- Fink 🧠

- Posts

- Sorry Americans, you're poorer than we realised

Sorry Americans, you're poorer than we realised

or how the US government lost a trillion dollars yesterday

How the US government lost more than a trillion dollars yesterday

Why the past isn’t a good guide for the future (& the present isn’t much better)

And the big question - Does it matter if you ‘time the market’?

🧠 The Big Brain

Uhhhh, where’d my savings go?

If you’ve been feeling inadequate about your measly account balance while the media banged on about TRILLIONS of pandemic excess savings, you’re gonna LOVE this.

See, economists, analysts & academics have spent months parsing data to try and figure out just how much of a buffer US households have to shield them from a downturn.

The pandemic stimulus injected some extra uncertainty into the calculations, but the general belief at the end of the last year was that those excess savings would be gone by now…

Now, we’re in September and that picture is really no clearer. It all depends who you talk to…

Have a chat with Moody’s and they’ll tell you “that excess savings peaked at $2.5 trillion in September 2021 and have declined $1.2 trillion to $1.3 trillion through July. By this estimate, 53% of excess savings remain”

Get on the phone to the San Francisco Fed & they’ll tell you that those savings are basically gone…

Their estimates show that excess savings peaked at $2.1 trillion and have since declined to virtually nothing, $190 billion in June

Moody’s know we love charts so they made this to compare the two views:

Pffft…. What’s a trillion dollars between friends?

If you’re not convinced by either of these measures, call in the authority on the matter: The US Bureau of Economic Analysis (BEA)

“Hi guys what’s your take on these excess savings?”

BEA: “Yeah, we’ve been meaning to contact you actually. There’s been a few, uh errors”

“Everyone makes mistakes guys. I’m sure it’s not that bad”

BEA: “We were out by $1.1 trillion”

Yep, as part of a big data revision, the BEA discovered that Americans Saved $1.1 Trillion Less Than Previously Thought From 2017-2022

This doesn’t mean economic Armageddon.

In the real world, nobody’s going to miss what was never there in the first place.

The concept of ‘excess savings’ has always been flawed.

Basing anything on assumptions layered on top of more assumptions, and at a time of huge uncertainty to boot isn’t a good recipe.

One other metric may be a more accurate gauge of consumer strength…

The Bank of America account data:

Two things leap out:

All groups well above the pre-pandemic level

The recent trend is clearly declining

Remember, inflation has devalued this by around 20% so although the level is currently higher, going back to the 2019 (100) level would be a huge decrease in purchasing power…

Which obviously wouldn’t be great for a consumer economy. For now though, that’s still tomorrow’s problem.

🔒 Premium subs: Look out for a report on the consumer discretionary sector later today

⚡ The Spark

Looking to the past as a model for the future ‘may mislead’

So says Dirk Schumacher. And he’s talking about stuff like this:

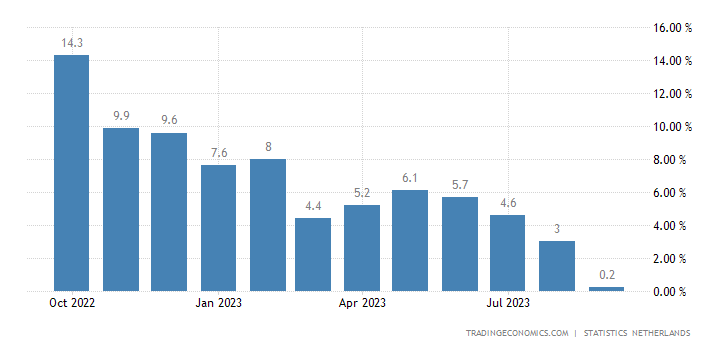

While eurozone inflation is currently running at 4.5%, Dutch inflation PLUNGED to just 0.2%.

Well done ECB, problem solved!!

If only. See, although energy prices fell by a whopping 38% YoY in the Netherlands, food prices rose by 10%.

It’s still oh so messy.

Germany’s economy is slumping too, opening the door to a second recession of the year, while the ECB ‘expects a rebound in economic activity in 2024’…

With large divergences across the 20 eurozone nations, setting policy is a tough task. Will there be a rebound?

"The rise in interest rates has been much quicker than in previous times so looking to the past as a model may mislead"

💡 The Lightbulb

Timing The Market

The evergreen investing adage “it's not about timing the market, but about time IN the market” is supposed to encourage investors to drop the ego & forget about being clever.

Just buy stocks every month or year and let the compounding magic do the work. Don’t try and buy bottoms, sell tops or any of that nonsense. Just keep buying…

Investec explain why here 👇

🧠 Here is a fantastic video from @Investec explaining how time in the market > timing the market

— Fink.Money (@Fink_Money)

2:37 PM • Sep 13, 2023

Schwab chimed in with their 2 cents on this too (with a twist)

They took five investing styles, added some cringe surnames, and shared the results.

Each received $2,000 at the beginning of every year for the 20 years ending in 2022 and left the money in the S&P 500

Pretty impressive returns for compounding 24k total investments. About those styles:

Peter nailed every low.

Ashley invested on day 1 of each year.

Matthew dollar cost averaged each month (2000 / 12 = 166.66 per month).

Rosie bought the peak every single year.

Larry stayed in cash/treasury bills waiting for market dips that never quite dipped enough to entice him in.

Rosie's results also proved surprisingly encouraging. While her poor timing left her $15,214 short of Ashley (who didn't try timing investments), Rosie still earned about three times what she would have if she hadn't invested in the market at all (like Larry)

There you have it. Even top-ticking the S&P 500 every single year is better than sitting on the sidelines…

Even nailing the ding-dong low doesn’t perform that much better than just sticking the cash in on the first trading day of the year.

Tempting as it is to sit out when the picture’s a bit gloomy, the best way to invest during uncertainty is soooo easy 👇