- Fink 🧠

- Posts

- 💵 What does posting a satirical Tweet tell us about the state of crypto?

💵 What does posting a satirical Tweet tell us about the state of crypto?

The last few days have been SERIOUSLY fun.

After the trouncing of altcoins late on Friday night, I decided to do a little sentiment digging by posting the below Tweet, which probably most have seen by now...

There were over 1000 replies, all roughly saying the same thing as Pewdiepie here...

0:00

/

What a throwback...

The problem with the replies that were saying 'bottom' though is that the Tweet is literally not my position.

This poses quite an important question then...

Which sentiment indicators actually matter, and is Twitter a good barometer of sentiment?

I've said MULTIPLE times to the Macrodesiac Premium members (if you're keen on joining probably the strongest community online of people interested in the macro side of trading, then do please come on board and if you buy an annual, I will upgrade you to lifetime for free), that I use Tweets sometimes to check sentiment and I don't necessarily believe some of the things that i say.

Depending on the type of accounts that reply, based on their previous history and just general feel of what they chat about, I can get a half decent grasp of what I think might happen to a particular market.

And I mean, the above is a perfect example of this.

Let's think of crypto in context right now.

Friday night, why did the market fall so hard?

Some whale sold a shitload of coins at market.

Doesn't matter the amount or any specifics, but what matters is why did this dump hurt the market so much?

Well, market makers seemingly don't wanna be in the market as much, which makes sense of course.

Here's a chart from Hyblock Capital showing the global bid/ask ratio...

CoinDesk & PriapusIQ

No one wanted to leave anything resting in the book at all, and liquidity has been slightly deteriorating at the 1% range of top of book since Jane and Jump scaled back their market making businesses in the US.

For smaller orders, there is no real impact since there is sufficient liquidity at market, but the second a large order comes through like on Friday, we see the effects (a big red dildo).

But to the point that we're trying to understand, does a sharp fall mean a bottom , especially in the case of my Tweet where I literally talking a load of shite that I do not believe?

We tried to look at magazine covers in crypto before to see if they were a sentiment gauge...

And the verdict is... sort of.

But in this case, absolutely not.

Altcoin dominance looks as if it is ready to die a painful death, quite frankly.

We might be at peak interest rates, sure.

But the market just seems to keep repricing that higher for longer view, even if ever so slightly.

And from the 10th of May, there has been an enormous amount of cuts priced out.

