- Fink 🧠

- Posts

- 💵 Oh, You're Bearish?

💵 Oh, You're Bearish?

"Bad things are coming, economy's f***ed, probably get hyperinflation, maybe deflation, great depression, so yeah, I guess you could say I'm bearish"

Maybe I've exaggerated a tiny bit for dramatic effect, but this should sound familiar. Doom and gloom sells, and it's all too easy to become bearish.

It's also completely mental.

Like, WTF are you doing?

"Oh, you're bearish?"

"Who gives a FUCK about your feelings bro? Nobody cares."

Seriously. Put your money on the table, place your bet and STFU.

See, this is the problem with these labels. If we're not careful, they'll own us.

That said, it's worth thinking about...

What does it even mean to be bearish?

We know what it SHOULD mean... 👇

The instrument of choice is likely going to go down and not up

But all too often it evolves into a perverted desire to watch the world burn. Like a bushfire restoring natural balance to the forest...

There'll be a new reserve currency, hyperinflation, the debt's too high, fourth turning, the global order will change, too many risks to quantify, OMG, this is the big one!

Or, if we're being less hyperbolic (booooring), then being bearish = general paralysis. A bias towards inaction. Getting too comfortable on the sidelines waiting for the horror movie to start...

Which leads to another problem (as we've seen over recent weeks). You miss everything (and/or have to chase).

And if you miss out, you end up making cringe jokes about people bearing the scars of being bearish. 👇

Bear The Scars (idiom)

to still suffer emotional pain from something unpleasant that happened in the past

e.g. "He still bears the scars of his traumatic experience... He was bearish in 2023"

Hilarious. Could never be me. This is serious though...

When bearish is used as shorthand for an outlook that isn’t so good, it's just lazy.

Not good? For how long? How bad? For who/what?

And are we forecasting the future here?

It's easy to say "you just wait, it's coming"

You'll be right at some point. The destination is far easier than the journey. But did you make any money along the way? How many predicted the AI stock surge ahead of time?

The future’s inherently un-knowable, a balance of risks that are very hard to discount in advance (even though we all try every day).

“I’m bearish” has to be defined into something tangible & actionable.

Just two short months ago, an idiot not too far from here said this 👇

Uncertainty. While it would be no surprise to see the S&P 500 seek out some liquidity in the 4200 zone, spending much time above there seems unthinkable, but then sentiment and positioning (see below) don't exactly scream that markets are exceptionally bullish or ignoring risks either...

Likewise, it makes little sense (to me) to bet on positive catalysts propelling the index significantly higher. Employment numbers have started to turn lower, and betting on the Fed pivoting at 'just the right time' while we're this side of 4k just isn't appealing.

What a genius. Of course, that wasn't actually the bet to make at all. Way too soon to bet on the Fed doing anything within a reasonable timeframe. And...

Uncertainty is a permanent feature of markets Timothy, not an investment case. How could you forget?

Sometimes it's more front and centre, other times it's ignored completely. Either way, uncertainty is always present.

The problem to solve is always how to express a view, or more succintly, if there is a way to monetise that view.

See, bearishness is infectious. And, if you're not careful it can infect everything.

Your overall risk appetite, the appeal of shiny metals, even your willingness to leave the house, cross the street, have unprotected sex with hook... Wait, not that one.

But risks are everywhere you know...?

Soooo.... Bearishness Needs To Be Specific

I’m bearish can easily become ‘don’t take risk’. Which is a problem for traders/investors. It's right there in the job description: Take risks.

Different risks are appropriate at different times so being bearish is a mere precursor to assessments like...

a) the TYPE of risk to embrace/avoid

b) The LEVERAGE to deploy towards that risk

c) The TIMEFRAME of that risk

And so on.

Risks need to be taken, that's the game.

While it makes no sense to lever up and pile into a big cyclical bet right now, it's fair to ask if there were tactical opportunities to take prudent risk during the last 6 months.

20/20 hindsight answers... Duh, OBVIOUSLY.

TL;DR I’m bearish should never become a general state of mind. Reject it.

Dig deeper...

What are you bearish?

Outright? Against another asset?

For how long?

Why?

Etc...

