- Fink 🧠

- Posts

- Markets Showing Signs Of Life

Markets Showing Signs Of Life

Yesterday's positive risk tone continued in Asia as they returned from the long weekend.

China's equities not looking quite so hot...

06:18BST

U.S. equity futures slightly green, yields and USD slightly lower.

Overnight data:

Aussie house prices up 7.5% YoY, 5.4% QoQ

RBA Minutes offered nothing new

UK lockdown extension: GBP barely flinched by the time BoJo and has brilliant barnet made the announcement. The decision was flagged well in advance.

There's a new trade deal to soften the blow...

The Northern Ireland issue still isn't resolved though...

Senior figures at the European Union have clashed over its response to the dispute with the UK over Brexit and Northern Ireland. Hardliners led by President Macron of France and Ursula von der Leyen, the European Commission president, insist that the letter of EU single market law applies, according to Brussels sources.

Others, such as Maros Sefcovic, the commission vicepresident in charge of negotiations, are pushing for flexibility on EU rules such as medicines approval to achieve a compromise.

Tensions between London and Brussels flared at the G7 summit in Cornwall over the application of the Northern Ireland protocol.

Brussels wants Britain to stick to the letter of the agreement, including strict single-market rules.

London wants exemptions to protect trade between Britain and the province. A source in Brussels said “there are real tensions” about how tough to be.

Hot take 🔥: The EU will compromise, because that's what they do.

Also, this isn't just a Britain/Brexit problem, no matter how the media tries to frame it.

If any agreement is going to last, all parties must be satisfied, otherwise the agreement will fail.

Basic knowledge innit.

Lots of China news (again)

"China's stated ambitions and assertive behaviour present systemic challenges to the rules-based international order and to areas relevant to alliance security," NATO leaders had said.

The NATO statement "slandered" China's peaceful development, misjudged the international situation, and indicated a "Cold War mentality," said China's response, posted on the mission's website.

China is always committed to peaceful development, it said.

"We will not pose a 'systemic challenge' to anyone, but if anyone wants to pose a 'systemic challenge' to us, we will not remain indifferent."

“Even for large corporates or for state-related entities, policy makers are much less willing to extend support,” Goldman Sachs analysts wrote. “Policy makers are now less likely to conduct full bailouts than compared with the past.”

Whether or not the government offers support will likely be influenced by the need to prevent systemic pressures from emerging and to limit contagion from any spikes in credit stresses, Goldman analysts wrote.

While systemic problems are unlikely to arise, idiosyncratic credit risks are likely to stay elevated, they wrote.

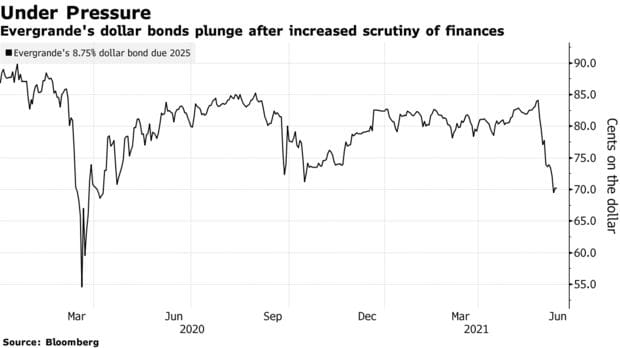

Official support in China hasn’t been limited to state-owned firms, and local governments in the past year have also stepped forward to help private enterprises, including property developer China Evergrande Group, according to Goldman analysts. Entities backed by city governments in Guangdong province came forward last year to buy equity in a unit of Evergrande at a time when Asia’s biggest issuer of junk dollar bonds was facing liquidity strains.

In early May, one real estate brokerage in a bustling Shenzhen neighborhood put on its window a list of what appeared to be fruit prices.

From a 10 million yuan ($1.56 million) durian to a 1 million yuan banana, the document seemed nonsensical to the untrained eye. But for those in the know, it served as code referring to homes for sale on the city's growing black market for property.

The disguised listings were a response to Shenzhen's efforts to cap climbing home prices, fueled by investors who see housing as a surefire profit maker.

China Securities Journal says PBOC might add liquidity in the second half of June

Shanghai Securities News suggests yuan might face depreciation pressure in H2 of 2021

China has approved record amounts of investment to flow out of the country through an official scheme as authorities liberalise the local financial system against a backdrop of a rallying renminbi.

A cumulative $147bn of approvals have been added to the nation’s qualified domestic institutional investor scheme, which allows investors to access assets outside mainland China through banks and other institutions. In early June, Beijing approved $10bn in new QDII allocation, the highest single amount in the history of the scheme, which was launched in 2006 and is used mainly by China’s retail investors.

The move to allow more capital to leave the country came as policymakers have increasingly voiced concerns over high asset prices, as well as a rally in the currency. Due to strict controls on its capital account, China’s vast household savings are primarily funnelled into domestic markets.

The renminbi has strengthened almost 10 per cent against the dollar in the past year and hit a three-year high in May. To help cool it, China’s central bank this month demanded lenders increase holdings of foreign currencies for the first time since the 2008 financial crisis.

Mitul Kotecha, chief emerging markets Asia and Europe strategist at TD Securities, said the renminbi’s strength against the dollar and on a trade-weighted basis had caused a “high degree of consternation” among policymakers in Beijing, and that QDII outflows were one measure to counter its rise. A stronger renminbi can make Chinese exports less attractive on the international market.

“If we look at it longer-term, this is part of China’s opening of the capital account, in support of renminbi liberalisation,” said Shuang Ding, chief economist for greater China and north Asia at Standard Chartered, of the record QDII approval. In the short term, he added, it was related to “the strength of the currency”.

GS break down Friday's OpEx

Looking ahead, EU-U.S. summit today is expected to yield a breakthrough on the Boeing-Airbus tariffs and improving relations.

U.S. industrial production, producer prices and retail sales data are all released.

Retail sales are expected to come in soft as mentioned here 👇

Other than that, it's wait and see mode until Powell and the crew tomorrow!