- Fink 🧠

- Posts

- The Opening Belle - Biden's Big Plan Faces Big Questions

The Opening Belle - Biden's Big Plan Faces Big Questions

Uncertainty creeping in on the back of Biden's spending announcement.

Not much green in Asia with the ASX closing flat, Nikkei -0.6% & KOSPI -2%.

10Y Treasuries yielding 1.10%. U.S. futures & oil in the red.

This (together with concerns over how much stimulus will pass the Senate) sums up the uncertainty...

“Right now markets are celebrating the additional stimulus and see it as a stronger bridge to a fully reopened economy,” said Jeff Buchbinder, equity strategist for LPL Financial.

“On the other side of it there’s the chance that markets will have to pay for this in the form of sharply higher interest rates or tax hikes that could cap equity valuations,” he said.

Analysts had already begun marking up their forecasts for economic growth this year after last week’s elections in Georgia delivered control of both houses of Congress to Democrats.

Many, though, had penciled in smaller packages, more along the lines of the $892 billion stimulus passed in December.

Spending big on vaccine rollout, testing, and to shore up state and local governments on the frontlines of those efforts could help bring a swifter end to the country’s healthcare crisis, which remains at the root of the economic crisis.

The incoming Democratic administration’s proposed package provides targeted aid that economists say delivers the most effective economic boost, including an increase to the current extra weekly benefit to the unemployed, to $400 from $300.

It would also direct $170 billion toward reopening schools, the closure of which in many parts of the country has forced millions of workers, particularly women, to leave their jobs.

And it would put an extra $1,400 into the hands of most Americans - money that can be spent on rent or food for those who need it, or saved for a splurge on travel or dining out later in the year once wider vaccine distribution allows everyday life to get back closer to normal.

The new spending comes at a critical time for the world’s largest economy. A winter resurgence of COVID-19 sent a partially recovered labor market into reverse last month as employers shed 140,000 jobs, especially low-income positions in restaurants, bars and other high-touch service industries.

All told the new package, which must still be voted on by Congress, would bring to $5.2 trillion the total fiscal stimulus delivered to the U.S. economy since the crisis began, equivalent to about a quarter of U.S. annual economic output.

Snapshot of the proposals...

CFRB

Away from the headline numbers, Vox offer superb in-depth detail on just how much Biden can realistically achieve with a thin majority.

The full article is recommended reading, (but it's long!) so here goes with the summary...

Biden and his allies in Congress can accomplish an awful lot through a process called budget reconciliation. The Senate filibuster means that a bill typically requires 60 votes to move forward. With only 50 Democratic senators (plus tie-breaker Vice President-elect Kamala Harris), that’s a nearly insurmountable barrier.

But the budget reconciliation process exempts certain legislation that primarily affects taxes and spending from the filibuster, meaning the 50 Senate Democrats can pass it on their own.

(so long as all Democrats are in agreement.)

However, reconciliation comes with profound limitations. It can usually only be used once per budget resolution, which in theory works out to one reconciliation bill a year. (Since Congress hasn’t yet passed a budget resolution for fiscal year 2021, Democrats could do two bills this year, one for 2021 and one for 2022; the details are a bit complicated, as the Center on Budget and Policy Priorities’ David Reich and Richard Kogan explain.)

The potential and limits of a Senate majority

Joe Biden’s agenda is vast and impossible to summarize in a single article, even when confined to what’s possible under budget reconciliation. But to pick out some of its most important aspects, Biden could:

Approve $2,000 checks, state and local aid, and a boost to vaccine funding

Create a $3,000-per-year child allowance for parents

Make housing a human right funded through federal vouchers

Guarantee paid maternal/sick leave

Achieve universal pre-K for all 3- and 4-year-olds, and massively expand child care access

Spend $2 trillion investing in clean energy and climate R&D

Forgive the first $10,000 in student loans for all debtors

Make community college free for all

Reduce Medicare eligibility to age 60 and perhaps create a public option open for all

Raise taxes on the rich by $4 trillion

Effectively abolish the debt ceiling to prevent future GOP hostage-taking

Then there are the limits on what a bill passed under reconciliation can do, imposed by the “Byrd Rule,” which offers a way for senators to raise an objection against “extraneous” provisions in bills being considered under reconciliation. If the Senate presiding officer (who has historically always acted on the advice of the nonpartisan Senate parliamentarian) agrees, the provision is struck.

The basics of the Byrd Rule are that reconciliation bills cannot change Social Security, or have merely “incidental” effects on spending/revenue, or increase deficits after 10 years. There are a couple of other limitations as well, but those are the major ones. In other words, reconciliation can be used for spending and taxing, but usually not for pure regulation or legal changes. If the main effect is not budgetary, it’s not reconcilable.

