 2022 is projected to exceed what it would have been in the absence of this pandemic.”

🔥 Hot and 🚫 Not

🔥 European travel companies are among the big winners this morning after Boris Johnson said that he was hopeful of foreign holidays by next month - May 17th is the key date 👇

No 'open door' policy: foreign travel may resume to 'some destinations with low coronavirus rates and high levels of vaccination' and there will be a traffic light system (specifics TBC) for overseas travel...

“Obviously we’re hopeful we can get going from May 17,” he said, “but I do not wish to give hostages to fortune or to underestimate the difficulties that we’re seeing in some of the countries that people might want to go to.”

The EU have proposed a 'digital green certificate' to allow travel within the Eurozone and expect Germany, France, Italy, Spain and the Netherlands to be in a position to fully inoculate more than 55% of their total populations by the end of June...

Rolls Royce, TUI, & British Airways all saw strong gains...

... although travel abroad is sure to remain a contentious issue throughout the summer: EasyJet CEO Lundgren is already criticising UK government plans to continue mandatory testing for 'green light' countries, highlighting that the cost of the test is often more than the ticket price...

“That means that you wouldn’t open up international travel for everyone, you would open up for those who could afford to pay it,”

🚫 BP's debt hit $35 billion today and it's actually a 'good news' story...

The debt has been reduced from a Covid peak of $39 billion

Previously, BP did not expect to reach this $35 billion net debt target until Q4 2021 or Q1 2022...

Why does this matter?

BP can now begin share buybacks again!

Having reached its debt goal, “BP is committed to returning at least 60% of surplus cash flow to shareholders by way of share buybacks.”

More information will be released on April 27th...

So why is it in the '🚫 Not' section...?

Because buybacks are a 'hot topic' that float in and out of media coverage, often light on detail and heavy on outrage (what's new?)...

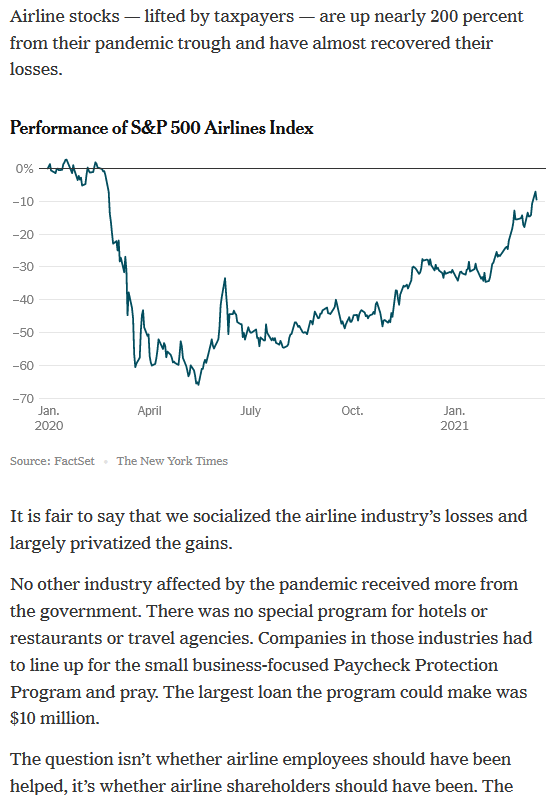

Sometimes they're right to be outraged: U.S. airlines are a great example...

U.S. Airlines Spent 96% of Free Cash Flow on Buybacks- 16th March 2020

Fast forward one year and...

Were the airline bailouts really neeeded? NYT - 16th March 2021

Shareholders need those returns, and it's usually a choice between dividends & share buybacks...

BP reduced dividends by 50% last year - more buybacks were inevitable...

Soooo buybacks are EVIL? Nope, and they're nothing new either - just ask Buffett... (from his 1999 letter)

"Instead of repurchasing stock, Coca-Cola could pay those funds to us in dividends, which we could then use to purchase more Coke shares,"

"That would be a less efficient scenario,"

"Because of taxes we would pay on dividend income, we would not be able to increase our proportionate ownership to the degree that Coke can, acting for us."

Putting this into current context, BP are undertaking a huge business overhaul and plan to increase investment in low-carbon energy 10-fold to $5 billion a year by 2030, taking its renewable-energy capacity to 50 gigawatts, from 2.5 GW in 2019.

Investors need compensating for this increased risk, and society stands to benefit from lower-carbon energy...

What's the moral of this story?

Errr, let me try... we should focus on striking the right balance between shareholder value (in exchange for them funding innovation) and the benefits society receives from those company innovations...?

Maybe both?

GO PREMIUM - 'outsource your fundamentals' 👇