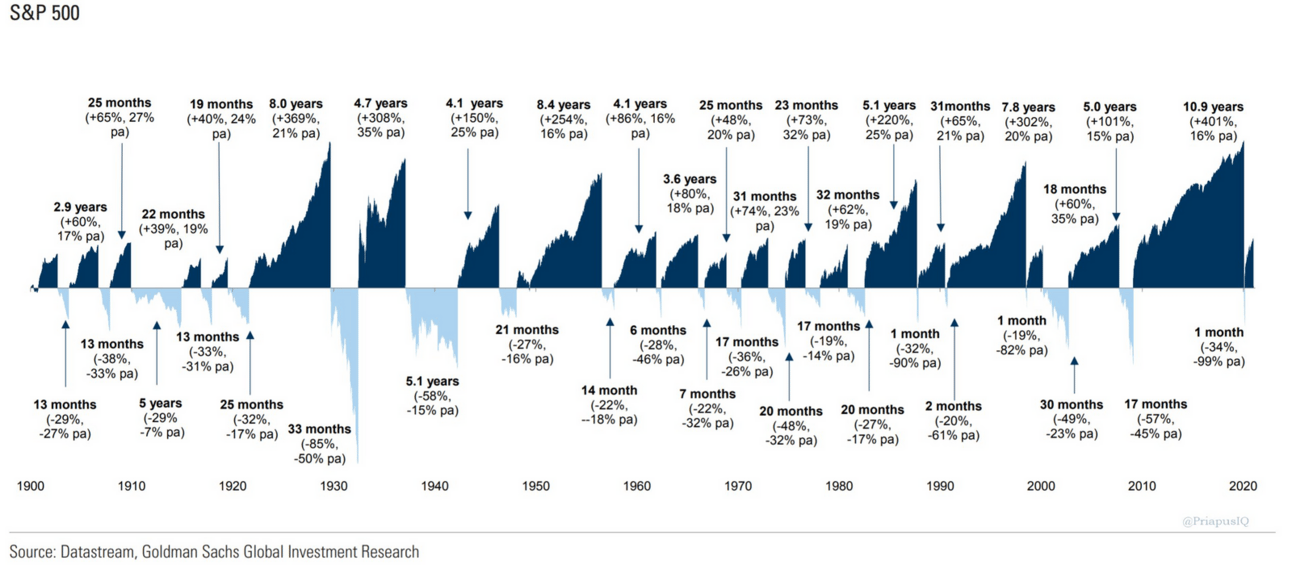

And of course, it goes without saying that there's no value in being permanently bearish. Especially stocks... 👇

The Infinite Bull Market

We're not just saying that because stocks are up by ~14% this year. We published the case for the bulls in Feb here 👇

5k was just for alliteration (or whatever the numerical equivalent of alliteration is IDK). The point stood though. There WAS a bull case.

You can definitely argue that there was a solid, logical case for sitting this rally out too, but that doesn't change the fact that it happened while plenty simply watched on...

Even when signs emerged that the market was caught too short and would need to chase, that general feeling of bearishness was too heavy to lift...

Was it the fear of looking stupid...?

Be dumber

“Pessimists sound smart – optimists make money”

“Negativity and pessimism tend to sound more logical and compelling than optimism and positive thinking”

“Bears always sound smarter than bulls”

Do you want to sound smart or do you want to make money?

Optimism is the default setting. Howard Marks' 'Tug Of War' sums this up perfectly... (emphasis added) 👇

I’ve been thinking lately about the fact that being an investor requires a person to be somewhat of an optimist.

Investors have to believe things will work out and that their skill will enable them to wisely position capital for the future.

Equity investors have to be particularly optimistic, as they have to believe someone will come along who’ll buy their shares for more than they paid.

My point here is that optimists surrender their optimism only grudgingly, and phenomena such as cognitive dissonance and self-delusion permit opinions to be held long after information to the contrary has arrived.

This is among the reasons why they say of the stock market:

“Things can take longer to happen than you thought they would, but then they happen faster than you thought they could.”

Today’s sideways or “rangebound” market tells me investors possess a good amount of optimism despite the worries that have arisen. In the coming months, we’ll find out if the optimism was warranted.

Indeed we will.