- Fink 🧠

- Posts

- 🔔The REAL Reason Stocks Are Crashing

🔔The REAL Reason Stocks Are Crashing

In partnership with capital.comTrade 5,600 markets

0% commission and tight spreads

Trade on market swings with CFDs & Spread Betting

Intuitive & easy-to-use interface

Smart risk management tools

Regular live updates & price alerts

78.91% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

OK. So you want to know the REAL reason stocks are down? We plugged the data into our proprietary Macrodesiac Model™ to bring you the answer.

Unfortunately our model broke down. She says it was the most uncomfortable experience of her life and refuses to work here again. Not very helpful (and a little bit selfish to be honest).

So we've cracked open some detailed sellside reports for extra insight. Just checking their workings and then we'll confirm.

Back to basics it is then. Let's try this one.

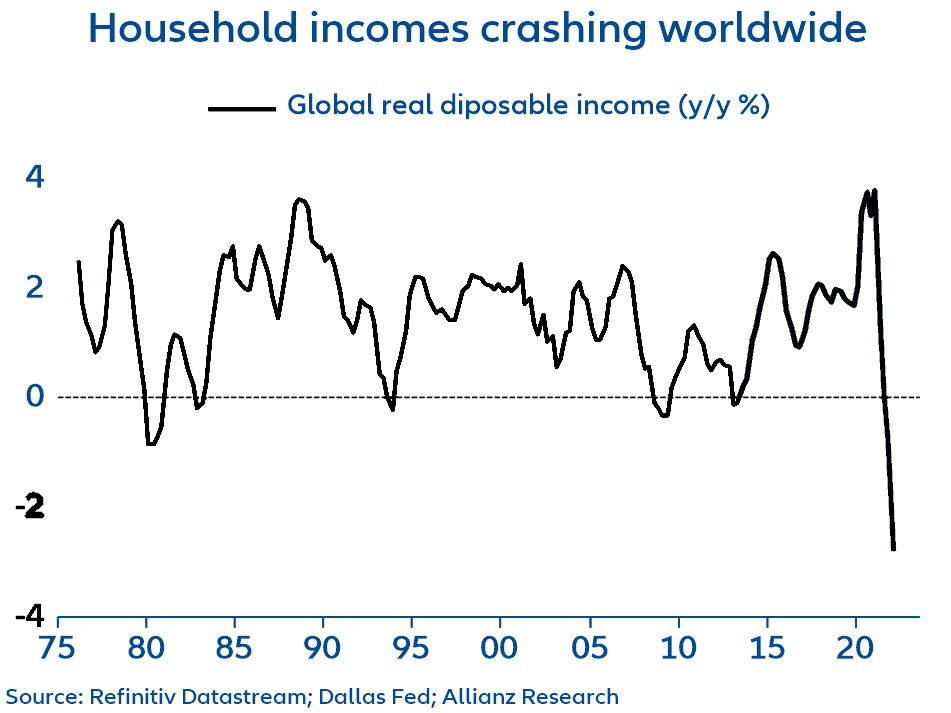

The greatest, though rarely raised, argument for stocks to fall isn't any fancy stock analytical ratio or price chart. It's that people need money to buy stuff to live on, rather than to buy stocks. pic.twitter.com/wsSGstbsVa— Polemic Paine (@PolemicTMM) September 7, 2022

Real incomes are negative. People need money to live, so they don't have the spare cash to pump into the stock market. Simple. Hard to sell it to anyone as knowledge they didn't already possess, but the concept is correct and something to build on.

The stock market is essentially a savings vehicle. People work, build up savings and those savings get invested somewhere. The same is true for companies. They save and invest in other companies.

Just look at Amazon & Ford investing in Rivian. Wait. That hasn't gone so well. Maybe Buffett and Munger investing in Occidental will be a more successful example.

Point is, when companies and individuals generate more cash than they can realistically spend (or want to spend), the excess needs to find a home and earn a return.

If that cash just sits in a bank account somewhere, it can get eaten up by account fees, taxes, & loss of purchasing power (inflation). No fun at all.

So they invest it. If there's less spare cash that means less to invest. If the downward trend in spare cash continues for long enough, people will be forced to sell their assets just to be able to live. If it gets bad enough, lots of people try to sell at the same time, stock prices fall, and that's generally ungood.

And this is where it gets a little more complicated...

Because the averages hide a lot. Let's go back to this chart 👇

Who's got the spare cash?

Let's grab a really simple example from the recent ADP report to illustrate. 👇

If you changed jobs. you got a big pay rise. You're probably not in the negative real disposable income category. But then take it a level deeper...

Who got the biggest raises? 👇

Pay gains also varied dramatically across industries. Workers in the leisure and hospitality sector — among the hardest hit by lockdowns — have seen wages climb 12.1% over the past year, according to ADP.

The trade, transportation, and utilities sector followed with an 8.4% gain in the year through August.

Construction workers, meanwhile, lagged the pack, with workers earning 6.7% more today on average than they did in August 2021.

Big pay rises = more savings to invest right? BTFD WOOOOO!

Sorry, facts coming at you. Check out this chart of average wages by industry. 👇

Statista

Accommodation and food services (Leisure & hospitality) is at the bottom of the list. A 12% pay rise at the bottom and a 12% pay rise at the top (information/ tech industry) are not the same if you're looking for evidence of excess savings needing a home.

When you combine that with the overall savings rate, the picture becomes even clearer 👇

(channel is the mean savings rate of approx 6.6% with 1 std either side)

We're not in the disaster zone, but the savings rate is below average. Bit of a headwind for stock valuations when that happens.

Not the end of the world though. If other assets are less appealing, capital can flow from one savings vehicle (such as bonds) into another, like stocks.

Are bonds less appealing right now? From a valuation perspective, they're certainly cheaper than they've been for a long time...

But do you want to allocate capital to say, the 10 year bond for a guaranteed 3.5% annual return when those bonds keep getting cheaper?

Maybe stocks are still a better option. Since 1992, on average, they've returned 9.89%.

But not all stocks are created equal... 👇

(the 9% of growth funds outperforming the index in this market environment either got lucky or they're worth keeping an eye on...)

By now, you're probably expecting the answer. Why IS the stock market crashing?

More sellers than buyers innit?

OK. Fine, technically, that can't be true because every transaction must have a buyer AND a seller to take place.

But there's a tendency of motivations. When sellers really want to sell but buyers are less keen, prices fall because sellers will keep dropping the price to entice buying.

The opposite is also true when buyers are more motivated than sellers...

It's the imbalances between the two sides that creates the changes in price.

An environment of lower savings tendency, with central banks hitting the QT button just as governments are looking to increase deficit spending (especially in Europe) combines with higher interest rates to create a more intense competition for capital.

There's no guarantee that the stock market will be favoured in this environment. And the longer it goes on for, the more likely it is that savers (both at the company and individual level) will have to indulge in a little quantitative tightening of their own and divest some of their holdings for liquidity.

Trade thousands of markets with Macrodesiac Partner capital.com 👇

Check out our reviews on TrustPilot 👇👇👇