- Fink 🧠

- Posts

- Man Says Things

Man Says Things

Here's what we want to hear...

Once again, all eyes are on the Federal Reserve and what they're going to do (say)…

Fed-Watchers:

It’s impossible to adequately express how much I detest the galaxy braining and signal-searching that surrounds these events.

One desk even says:

The key will be to watch Powell’s body language and tone

Body language and tone? REALLY?!

Most of the time sellsiders are just plucking numbers out of thin air absurdly complicated models.

Today, we’ve flipped to playing the man across from us at the poker table even though that man still has no idea which cards he’s been dealt…

Any GENUINE clues will be in the words themselves, not tone and body language.

So, what should we be paying attention to?

Once the dust settles, the most important takeaway needs to be Goldilocks dovishness.

i.e. lots of focus on sticking the soft landing and being pro-active.

If Powell throws shade on the Phillips Curve, even better, as that would indicate that the Fed is keenly aware of the employment risks, and sees no need to wait for unemployment to rise before they act.

That really is the key if the Fed wants to keep the story alive.

The MUFG desk did a good (almost great) job of the scenario analysis:

Dovish (50%): Our base-case is for a more dovish official communiqué and press conference. We expect the statement to shift to a more neutral stance as the balance of risks between growth vs inflation move to equal importance. The key will be to watch Powell’s body language and tone. 😩

We expect the Q&A to force a dovish response to these questions:

Do you still expect to cut “well before 2%”? Why was BTFP altered? At what stage (if there isn’t an official release in January) is the FOMC at in terms of tapering QT? Any mention that real rates are now “too restrictive” would be very dovish too.

Neutral (30%): If the statement is neutral, chair Powell can play it down the middle, emphasizing that the Fed remains data dependent and open-minded.

Hawkish (20%): The recent string of Fedspeak has been leaning hawkish, so it’s possible Powell echoes that and does his best at sounding hawkish. If he mentions financial conditions are too easy and that means there is no reason to “rush” and cut rate so soon, that would seriously disappoint markets.

If he mentions financial conditions being ‘too easy’, I’ll renounce every nice thing I’ve ever said about him.

Stocks are up is NOT Financial conditions, no matter what the Goldman Sachs FCI says.

Credit is still harder to obtain and more expensive than it was before Covid, even though it’s cheaper and a little easier than three or four months ago.

In any case, does the Fed really want tighter financial conditions now that inflation’s practically back to target?

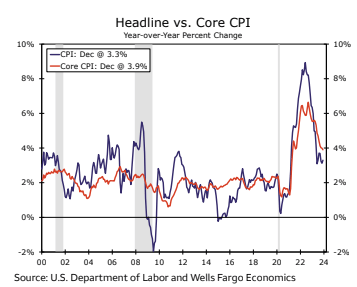

Core inflation as measured by the Fed's preferred index rose 0.17% in December, as expected

This is the sixth month in the last seven where monthly inflation has printed at a rate equal to or below the Fed's 2% target

YoY: 2.9%

6-month annualized: 1.9%

3-month annualized: 1.5%— Nick Timiraos (@NickTimiraos)

1:34 PM • Jan 26, 2024

Slightly tongue in cheek. Inflation’s clearly not back to target on the annual measures. The recent trend is encouraging though, and suggests that there’s really no need to maintain a base rate of 5.25-5.5% for long.

As for the idea that an over-heating labour market will drive another round of inflationary pressures…

Check out the hires and quits rates here:

Throw in the waves of recent layoff announcements:

UPS cutting 12,000 jobs

Activision Blizzard lays off 1,900

PayPal to trim another 2,500 workers

Block lays off close to 1,000 staff

And it’s clear that the labour market is far softer than it was.

The Fed seems to be aware of the risks. What matters now is how they decide to manage them.

Realistically, there probably won’t be any clear signal at tonight’s meeting. The main theme to look for is a strong and clear message that they’ll be acting decisively throughout the year, as long as the current disinflation trends continue.

Oh, and if we have to resort to body language and speech tone for a signal, Powell will have failed the communications test.

Then we need to put it all into context and see if the market (over) reacts to the QRA announcement…