- Fink 🧠

- Posts

- 🔄 The market has done a 360, not a 180

🔄 The market has done a 360, not a 180

Who had fun last night?

Well, me to an extent.

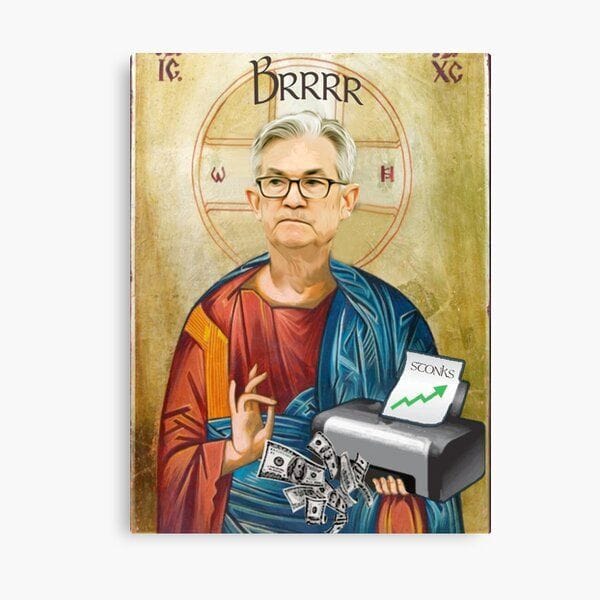

Purely because of the FOMC jokes that were flying about on FinTwit.

It was more of an interesting presser than I'd first gauged, purely because of the initial hawkishness, but then the bizarre walk back of the comments.

Let's check some of 'em out.

Actually, first let's frame my thoughts around what the Fed is thinking so we can put it into a bit more of a Macrodesiac context.

My view is that the Fed is focused more on the employment side of things rather than price pressures necessarily.

The more tangible element of the economy - how many people are earning, consuming and so contributing to GDP - is more important than simply looking at a number that has been affected by many different variables from a big global shock.

With that in mind, we can now look at some snippets from Powell's presser.

These were said from the beginning to the middle of the presser.

He was cautious at the beginning, using words such as 'risks' and 'limited (when referring to labour supply)...

But what I found most key was the following statement.

The dot-plot had changed to signify two rate hikes in 2023...

The market had shat itself at this news at the top of the hour.

Cheers, for that on my AUDJPY long position (although I have stated that this is more of a summer runner and a play into Jackson Hole).

Powell, in my view, is certainly trying to temper expectations...

Almost allowing the inflationistas to have their views priced in.

Remember, central bank policy chatter is all about managing expectations, just like in sales (albeit, central bank speeches are way more boring).

Walking back the importance of the dot-plot is possibly one of the smartest ways to temper said expectations in my view.

Most people are familiar with the two charts below.

I'm dropping these because of what Powell also said...

Which is something I have been chatting about since the start of the year.

This is key.

If we look at labour force participation, the total capacity utilisation mentioned last week and the demographic changes that have occurred over the past year, I'd argue these longer term fundamentals have WORSENED because of the pandemic.

Civilian Participation Rate

Total Capacity Utilisation

10 year yield curve

10 year breakeven inflation, with 2013 taper tantrum highlighted

The last chart there shows where we are now in terms of 10y inflation expectations.

We're practically back at the mean of the range.

So people are shitting themselves based on short term issues, with the prior three charts highlighting that there is NO material change in longer term inflation fundamentals that are outside the realm of monetary policy.

I noted this in the below article back in October 2020.

So what does this mean for markets?

We had a pretty brutal short term reaction after the initial statement was read out, as noted above.

But what we have to think about now is how the presser and statement will be digested.

So people are shitting themselves based on short term issues, with the prior three charts highlighting that there is NO material change in longer term inflation fundamentals that are outside the realm of monetary policy.

Read it back.

Nothing has materially changed.

What the Fed is focusing on, and what is clear from Powell's presser, is that employment is key, and less so other price pressures, since they are largely out of the Fed's control (read, supply chain issues, bottlenecks - lumber didn't have issues with supply, but capacity at sawmills - and fiscal policy issues, namely distortions created with unemployment benefits).

Rather than fixing the problem, since they can't really do much more, their game is to manage expectations of the markets.

Now, why would they be looking to nuke the SP500 or Nasdaq at a time like this?

They wouldn't, so talk of an overheating economy isn't in their remit.

Powell has expressed many times since Jackson Hole last year that he would be looking at data and not trying to policy make based on forward expectations - and right now, the employment data isn't really meeting the need to adjust.

The play for me is to remain looking at the path of least resistance til August, which is where we may see hints towards the tapering talk.

But I still think the inflation guys are in for disappointment.

This means we can play a proxy short vol trade by being long AUDJPY and I am still in favour of being long bonds, more passively via TLT of course, and look to risk on trades.

And on the point of bonds, Quant Insight (who will be launching a non-institutional product soon, which I will talk more to you about) had this to say in a recent note...

Summary: history shows that Treasuries anchor their inflation expectations on long-run historical patterns and only very slowly shift their view even after a new paradigm develops. As far as investable ideas that leverage that point:

• Shorting Treasuries based on a thesis that they will respond dramatically to even 1-2 years of hot inflation prints is problematic. There’s very little in the historical record to support that perspective.

• At the margin, a Treasury yield curve that refuses to steepen materially is good for high multiple stocks like US Big Tech and bad for bank equities. Since the latter has dramatically outperformed the former this year, there may well be some mean reversion coming.

• While the Fed will taper its bond purchases at some point soon, any resulting sell off in fixed income is more likely to be a buying opportunity than the start of a regime shift to higher rates.

That last point is key, and emphasises the point about short vol continuing for longer, and that the market is over-egging the short term impacts of base effects in the inflation regime, as well as the fact that inflation and rates are unlikely to move materially higher in the short term...

If indeed as all - backed up of course by the poor forecasting of rates heading higher in the charts above.

What they also found was a stronger relationship between bonds and EM credit default swaps, specifically China.

As more protection is bought against a poorer Chinese situation, there was a fall in US 10 year yields, I gather as investors seek safety in risk free US debt.

What makes this narrative stronger is that you'd expect yields to rally hard with oil pushing higher, since oil is a key driver of inflation.

That happened in the front part of the year, but this correlation has dropped of late with the recent oil rally.

What did we start to see from mid-March?

Warnings about China's credit impulse...

And the relation to the US10 year yield...

Source: macro_daily

What did we also see over the last couple of months?

Well, warnings were provided here...

But there's been a specific continuation in China of the debt and deleveraging policy (naturally which is connected to the credit impulse decline)...

There are many more of these stories, but the fact of the matter is that we could be trading in the tails here.

By spotting that there is a disconnect between the drivers of the 10 year and what many think is driving it (especially when SO many are focused on it being an indicator of inflation), we could have some good value by remaining steadfast in the view that yields will not push higher and that inflation will remain subdued.