- Fink 🧠

- Posts

- The Opening Belle - Wounded Wolves Of Wall Street

The Opening Belle - Wounded Wolves Of Wall Street

Wall Street have taken a hit from those 'degenerates' over at WSB.

It's a great story, and we wrote about it here in more detail.

Wall Street will be fine, even though a few tears have been shed...

Actual Wall Street Footage

Not all will make it out alive - there is speculation that Melvin Capital could go under on the back of this.

They say they'll be fine - time will tell...

(2/4) say Citadel @citsecurities discussed a buyout w Melvin mgt, but Melvin ultimately demurred through a massive deleverage. The firm believes it can survive now that it has money from Pt. 72 and Citadel combined w much lower leverage that will reduce portfolio volatility.— Charles Gasparino (@CGasparino) January 27, 2021

(A Melvin Capital spokesman separately rejected the 'false' reports of bankruptcy on social media)

There are still questions though... The Citadel/Point72 bailout wasn't an act of charity, so how do they stand to benefit?

If Melvin does declare bankruptcy, the biggest creditors are first in line at the buffet...

And the Gamestop fun might not be over yet, with short interest back above 120%

New sellers are entering the game at these higher prices looking to short the top and ride the wave back down, and brokers are starting to restrict orders to protect themselves from overleveraged retail traders...

Gamestop closed just above $347 yesterday.

It's not just the little guys who have benefited either - BlackRock may have raked in as much as $2.4 billion due to their 13% stake in the video game retailer.

While we're on the subject of the little guys sticking it to the man, remember the Essex oil traders who made $660 million in one day when oil went negative last year?

A US judge has been asked to ringfence their profits - “the full amount of each defendant’s unjust enrichment”...

Federal Reserve Rejects Taper Talk

Policy remained on hold at yesterday's meeting, as widely expected.

Powell expressed concern about the tough few months ahead, although the Fed see reason to be optimistic later in the year on the back of the vaccine rollout, estimating that

U.S. economic output will grow 4.2% in 2021

The unemployment rate will drop to 5% by the end of 2021, and to 4.2% by the end of 2022.

“In a world where, almost a year later we’re still 9 million jobs at least ... short of maximum employment, it’s very much appropriate that monetary policy be highly accommodative,”

He also had comments on house price increases...

“There was a lot of pent up demand... The price increases are unlikely to be sustained.”

And asset bubbles more generally...

“I think the connection between low interest rates and asset values is probably something that’s not as tight as people think because a lot of different factors are driving asset prices at any given time,” Powell said.

“If you raise interest rates and thereby tighten financial conditions and reduce economic activity in order to address asset bubbles and things like that, will that even help? Will it actually cause more damage?”

Earnings: Tesla Underwhelms, Apple's $111 Billion Quarter

Tesla delivered 180,570 vehicles in Q4, a quarterly record, but fell short of the 500,000 deliveries targeted for 2020.

The average sales price per vehicle dipped 11% on a yearly basis, and investors were left disappointed by vague guidance for 2021;

“Over a multi-year horizon, we expect to achieve 50% average annual growth in vehicle deliveries. In some years we may grow faster, which we expect to be the case in 2021,”

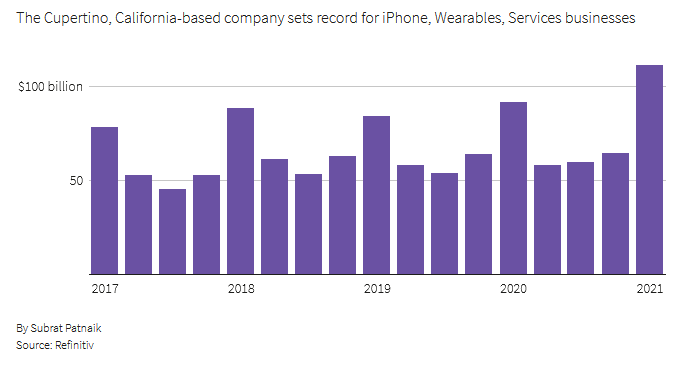

Apple reported record revenues, beating expectations while reporting a a 57% rise in China sales...

Strong sales of Mac laptops and iPads pushed up profits, driven by consumers working, learning and playing from home during the pandemic.

Apple's revenue for the quarter ended Dec. 26 rose 21% to $111.44 billion.

Earnings per share rose to $1.68 from $1.25, beating Wall Street targets, according to IBES data from Refinitiv. Sales of iPhones were $65.60 billion and beat a record set three years ago.

As part of the strategic partnership, GSR will become a shareholder in Diginex and one of the main liquidity providers for EQUOS, Diginex’s crypto exchange.

Richard Byworth, CEO of Diginex, commented:

“As an exchange that avoids the conflict of interest of making markets against its own participants, the partnership with GSR is key to growing the depth and liquidity in all our trading pairs.

GSR are one of the largest market makers in crypto and crypto derivatives, so longer term the partnership will evolve more broadly into liquidity provision around key offerings like options, structured products and borrowing and lending.”

“Since the launch of our BTC Perpetual product, we have seen a meaningful increase in activity on EQUOS, with overall volumes increasing over 2.5 times on an average daily basis, compared to December levels.

We anticipate that with GSR onboard and the additional depth they will bring to our books, we will continue to see volumes increase meaningfully as liquidity and spreads improve.”

Coming Soon - Central Bank Digital Cash

In just three years, central bank digital currencies will be available to 20% of the world according to the latest BIS survey.

Utrust are making crypto payments easy

Whether you want to receive crypto payments for your business or simply spend crypto on everyday items, Utrust is the solution for you...

Besides significantly lower fees, the core @Utrust advantages are:

- Zero chargebacks losses ✔️

- Zero locked funds for flagged card payments ✔️

- True borderless coverage ✔️

- Fast settlements ✔️

Keep it simple 👍 pic.twitter.com/2IIfYtkyMq— Nuno (@nunocor_) January 12, 2021

Market Snapshots

Pretty dire in Asia, with all major indices heavily in the red...

The negative risk tone has dragged U.S indices lower, (although they are attempting to bounce from the lows as I type) and European markets open in the red this morning.