- Fink 🧠

- Posts

- 🔔 Learning To Love The Grind

🔔 Learning To Love The Grind

In partnership with capital.comTrade 5,600 markets

0% commission and tight spreads

Trade on market swings with CFDs & Spread Betting

Intuitive & easy-to-use interface

Smart risk management tools

Regular live updates & price alerts

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

"I am struggling to get decent trades, I believe I have good views on the market, I know why markets are going this direction etc but I struggle turning all the research into good trades.

Could you offer some advice?"

Received this via DM over the weekend so thought I'd turn the response into a post.

We've all been there. It's a problem every trader suffers with, especially early on. I honestly don't think there's a complete 'answer'.

There are things that can be done to face the issue head on though. Let's break the problem down.

Struggling to get decent trades (decent = profitable/ positive expectancy)

I believe I have good views on the market

I know why markets are moving in certain direction

Struggle turning research into good trades

Point 1 is the easiest to address. It's the objective to work backwards from.

The foundation of any trading business: "Find trades with a positive expectancy; good risk:reward and/or high probability"

Obviously, if that objective isn't being achieved, the business/trader is going to struggle. The tendency is to blame market conditions, keep grinding through and hope it comes good.

For more experienced traders, this can be a better option. Sometimes conditions simply aren't favourable to their style. No need to drastically change anything. Recognise the shift and manage risk accordingly.

For newer traders, more scepticism is warranted. Assumptions need to be tested, and tough questions need to be asked. Starting with this...

WHY do I have this problem?

Sounds ridiculously simple, but the simple is all too often ignored in favour of the complex.

Let's dig a bit deeper...

"I believe I have good views on the market"

What does this mean? Define 'good'.

If you're at a point where it's harder for the market to surprise you each day (vs the wide-eyed wonder of the early days when every 20 pip move had you like this) 👇

Then that's good news.

If "good views on the market" means you're more aware of the risks (and less likely to become a rabbit frozen in the headlights or overcome by panic), then that's definite progress.

But calling a market and trading a market are two very different things...

If "I have good views on the market" = "I'm pretty good at calling the market direction, but my trades aren't matching that", then we need to figure out why.

First off, how are you tracking your directional calls?

It's easy to fall into the trap of thinking we KNEW this move was going to happen, but our brains are tricky little f**kers and they can deceive us into thinking we can see the future.

Try this. If you're day-trading, note down your bias at the start of the day.

Will it be a:

Bullish/Bearish day?

To extremes or not? e.g. Beyond 20 day ATR?

What are the likely turning points?

If you genuinely have an edge in calling direction, volatility, and turning points then that's fantastic news. No shortage of trades! Holy grail unlocked.

Onto the next point.

"I know why markets are moving in certain direction"

Me too!

More buyers than sellers or... More sellers than buyers

OK, this isn't technically accurate (for a trade to take place, there needs to be a buyer and a seller) but an imbalance between buying and selling interest is ultimately the main (only?) reason markets move, which brings us to the final point...

"Struggle turning research into good trades"

What does a good trade look like?

"One where I make money, duh"

Yeah, but is it though? What if you just got lucky?

Maybe there was nothing wrong with the trade idea, but your stop was too tight/wide and you got stopped out (tight), or you tried to hold it too long/far to maximise profits (wide)...

Do you have any advice?

Yep. Learn to love the grind. There's only one reason to pay attention to the fundamentals. To give you a directional edge over a certain time horizon.

That doesn't mean you trade based on the fundamentals alone. Got to respect those flows, monitor volatility, positioning, and news/catalysts.

When you strip the scaffolding away, markets are just positions based on beliefs about the future.

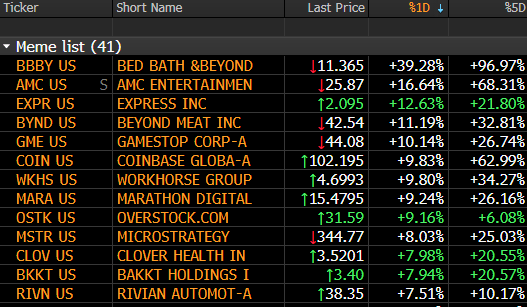

Good luck shorting the meme stocks based on fundamentals. 👇

Danny Kirsch

Now, this shouldn't happen in a purely rational world with rates heading higher. But this isn't a rational world (never has been, never will be), and where was the alpha in shorting these stocks when they were already at or near the lows anyway...?

Ultimately, one of the biggest breakthroughs a trader can make is in deciding which trades not to take. Figuring out the anatomy of good trades is often a function of looking at what links the bad trades and doing the opposite...

That said, what a 'good trade' looks like is different for every trader. Trading style, market focus and time horizon all come into it.

But if you don't figure out the nuts and bolts of the best trades, your trading bread & butter (and occasional steak) how are you going to identify them in real time?

Even when they're staring you right in the face...?

Trade thousands of markets with Macrodesiac Partner capital.com 👇

Check out our reviews on TrustPilot 👇👇👇