- Fink 🧠

- Posts

- AM Notes: Release The Owl

AM Notes: Release The Owl

Risk sentiment remains buoyant, with Asian indices firmly in the green following on from strong U.S. performance yesterday...

Yesterdays main event: BOC tapers, brings forward rate hike expectations...

CAD reacted positively...

Wells Fargo now forecast USDCAD to reach 1.18 by the middle of next year...

In addition to monetary policy, the government's latest budget was released this week with indications of continued fiscal support.

A combination of tighter monetary policy and easier fiscal policy is typically the most supportive backdrop for currencies

While we are far from that mix in absolute terms, this week's announcements at least represent a move towards tighter monetary policy and easier fiscal policy. and we view these developments as supporting our view for a stronger Canadian dollar over the medium-term.

ING see at least 1.20

...given that our commodities team believes oil prices will stay supportive in the remainder of the year, CAD may be left without any meaningful short-term dampening factor. An improved rate profile, thanks to markets frontloading a rate hike in 2022 and further scaling back of QE this year, all point to further strength in the loonie.

In line with our bearish USD profile, we expect USD/CAD to touch 1.20 - and possibly move below those levels - by the end of 2021.

Canada is bouncing back - employment and GDP levels

ING

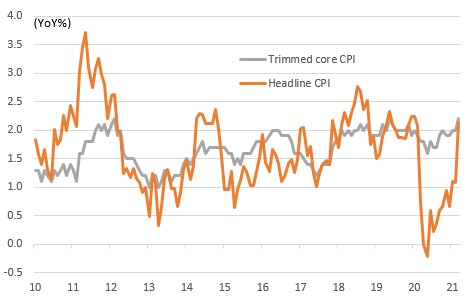

Inflation is back in line with target

ING

BOC Governor Macklem:

"We remain committed to holding the policy interest rate at the effective lower bound until economic slack is absorbed so that the 2 percent inflation target is sustainably achieved.

Based on the Bank’s latest projection, this is now expected to happen some time in the second half of 2022".

Clearly, the ECB won't be anywhere near as hawkish at their meeting today...

Should be a snoozefest, but there's always the possibility of a mis-step from the wise old owl, or the market misinterpreting something, (plus the sources comments in and around the presser)...

Danske

PiQ

At this point, there seems zero upside for the ECB to communicate anything in advance, and we can expect the usual mixture of deflection and philosophy from Lagarde in the press conference...

The path of least resistance for EURUSD is surely to the upside, with the usual caveat that political risk is ever-present...

The recovery fund isn't approved yet, (although the German court case has now been dismissed) and Draghi has announced that Italy will be spending all of the money before it's even hit the account...

PM aims to use share of EU pandemic recovery funds for digitalisation and high-speed rail

Italy and Spain are expected to be the two largest recipients of grants from the programme. The Draghi recovery plan, which should be approved by the Italian cabinet by the end of this week, involves €30bn of Italian budgetary resources and €191.5bn of loans and grants from the Next Generation EU scheme, people briefed on the plans said.

China Developments

Congress is moving with increasing urgency on bipartisan legislation to confront China and bolster U.S. competitiveness in technology and critical manufacturing with the Senate poised to act within weeks on a package of bills.

As part of the package, Senator John Cornyn, a Texas Republican, plans to push for incentives to strengthen domestic semiconductor manufacturing through his CHIPS for America legislation, according to a person familiar with the matter. The bill became law earlier this year but was never funded. President Joe Biden has called for as much as $50 billion for the initiative.

“It’s a big, bold, bipartisan initiative” to propel the U.S. “into the 21st century,” Schumer said on the Senate floor.

“Right now, the Chinese Communist Party is emphasizing to the world that the United States is a divided nation,” Young said in a statement. “This is a rare opportunity to show the authoritarians in Beijing, and the rest of the world, that when it comes to our national security, and most importantly our China policy, we are united.”

Australia on Wednesday cancelled two deals struck by its state of Victoria with China on Beijing's flagship Belt and Road Initiative, prompting the Chinese embassy in Canberra to warn that already tense bilateral ties were bound to worsen.

Under a new process in Australia, Foreign Minister Marise Payne has the power to review deals reached with other nations by the country's states and universities.

Payne said she had decided to cancel four deals, including two that Victoria agreed with China, in 2018 and 2019, on cooperation with the Belt and Road Initiative, Chinese President Xi Jinping's signature trade and infrastructure scheme.

"I consider these four arrangements to be inconsistent with Australia's foreign policy or adverse to our foreign relations," she said in a statement.

"This is another unreasonable and provocative move taken by the Australian side against China," the embassy said in a statement. "It further shows that the Australian government has no sincerity in improving China-Australia relations."

Economic co-dependencies between Australia and China will restrain Chinese policymakers from targeting products such as iron ore that are core to the bilateral trade relationship, even if political and trade frictions between the two countries continue to escalate, says Fitch Ratings.

Recommended Read 👇