- Fink 🧠

- Posts

- AM Notes: Retail sales and great expectations

AM Notes: Retail sales and great expectations

Retail sales will dominate media attention today - we'll get on to those in a minute...

Let's recap a couple of things that stood out overnight...

First, Fed comms 👇

The uneducated: 'OMG Powell's speaking soon he's the BOSS of the Fed, better watch him repeat the same things again'

Me, a market connoisseur: Watch VC Clarida: 'New Policy Framework & Outcome Based Forward Guidance at the Shadow Open Market Committee Meeting' (20:45 UK) pic.twitter.com/dLyyXdq4ft— Tim 📈 (@VolaTim) April 14, 2021

Like all great tweets with 1 like, it was tongue in cheek with a bit of truth attached...

Powell's appearance was far worse than expected - at one point the interviewer was asking him if it was safe for the Fed chair to be riding around on his motorcycle - painful viewing...

If an expected jump in inflation this year does not reverse going into 2022 the Fed “will have to take that into account” in setting policy

“If inflation at the end of the year has not declined from where it is in the middle of the year that will be some good evidence,” that the Fed’s current outlook is wrong

In order to maintain sustained inflation, salaries must be higher than productivity

Maximum employment is the highest level of employment that does not generate inflation pressures

“We are going to be very attentive to what we are seeing in the nexus between wages, productivity, prices and markups,”

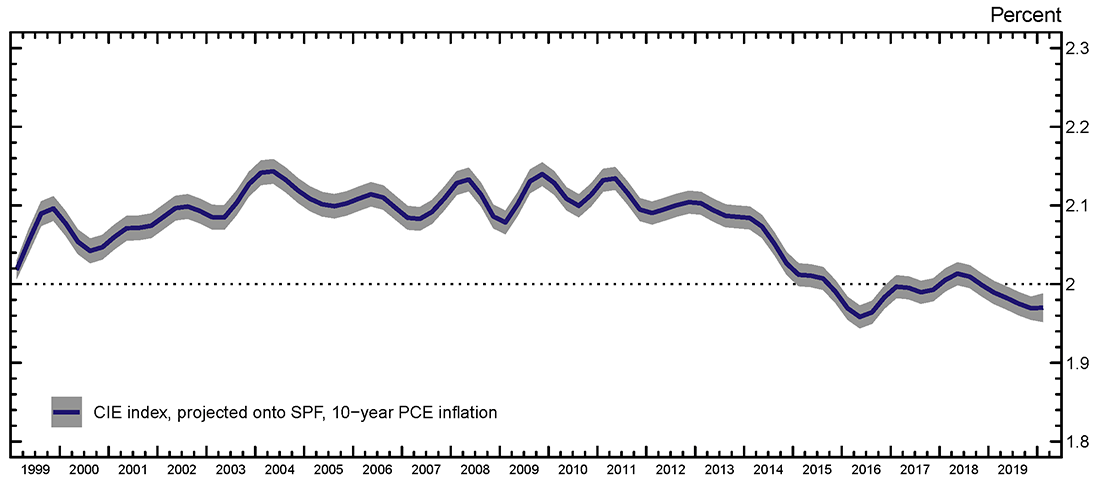

If a new Fed index of expectations were to “drift up persistently...that would indicate to me that policy would need to be adjusted”

WHAT?! A NEW FED INDEX of inflation expectations - I told you it was exciting!

OK, maybe not exciting... Interesting?

Mildly? No?

The index has actually been around since September last year but (as far as I know) this is the first time it has been referenced to directly influence policy...

Australia's seasonally adjusted unemployment rate fell to 5.6% in March 2021 from 5.8% a month earlier and below market consensus of 5.7%.

This was the lowest jobless rate since March 2020, as the economy recovered further from the disruption caused by COVID-19.

The number of unemployed declined 27,100 to 778,100 people, as people looking for full-time work declined by 32,600 to 544,100 and those looking for only part-time work was down by 5,500 to 234,000.

Employment grew by 70,700 to a record high of 13,077,600, easily beating market estimates of an increase of 35,000, as part-time employment gained 91,500 to 4,203,400, while full-time employment fell by 20,800 to 8,874,200.

The participation rate unexpectedly rose 0.2 points to a record peak of 66.3% and beating forecasts of 66.1%.

The underemployment rate dropped 0.6 points to 7.9%, and the underutilization rate fell 0.8 points to 13.5%.

Monthly hours worked in all jobs increased 38 million hours, or 2.2% to 1,800 million hours.

Australia's unemployment rate dips to 5.6% (from 5.8% in Feb). Just as impressively, the underemployment rate - that is people with jobs but who would prefer more hours - declines to 7.9% (from 8.5%) - that's the lowest level in almost 7-years #ausbiz #auspol @IndeedAU pic.twitter.com/GbrecAJKjE— Callam Pickering (@CallamPickering) April 15, 2021

Still some way to go with the recovery in part-time employment continues to outpace the recovery in full-time employment, but those jobkeeper cliff edge fears don't look well-founded...

Retail sales the main event today...

'Official' consensus expectations for a 5.9% MoM increase look to be on the low side; stimmy payments, reopening, weather, card trackers - everything points to a big beat...

@MichaelGoodwell

When everyone's expecting a data point to beat expectations is it actually a beat?

Card spending data definitely suggests it should be a huge print but how the market will react is anyone's guess 👇

Turkey CBRT decision: The newest new guy's up...

Erdogan replaced Naci Agbal, a policy hawk, with Sahap Kavcioglu, who has openly criticised Turkey’s tight monetary stance and who shares the president’s unorthodox view that high interest rates cause inflation.

Don't f**k up - I'll be watching

It's not gone well so far...

The new governor has signalled that there will not be any major change to policy or an early rate cut, and most expect rates to stay on hold...

A hike would probably see him executed in the square, and a cut would further dent market confidence...

Worth noting that Erdogan is still under pressure from Turkish opposition too...

More earnings today, and the pace starts to pick up...

Citi & BofA especially worth watching after JPM, GS & Wells Fargo posted strong results yesterday...

Weekly claims data is due - initial claims is being distorted by people chancing their arm according to JPM's Feroli:

"Historically, about 45% of initial claims resulted in a first payment of benefits. Over the last few months, fewer than 25% of initial claims generated a first payment of benefits," he added. "Why is this so? One reason may be that the $300 weekly bonus payments are encouraging more people to give filing a shot—the payoff from a successful claim is significantly greater than before the pandemic."