- Fink 🧠

- Posts

- 💵 Self Doubt & Deconstruction

💵 Self Doubt & Deconstruction

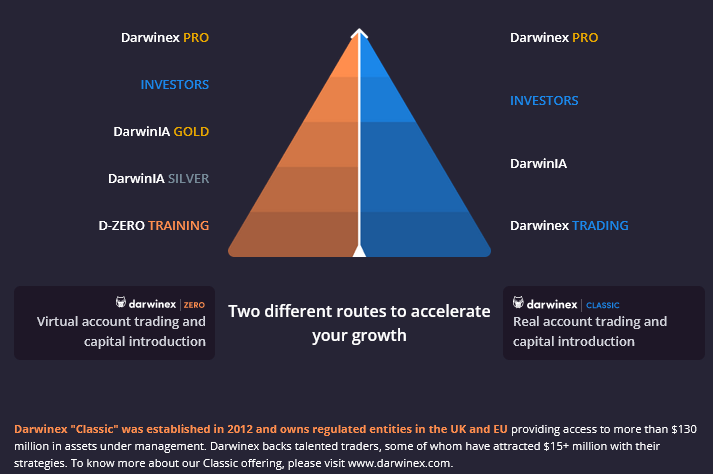

In association with DarwinexZero. Allocating real capital to successful traders 👇

You may have noticed that I share my success quite freely.

I post my ideas thoughts and observations in the discord chat and provide regular performance updates about the ideas and opportunities that come good and those (few 😉) that don’t.

In other words, I blow my own trumpet, regularly and loudly, and I won't let you forget it when I am right.

The truth is that I enjoy getting it right and want to share that feeling...

Am I boasting?

I hope not. To my mind, I'm reinforcing the message that there are opportunities out there if you know where to look and what to look for.

(if you want to see some proper boasting have a look at my Linkedin posts)

Given the above, you might think that I am 100 % confident in what I do. Indeed, it’s fair to say that I'm not shy in coming forward. Especially when I think I have a good idea or have hit the jackpot as it were.

A faint heart never won a decent order from a hedge fund. Since I used to make my living selling ideas to hedge funds I guess that it’s become second nature to me.

However, I do have moments of self-doubt from time to time and when I do I start to unpick my work.

Now, I can take criticism, constructive or not. And let's be honest the proof of the pudding in this game is in your mark-to-market performance.

I've been put down by the best of them (but they were mostly wrong)

Like Two Sigma when they told me that my ideas were not generating Alpha, even though the stocks I was suggesting moved two or three days before a wider market move.

Perhaps it was a form of “time travelling” Beta instead. Hard to fit that into your quant models...

Anyway, I digress... 😁

The point is that there are opportunities everywhere, and what's good for one might not be good for another.

That's what makes a market as the saying goes...

You may recall a few weeks ago that I created a list of under-appreciated S&P 500 stocks, through a well-documented screening process.

In case you have forgotten about the left behind list, there were 30 odd stocks which was created on June 12.

The table below contains those tickers and shows the one-month percentage change and their current RSI 14 reading, amongst other things.

Over the last month, the stocks have averaged gains of 12.15%, the median one-month gain is 12.86% and at the time of writing, just one of them was down in that time frame.

On the face of it, that looks pretty healthy performance but was it really?

De-constructing this... Had I just wasted my time and yours? Could we just have bought the S&P tracker SPY and not worried about all the leg work?

Well as it turns out... no we couldn't!

If you bought SPY one month ago today you would have seen a return of +4.96% which compares to the average 1-month return on S&P 500 stocks of +6.55% and the median 1-month return of +6.07%.

But hang on a minute... If you could get that +4.96% return by buying one stock, making just one trade... Could you realistically capture all of the returns from my list?

Are you going to buy 35 stocks and hold them? What would your expenses be? How about the opportunity costs of doing so?

This is where the doubts begin to creep in...

We have already seen the demise of un-exploitable 'opportunities' with the closure of the Night Shares ETF (NSPY) which sought to take advantage of the well-documented anomaly (clue here for any efficient market fans) that the S&P 500 makes most of its gains overnight rather than in the regular session.

The fund failed to attract assets and underperformed its benchmarks...

Speaking about the news of the ETF’s closure, Ben Johnson head of asset management client solutions at fund research house Morningstar said:

“Investment strategies that look great on paper are rarely worth more than the paper they’re written on,”

“That’s often because they don’t adequately account for real-world implementation costs.”

It's an easy trap to fall into...

One way that I try to avoid this trap is to keep blowing my own trumpet, giving you a running commentary on the performance of individual stocks within these lists.

I typically flick through the charts of the stocks thrown up by my screening processes, note the ones that speak to me, and set alerts for events in the price action that would set them in motion.

I don’t want to be accused of cherry-picking here. It's more of a distillation process to concentrate on a smaller group of stocks within the wider list.

With this in mind I give you Nucor (NUE). Up by +16.89% since June 12th and by +12.92% over the last month.

Victory lap out of the way. One final point. These lists can generate parallel ideas too.

Tim took this Nucor idea as an example of when to fade the trend (and more importantly when NOT to), using a simple combination of price behaviour and the 20 day moving average...

"Give us a sharp move into 170 and maybe things will get interesting"

We got that sharp move into 170, then pulled back to the 20 day moving average and rallied to a new high.

Even if you're more technically minded and looking to clip tickets rather than ride multi-week trends, there's value in screening for stocks that are primed to move...