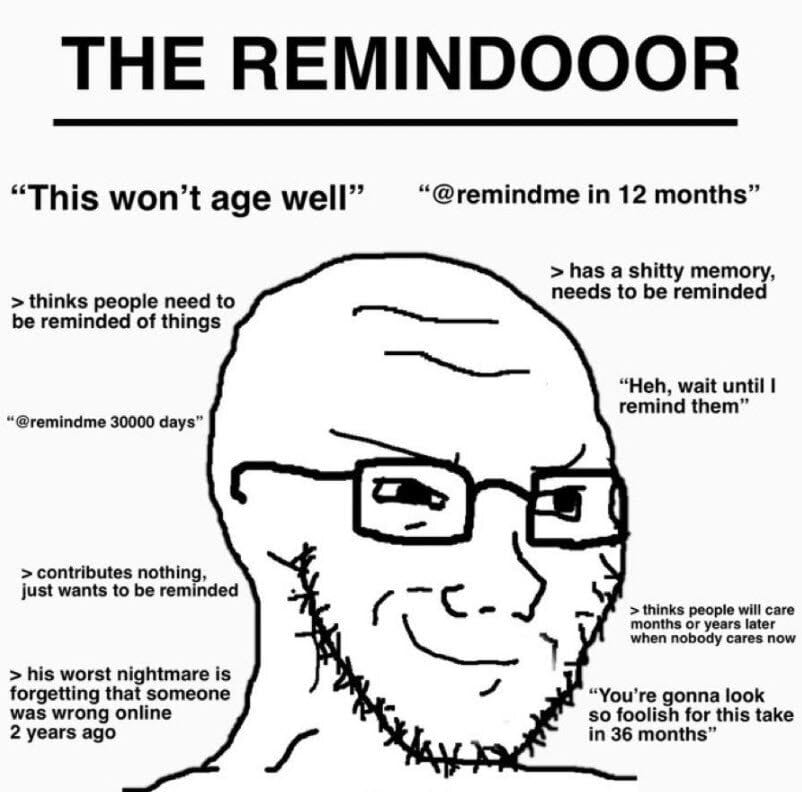

One thing that perhaps is being hinged on at the moment is tomorrow's CPI, which the remindoooors and bottom callers might not recognise actually matters in crypto and to the market makers keeping price stable.

A high print increases tightening, leading to a further flight to quality.

As I had explained to Macrodesiac Premium guys last week, there is one factor that is not quite budging to cause any real concern just yet in equities...

...but higher rates lead to a flight to quality of any capital that is invested.

Now ask yourself why your altcoin bags aren't going up - would you consider them of greater quality than say, buying Monster Energy (world's greatest stock) for example?

So it is not that higher interest rates lead automatically to markets falling.

It takes a few components coming together to do that, and it actually rests more on interest rate expectations increasing than actual fundamentals of what interest rates being higher do (until we reach a tipping point, of course)...

But your job as an investor or trader is to examine exactly whether the likelihood of an asset going up or down is, and bet accordingly.

Using a false bit of information such as my Tweet will not provide you with the desired signal.

What might not be a false signal is seeing Cobie bid farewell to Twitter.

Yet most of the guys with crypto contest retweets in their timelines to win $40 of the newest shitcoin wouldn't really get Cobie's importance.

Is there anything objective to counter trading sentiment though?

Yes.

From this paper, 'Macro Sentiment and Hedge Fund Returns'...

Using a novel dataset, we show media sentiment on growth, inflation, unemployment, and sociopolitical conditions predict hedge fund returns. We blend these into a macro sentiment index (MSI) and show that funds betting against sentiment generate higher risk-adjusted returns. This result is robust to orthogonalizing MSI against popular sentiment indices.

We demonstrate MSI as a state variable in Intertemporal Capital Asset Pricing Model (ICAPM) for hedge fund portfolios but not for unmanaged portfolios or individual stocks. Overall, our results highlight differences between media-based and popular outcome-based sentiment measures and suggest a role for sentiment in heterogeneous agent asset pricing models.

The part in bold is the only really key bit here.

From a macro perspective, it is much smarter to bet against the media, and therefore the general public's incorrect view, since they are guided heavily by the media.

This is something that I am ardent about, and have said over and over again.

The goal of Macrodesiac at the end of the day is to dispel this weird relationship, where the media seems to lead conversations rather than reporting on what is going on.

I'll revert back to one of my appearance on GB News as well, where I contest the views on air around Huw Pill's nonsense on mortgages...

0:00

/

However, the descriptions and reasonings for the current crypto atmosphere is not 'macro'.

The above paper was written on 'growth, inflation, unemployment, and sociopolitical conditions,' something which sentiment on Twitter might be ignorant of.

If we look at these indicators, we can see something...

The stock market is literally fading the constant doom and gloom from the media and general public right now.

Why?

Well the macro conditions are not exactly causing that big of an upset.

Unemployment is still low, growth although revised a bit lower, is still strong and inflation is coming down.

It's like the ever lasting Goldilocks (fucking hate that description) situation.

This means that for now, cashflows are not affected, meaning people are willing to own stocks, and the new AI narrative has really thrown a spanner in the works for bears.

And think about that mania... it's not really helping crypto right now.

Which technology seems more attractive to you right now, the one that is going up and has real world uses right here right now, or the one that has its uses on paper, requires broad network effects to work and is being shat on by regulatory clampdowns?

This comment is not anti-crypto, it is simply pro-opportunity cost.

Right now is not the conditions for a broad based crypto rally - there is a flight to quality that has and is occurring and unfortunately, crypto isn't current a part of that – until rates head lower again.

Yes, that will be the cause of the next cycle.