The purpose of budget reconciliation is to reconcile tax and mandatory spending laws to the budget, and it’s never been used to alter discretionary spending, which sustains the military, most domestic government agencies, and some social programs like Head Start, although an ambitious vice president willing to lean on the Senate parliamentarian might be able to force through at least some changes.

Those strictures set some pretty stiff limits on Democrats’ legislative ambitions. Some examples of legislation that probably wouldn’t survive a “Byrd bath” (the Capitol Hill term of art for how the Senate strikes Byrd-violating provisions from reconciliation bills) include:

Statehood for DC and Puerto Rico

A minimum wage increase to $15 an hour

Comprehensive immigration reform

Redistricting and/or campaign finance reform

Revival of the Voting Rights Act

A nationwide mask-wearing mandate

A nationwide ban or limit on indoor dining or other Covid-19 spreading activities

Labor law reforms to make it easier to join a union

A minimum wage increase, for example, might indirectly affect the federal budget by leading to higher income and payroll tax revenues and less expenditure on food stamps. But that’s exactly the kind of “incidental” effect the Byrd Rule doesn’t allow legislation to use as an excuse.

But even with those constraints, there is still plenty that Democrats can do. Any spending or tax measure that is deficit-neutral or expires within 10 years and doesn’t touch Social Security is fair game.

“Now is not the time to be talking about exit,” from the $120 billion in government securities the Fed is buying each month, Powell said in a web symposium with Princeton University.

“A lesson of the Global Financial Crisis is be careful not to exit too early, and by the way try not to talk about exit all the time...because the markets are listening.”

“The economy is far from our goals...and we are strongly committed...to using our monetary policy tools until the job is well and truly done,” Powell said, pushing back against recent suggestions from some of his colleagues that the Fed might consider trimming its bond purchases even later this year if vaccines supercharge an economic rebound.

Powell said the Fed’s main focus is restoring the labor market to where it was before the pandemic, when opportunities had begun flowing more fully to lower-wage and less-skilled workers after a decade of unbroken economic growth.

The distribution of new coronavirus vaccines has boosted the outlook for recovery this year, and Powell said overall “we think we can get back there much sooner than feared” last spring when some analysts raised concerns of another Great Depression with years of high joblessness and weak or negative growth.

As Cryptocurrencies continue their flow into the mainstream, EQUOS are setting the standard...

And they've dropped fees to ZERO for the whole of January!

EQUOS is a digital asset exchange built to institutional standards & available to everyone.

They've created a truly institutional-grade infrastructure while enabling anybody to join. Users can enjoy a higher level of security, capital efficiency and reliability.Founded on real-world values of fairness and equality to promote liquidity and help build long-term equity.

With a focus on innovation, transparency, and trust, EQUOS is a part of Diginex Global, the first Nasdaq-listed company with a cryptocurrency exchange.

"Siri, Play 'Hysteria'"

The usual suspects will be out in force on this one.

We've got an early favourite from the comments section...

This is why Boris’s government doesn’t want the pandemic to close nurseries. They want to to start teaching kids to sweep chimneys again.

Perspective.

There is an EU directive on the maximum weekly working hours (48).

The UK chose not to enforce this - yet workers currently have to opt out if they choose to work more.

Sounds like cutting unnecessary red tape to me.

Full details are due at the end of the month so we'll find out more (and judge the plans on merit) then.

Worker protections enshrined in EU law — including the 48-hour week — would be ripped up under plans being drawn up by the government as part of a post-Brexit overhaul of UK labour markets.

The package of deregulatory measures is being put together by the UK’s business department with the approval of Downing Street, according to people familiar with the matter. It has not yet been agreed by ministers — or put to the cabinet — but select business leaders have been sounded out on the plan.

The proposed shake-up of regulations from the “working time directive” will delight many Tory MPs but is likely to spark outrage among Britain’s trade union leaders.

The move would potentially mark a clear divergence from EU labour market standards but the UK would only face retaliation from Brussels under the terms of its new post-Brexit trade treaty if the EU could demonstrate the changes had a material impact on competition.

The main areas of focus are on ending the 48-hour working week, tweaking the rules around rest breaks at work and not including overtime pay when calculating some holiday pay entitlements, said people familiar with the plans.

The government also wants to remove the requirement of businesses to log the detailed, daily reporting of working hours, saving an estimated £1bn.

The government insisted that any reforms would be designed to help both companies and their employees — and put to a full consultation — saying it had no intention of “lowering” workers’ rights.

Brussels has often highlighted labour market standards as a core issue for the “level playing field” that the deal is meant to uphold, but regulation of working time at EU level is patchy, with Brussels seeking repeatedly to shore up how the directive is applied. Britain, along with many EU countries, opted out from enforcing the 48-hour limit on the working week as a member state.

The government points out that the UK often “gold plates” EU minimum standards — such as offering 5.6 weeks of annual leave compared with the EU requirement of 4 weeks.

Utrust are making crypto payments easy.

