- Fink 🧠

- Posts

- 🔔 The Masters Of Messaging

🔔 The Masters Of Messaging

Last night, the Federal Reserve delivered their largest interest rate hike in over 20 years, pre-announced another two 50bps rate hikes at the next two meetings and the start of Quantitative Tightening from June 1st.

The market responded. S&P 500 Futures closed up 3% on the day...

The headlines?

Markets rally on ‘dovish’ Fed hike

But how can you announce a straight run of 150bps (1.5%) of interest rate hikes (the fastest hiking cycle in a couple of decades as the headline writers love to remind us) yet still be perceived as dovish?

We were chatting about this with Macrodesiacs earlier. Some call it PsyOps, others call it Expectation Management. Either way it's clear that the pre-meeting messaging played a part.

As it always does.

This 2019 Bloomberg article discusses Shiller's Narrative Economics book. At the time the big worry was that U.S. business may have been talking itself into a slowdown. 👇

But that's not the most interesting part. 👇

At the Kansas City Fed’s annual symposium in Jackson Hole, Wyoming last month, central bankers discussed the new roles they have to play.

“I’m a shaman,” said Stefan Ingves, governor of Sweden’s Riksbank. “I’m a weatherman, I’m a showman, and I’m an economist.’’ But above all:

“I’m expected to be, and I am, a storyteller. I tell stories about the future.”

“And if I’m successful in my storytelling,” he added, “people say: ‘Hmm, that’s reasonable.’’’

Bloomberg covered this as central bankers discussing the new roles they have to play.

This is nothing new, nor do they mind this 'obligation' to play a role. It's part of the job description.

The very same Stefan Ingves discussed this back in 2009(!) after the Great Financial Crisis

The underlying idea of my cure is quite simple. Confidence is essential to operate a bank.

Consequently, confidence is essential to prevent and resolve financial crises. More precisely, to resolve a crisis, the cure should restore the public’s and the market’s confidence in the banks.

This should be done by acknowledging the losses and dealing with the bad assets.

To prevent this crisis from repeating itself, measures should be taken to ensure that confidence does not dissipate so rapidly again. To this end, liquidity and capital regulation need to be reformed.

The final ingredient in the cure is trust. This ingredient stresses the importance of trust between national authorities to the efficient management of cross-border crises.

Banks create confidence by telling good and credible stories about the future, stories about why you will get your money back. Money may make the world go around, but it is good confidence-building storytelling that spins the money around. When these stories fail to create confidence, the markets will dry up.

And that's exactly what central bankers do. They tell us stories about the future to try and frame the outcomes, and avoid (excessively) surprising or shocking markets.

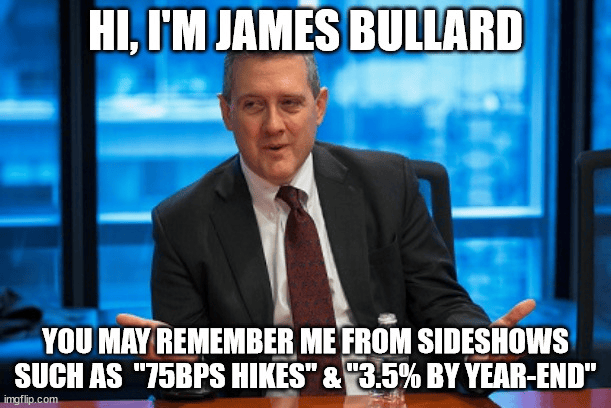

Focusing on the Fed, every good story needs a villain. Here's the St Louis Fed president 👇

He's been talking up big hikes (75bps), getting rates well above neutral ASAP (3.5% by the end of 2022), and even outright asset sales to slow inflation.

Far more hawkish than any of his colleagues.

Before Bullard, the role of hawkish pantomime villain was played by the Dallas Fed's Robert Kaplan.

And why do we need a villain?

To frame expectations... 👇

Lubing us up for the 50bps Goldilocks hike

25 too small

50 juuuuust right

75 TOO BIG pic.twitter.com/Ng5opUo4JF— Tim (@VolaTim) April 21, 2022

The messaging was so well-telegraphed, and the response was as expected 👇

Some say the market response is evidence of a communication error. E.g. 👇

...few weeks later Fed speakers had to boost their hawkish rhetoric (Bullard, you there?) to stop the risk asset rally in April (light blue and grey bars).

This press conference is shaping to be a communication mistake similar to March, which will need to be corrected.

8/13— Alf (@MacroAlf) May 4, 2022

I disagree. The messaging has been carefully crafted.

Financial conditions have tightened somewhat already. Yesterday's rhetoric gives breathing room while 150bps of hikes come into play over 3 meetings (including yesterday).

Year on Year inflation comparisons will get tougher & the economy is already showing early signs of slowing.

The Fed is aiming for a soft(ish) landing. It makes sense to ease back on the throttle and see how things evolve as they deliver the hikes to try & achieve it.

If inflation doesn't slow, then the soft landing's out of the window anyway ("hey, we tried") and they can ramp up the rhetoric again.

Some central banks do it better than others

Here's the Bank of England's message today 👇

Bank of England warns of recession as it raises interest rates https://t.co/lem5aiZcNR— FT Breaking News (@ftbreakingnews) May 5, 2022

The BoE committee is divided too. Three members voted for a larger (0.5%) rate increase today. Two think no more hikes are likely to be required in future. The only thing that they seem to agree on is the bleak outlook 👇

GDP lower, inflation higher, unemployment higher. Wonderful.

ING with the details 👇

Summing up, don't hate on the central bankers messaging game. We're all players, and it's better to figure them out by reading between the lines than stomp and shout about central banks making POLICY ERRORS!!! on the Internetz.

Leave that to the 'experts'.

Don't know what financial news stories are important and what's complete bullsh*t? Hop onto our filtered news channel.

It's completely free 👇👇👇

Subscribe to our YouTube Channel and stay up to date with all of our videos as they're posted. We'll keep expanding and adding more formats as we go!

Check out our reviews on TrustPilot 👇👇👇