- Fink 🧠

- Posts

- AM Notes: Pub?

AM Notes: Pub?

Bit of a risk off start to the week in Asia...

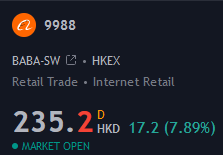

Seems that it's nothing to do with Chinese regulators fining Alibaba a record $2.8bn after finding that the ecommerce group had abused its market dominance...

“They are affirming our business model,” said Alibaba executive vice chairman Joe Tsai. “We feel comfortable that there’s nothing wrong with our fundamental business model as a platform company.”

“Now the penalty is determined, the market’s uncertainty about Alibaba will be reduced,” Everbright Sun Hung Kai analyst Kenny Ng said. “Alibaba’s stock price has lagged behind the overall emerging economy stocks for some time in the past. The implementation of this penalty is expected to allow Alibaba’s stock price to regain market attention.”

And gain attention it did... 👀

Just another cost of doing business I guess...

U.S. yields slightly lower, equities a tiny bit red but nothing too concerning...

Busy week ahead!

Low volumes expected today as London heads to the pub instead of the office, Macrodesiac analysts upgrade Wetherspoons (JDW) to BUY with a price target of 🌕🚀

G10 volumes are generally low, with activity in USDJPY the highlight. Compared to the 5d MA, turnover is as follows:

{jn} USDJPY +8%

{eu} EURUSD -26%

{au} AUDUSD -20%

{nz} NZDUSD -13%

{ca} USDCAD -7%

{gb} GBPUSD -39%— InTouch FX (@ITCMarketsFX) April 12, 2021

Something worth noting re GBP/FTSE inverse correlation 👇

FTSE100/GBP beta flipping positive is interesting given strong £ is a headwind to the index's large foreign earnings base. Looks to be a result of strong performance in domestic banks and GBP as part of the recovery trade, which UK is seemingly a leader in pic.twitter.com/7UFm9wLrRI— trap_zack (@ZackEiseman) April 11, 2021

Strong performance from domestic banks...? 👀

Unfortunately, the hangover will kick in tomorrow alongside the base effect and terrible YoY comparison headlines - these will not be affected by supply chain disruptions, even though the figures clearly will be...

'Hidden Price Momentum'

At least we'll have earnings season to distract us...

Here's the calendar for this week via @ewhispers

Earnings comments from The Veteran 👇

Key Quote: Our first chance to see how US companies have been performing this year and perhaps more importantly - how they view their prospects over the next 9 months...

And some more colour via Scotiabank (yes, I'm choosing this because it matches my own view and saves typing it all out again)...

EARNINGS—It May be Rich to Say Equities are Rich!

US earnings season kicks off next week with twenty-four S&P500 firms releasing. The typical early focus is mostly on financials and this time will be no different. Key names will include firms like JP Morgan, Goldman Sachs, Morgan Stanley, Citigroup, BofA, Wells Fargo, BlackRock, BoNYM, and State Street. A sprinkling of nonfinancials will include Delta and PepsiCo.

The analyst community is rather upbeat on the forward path for earnings (chart 1).

The healing is continuing from the harshest results reported in the aftermath of the first wave’s shocks. Forward guidance from companies that informs this expected future path will probably be more important than actual results for Q1. In particular, watch for discussion and possible guidance around banks’ capital management plans given the flexibility granted by the Federal Reserve on dividend payouts and buybacks by June.

If the usual pattern holds, then the season might face further upside. As chart 2 demonstrates, earnings beats have been common ever since Sarbanes-Oxley legislation after which analysts turned more conservative for fear of being pilloried, ostracized or held directly liable. The vast majority of seasons have witnessed strong beat ratios defined as the share of reporting companies beating analysts’ expectations.

Enter the question of what’s priced and whether equities are overly rich.

Judged by a conventional 12-month trailing price-to-earnings ratio, equities are looking rather rich indeed with the S&P at 33.5 times earnings (chart 3).

Using Shiller’s Cyclically-Adjusted Price-to-Earnings ratio (CAPE) that compares prices to a rolling ten year earnings cycle also looks rather rich (chart 4).