Spend crypto on everyday items. Receive crypto payments for your business, it's all possible.

Utrust is a truly revolutionary project, read more about it here...

Besides significantly lower fees, the core @Utrust advantages are:

- Zero chargebacks losses ✔️

- Zero locked funds for flagged card payments ✔️

- True borderless coverage ✔️

- Fast settlements ✔️

Keep it simple 👍 pic.twitter.com/2IIfYtkyMq— Nuno (@nunocor_) January 12, 2021

Earnings season starts picking up pace with JPMorgan, Citigroup and Wells Fargo all reporting today.

Bank of America, Goldman Sachs and Morgan Stanley follow next week...

KBW analysts expect per-share bank earnings to fall 8% in the fourth quarter compared with the same time in 2019. They also expect profits to fall compared with the third quarter, when some of the largest banks delivered better-than-expected results.

Net charge-offs are expected to rise in the fourth quarter from the third but remain far below historic highs, analysts said. Concerns over deteriorating credit quality ate into profits in 2020, when banks set aside billions of dollars to cover potential losses. Banks and analysts have lowered their loan-loss estimates since the pandemic’s early days, but those could rise again if the current jump in coronavirus cases further slows the economic recovery.

Banks are expected to announce plans for stock buybacks, one of the main ways they return capital to shareholders. The Federal Reserve stopped buybacks at big banks last year, a move to preserve capital in an unsettled economy, but said in December that banks could restart them with limitations.

Bank stocks mounted an impressive recovery in the fall after trailing the broader market for much of 2020. The KBW Nasdaq Bank Index rose 34% between October and December, compared with a 12% increase in the S&P 500.

The unusual nature of the coronavirus recession padded bank revenue in ways that few could have predicted at the pandemic’s outset. Mortgage originations, a key source of fee income, reached record levels as well-off families looked for homes with more space. The stock market, boosted by tech companies that profited from the stay-at-home economy, soared to records, lifting trading desks. Stimulus checks, loan deferrals and expanded unemployment helped many consumers and businesses, driving loan defaults lower—not higher—for some companies.

Still, mortgage levels are expected to decline in 2021. Rising coronavirus cases and job losses threaten to keep consumers at home and squeeze their income, which would likely weigh on credit-card spending and leave some customers unable to pay their bills.

Low interest rates, which crimp bank profits by limiting what banks can charge on loans, are also a challenge. The Fed slashed its benchmark rate to near zero last March. Analysts expect net interest margin, a key measure of lending profitability, to decline even from what was already an all-time low of 2.68% in the third quarter.

What’s more, making loans in such an uncertain economy could prove difficult, in part because lenders aren’t sure how to evaluate customers’ risk profiles after months of loan deferrals. Loan growth decelerated in the fourth quarter, falling by an annualized 3% from the previous quarter, according to analyst estimates. And businesses that socked away cash earlier in the pandemic won’t need loans.

“When businesses feel optimistic about the outlook and want to expand or hire, they’ve got the cash to do that,” said Terry McEvoy, a bank analyst at Stephens Inc. “They will not need to call their banker and ask for a loan.”

Aside from earnings, we have the January OPEX...

⚠️ January OPEX ⚠️

(GMT)

🇬🇧 10:15 FTSE 100

🇪🇺 11:00 Euro Stoxx 50

🇩🇪 12:00 DAX 30

🇺🇸 14:30 E-mini S&P

🇺🇸 14:30 NASDAQ

🇺🇸 14:30 DJIA— PiQ (@PriapusIQ) January 14, 2021

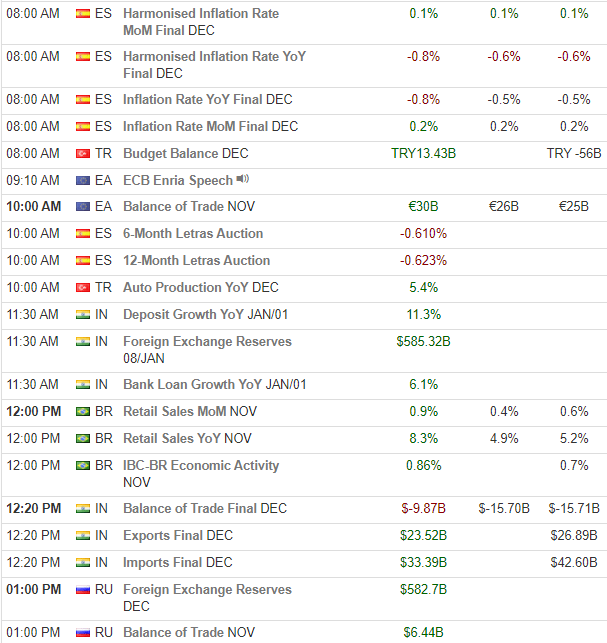

and a pretty packed calendar!