- Fink 🧠

- Posts

- The Opening Belle - Tech Leads The Way

The Opening Belle - Tech Leads The Way

Overnight markets are looking pretty constructive, risk sentiment leaning towards positive as we start the week.

Asian indices setting the tone....

Bitcoin's quiet weekend ended with a decent rally in Asia - we're knocking on that $34,000 resistance level once again as London comes online...

Remember to check out Equos and their zero fees January trading!

As Cryptocurrencies continue their flow into the mainstream, EQUOS are setting the standard...

EQUOS is a digital asset exchange built to institutional standards & available to everyone.

Truly institutional-grade infrastructure available to anybody. A higher level of security, capital efficiency and reliability.Founded on real-world values of fairness and equality to promote liquidity and help build long-term equity.

With this focus on innovation, transparency, and trust, EQUOS is a part of Diginex, the first Nasdaq-listed company with a cryptocurrency exchange.

In U.S indices, Tech leads the way once again. The Nasdaq (NQ) up by 0.8% already.

Good news for these call buyers...

Bullish Stock Bets Explode as Major Indexes Repeatedly Set Records

Investors are piling into bets that will profit if stocks continue their record run.

Options activity is continuing at a breakneck pace in January, building on 2020’s record volumes. It is the latest sign of optimism cresting through markets as individual and institutional investors pick up bullish options to profit from stock gains and abandon bearish wagers.

More than half a trillion dollars worth of options on individual stocks traded on Jan. 8 alone, the highest single-day level on record, according to Goldman Sachs Group Inc. analysts in a Jan. 13 note.

Bullish call-options trading surged to a high on Jan. 14, with about 32 million contracts changing hands, according to data provider Trade Alert.

All eyes on GameStop and the next WSB target today after $GME gained an astronomical 69% on Friday as a huge retail-fuelled short squeeze took the stock to All-Time Highs of $65.

Although GameStop grabbed the headlines, this is more than a single-stock story...

And it's leading to Robinhood envy in the ultimate battle of "flows before pros."

Hard for Wall Street to justify their management fees when they're being outperformed by an internet message board...

Maybe Biden will announce a new policy to protect investment bankers?

He's certainly announcing plenty of policy in the early days of his administration...

Biden says 'We can't wait' for $1.9 trillion COVID-19 relief plan, he will unveil more climate policies, urge China to toughen emissions target, reverse Trump's 'draconian' immigration policies, & order an assessment of domestic extremism risk.

Biden's also scheduled to sign an executive order on American Manufacturing & American Workers today.

Busy guy.

All of which means Trump's impeachment trial has been pushed down the agenda...

China-Taiwan tensions are back in the spotlight after a large incursion of Chinese bombers and fighter jets into Taiwan's air defence identification zone.

A U.S. carrier group entered the South China Sea in response to promote “freedom of the seas”, China passed a law last week authorising the coast guard to fire on foreign vessels if needed

Volkswagen is looking to claim damages from suppliers over chip shortages & Taiwan's TSMC has said that it will prioritise auto chips if possible...

The Great Vaccination

Bloomberg has an excellent Vaccination Tracker packed full of stats and info on the different vaccines and countries.

We'll focus on the most important point...

Which countries are leading the vaccine rollout?

Israel is approaching 40% vaccinated & the U.K. leads the European pack by a distance, nearing 10%...

The general theory is that the faster the vaccine can be rolled out, the faster the economic recovery will be.

Japan & Australia haven't even started yet...

The U.K may be leading the way on the vaccine front, but there is pressure elsewhere with speculation that the UK faces a constitutional crisis after The Times commissioned a four-country survey on 'the state of the union'.

Another (Scottish) referendum?

In other UK news, Boohoo is acquiring Debenhams for ~£50m

Debenhams went into administration last month after the enforced store closures that were part of the response to the coronavirus pandemic wreaked havoc on the group’s already-fragile finances.

Sale processes both before and after the insolvency failed to find a buyer, and the company is in the process of being liquidated.

As was the case with its previous acquisitions, such as those of Karen Millen, Coast and Oasis, Boohoo is acquiring only the Debenhams brands and its fashion sub-brands, such as Mantaray and Principles

Want to receive crypto payments for your business or simply spend crypto on everyday items?

Utrust is the solution for you...

Besides significantly lower fees, the core @Utrust advantages are:

- Zero chargebacks losses ✔️

- Zero locked funds for flagged card payments ✔️

- True borderless coverage ✔️

- Fast settlements ✔️

Keep it simple 👍 pic.twitter.com/2IIfYtkyMq— Nuno (@nunocor_) January 12, 2021

A big earnings week awaits with 118 of the S&P 500 due to report...

The World Economic Forum kicks off today and will continue throughout the week.

No private jets alongside the discussions of climate change this year...

Covid means that this will be a virtual event, with corporate & political leaders coming together online to discuss vaccines, economic recovery, 'the inequality virus', social justice, digital currencies & stakeholder capitalism (to name just a few)...

“When I’m done, half of humanity will still be alive.”

The first of the big-hitters is BOJ Governor Kuroda, who will participate in a 'Leadership Panel' titled 'Restoring Economic Growth' at 8:00GMT.

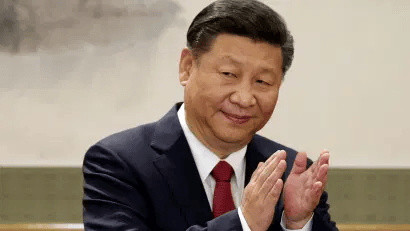

Xi Jinping follows at 12:00GMT - the Chinese president will be speaking on human rights and the importance of equality between religious groups...

"Funny guy, I'll follow you on TIkTok"

OK, he'll be talking about China's pandemic experience and economic recovery.

BOE Governor Bailey also speaks at 5PM on 'resetting digital currencies'...

Not much of note on the economic data front, Germanys's IFO the only release worth highlighting, although ECB's Lane, Lagarde & Panetta will also speak today (Lagarde on Green Banking in the morning & Restoring Economic Growth later in the day).

Also keep an eye out for Italy's PM Conte resigning as he attempts to form a new majority government.