Obviously, the denominators in both of these ratios are distorted by the depths of the pandemic which is no longer relevant to markets that began pricing a more upbeat outlook almost instantaneously a year ago.

They are also distorted by the prolonged post-GFC recovery.

Instead, current price to expected future earnings one-year forward stands at 23.7 times and two-years forward sits at 20.6 times (chart 5).

Forward earnings encapsulate an attempt at measuring effects of vaccines coupled with unprecedented fiscal and monetary policy stimulus.

That doesn’t strike one as particularly rich if analysts are anywhere close to the mark with their earnings calls even sans what have become fairly routine upsides to their expectations.

These low-volume rallies we've seen recently have me cautious, but nothing has fundamentally changed...

My working theory: the low volumes are just caution ahead of earnings, 'no-one' wants to sell (there seems no good reason to) so we keep grinding higher...

Some optimistic forward guidance should see us right...

Powell's 60 minutes appearance was a repeat of the recent rhetoric, long way to go blah blah...

Biden is chatting to a bipartisan group today regarding the infrastructure plan - they probably won't agree on much:

Retail sentiment check: Finally getting long USD 😬

FXSSI

IG

Retail have been short/neutral USD for months, and it looks like the tide is turning...

Nowhere near extreme positioning yet but definitely something to note...

Beyond FX, there's this...

IG

70% short the S&P?!

77% short the Dax?!

I know the CAC 40 is French (Bonjour Martin 👋), but 82% short seems a bit unnecessary...?

*Silver always seems to be at extremes and I've never asked why

Ahead of tomorrow's CPI...

🇺🇸 Goldmans | on this week's US CPI data (on Tuesday)

🔹"If bond markets can look through a stronger-than-expected Core CPI result as well, rate volatility may begin to come down, opening room for Dollar shorts vs EUR and potentially other crosses."— PiQ (@PriapusIQ) April 11, 2021

Treasury department seeks to offload more than $370bn of new securities over the next three weeks

The deluge continues on Tuesday, when the Treasury holds a $24bn auction of 30-year debt. The following week, a new wave will add to that $120bn in supply, with a $24bn sale of 20-year debt, according to analyst estimates.

The week after that, strategists forecast the Treasury will sell another $183bn of securities, with $60bn coming in two-year notes, another $61bn in five-year debt and $62bn at the seven-year mark.

That brings total supply for the month to an all-time record of $373bn, according to estimates by Gennadiy Goldberg, a rates strategist at TD Securities, once the remaining auctions for inflation-protected government securities and other notes are factored in.

“Given the enormous amount of supply continuing to hit the market every month, every Treasury auction should be viewed as a risk event,” Goldberg said.

JPMorgan's Phil Camporeale: “The auctions may not be smooth but they are going to be digestible,”

Indirect bids will be closely watched for signs of foreign demand...

Great primer on reading auction results 👇

And it all starts today with 3 & 10yr treasury auctions at 6PM BST...

Likewise, there may be some juggling in bonds when the Fed announce their new purchase schedule...

Barclays Plc strategists Andres Mok and Anshul Pradhan in a report also predicted the 7- to 20-year sector would be “the biggest beneficiary” of a rebalance by the Fed, with about $3 billion of additional purchases at the expense of other buckets.

Bloomberg say the current purchase schedule runs through April 13, with a new one set to be released at 3 p.m. NY time the same day

Newsquawk are expecting that announcement at 3 p.m. NY time (8PM BST) today rather than tomorrow...

Quiet calendar today, a few central bank speakers, but none that look likely to move the needle at all...

- Looking ahead, highlights include EZ retail sales, ECB asset purchases, ECB's Panetta, de Cos, BoE's Haldane, Tenreyro, Fed's Rosengren, 10 and 30yr supply from the US— Newsquawk (@Newsquawk) April 12, 2021

Haldane's speech should be the highlight, set your alarms!

Really looking forward to this tomorrow pic.twitter.com/dFsk3Nww66— Tim (@VolaTim) April 11, 2021