- Fink 🧠

- Posts

- 🔔 The Stagflation Apocalypse

🔔 The Stagflation Apocalypse

Have you heard?

The world is ending. Stagflation is imminent and our money isn't backed by anything other than blind faith.

Buy gold, trade it for food (until the armed mob arrives and encourages you to 'pool your resources')

Even Bitcoin can't fix this. 😢

🚨 Sarcasm Alert Triggered 🚨

Right, when we did the idiot's guide to inflation we missed this one off, so let's quickly define stagflation and then look at the merits of this argument

Stagflation is a situation in which the inflation rate is high, the economic growth rate slows, and unemployment remains steadily high.

Over to Dr Doom to explain why the apocalypse is nigh 👇👇👇

It's LOOMING, like a big scary monster or a giant. Are ya scared yet?

Let's see what he says...

Years of ultra-loose fiscal and monetary policies have put the global economy on track for a slow-motion train wreck in the coming years.

When the crash comes, the stagflation of the 1970s will be combined with the spiraling debt crises of the post-2008 era, leaving major central banks in an impossible position.

Wonder how he got the nickname Dr Doom... 😬

Sponsored: Don't miss out on the Eqonex airdrop! 👇👇👇

Everybody loves an airdrop. But the real question is, what is it going to be?

Enter your guess to win $100 in #EQO https://t.co/IKpJmlIu0M— EQONEX (@eqonex) July 16, 2021

Let's do some investigating of this stagflation narrative...

First up, is economic growth slowing?

Over to the IMF and their latest GDP growth projections

Yes and no...

It's slowing from a higher growth rate back down to a normal growth rate...

Hardly 'stagnant'...

Sponsored: Customers ready to spend and you don't accept crypto yet?

Utrust have you covered 👇👇👇

How about that inflation?

Big tick there. ✅

It's important to break it down though.

There's 'reopening' inflation and 'underlying' inflation. 👇👇

The lopsided US inflation story: about 90% of the core CPI was +0.2% in June (+2% YoY) and 10% of it jumped over 5% (+20% YoY). Autos (used, new, rentals), airlines, movies, hotels — there's your inflation. The skew is unprecedented.— David Rosenberg (@EconguyRosie) July 14, 2021

(Reopening inflation can also be filed under 'give everyone money to spend while supply chains are obliterated and see what happens')

Some underlying inflation pressures are there but it looks far more likely that various items will spike in the coming months (such as used cars in the past couple of readings) and have a disproportionate impact on the headline number.

Why have used cars surged so much?

a) Because rental companies had to buy them all back when they didn't go bankrupt (thanks WSB)b) Because new car production is struggling with a chip shortage. Or it was...

There was finally some good news for the auto industry today, with the world’s largest contract chipmaker saying the semiconductor shortage disrupting car production should ease in the current quarter.

Taiwan’s TSMC increased its output of microcontroller units, an important component in car electronics, by 30 per cent in the first half and MCU production is expected to be 60 per cent higher for the full year, compared to 2020.

“By taking such actions, we expect the shortage to be greatly reduced for TSMC customers starting this quarter,” said CC Wei, TSMC’s chief executive

There's no doubt that 'transitory' inflation is being stretched out further than many believed.

As long as it remains isolated to spikes rather than trends towards continuing higher costs for consumers, there's no reason to panic.

Key Fed voters are still pretty sanguine, so there's no reason to think they will respond by tightening policy sooner than expected.

Then there's the high unemployment.

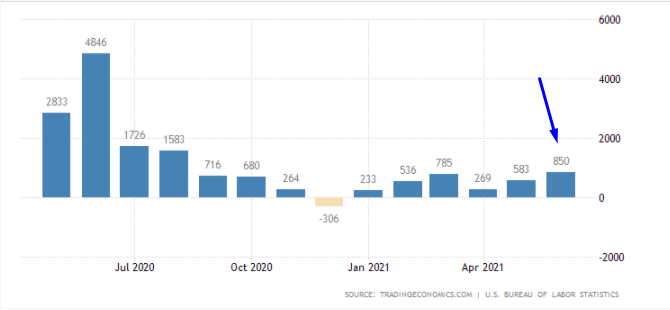

It's improving at a pretty decent clip as mentioned yesterday 👇👇

And 850,000 jobs were added in last months NFP 👇👇👇

Current levels of high unemployment are not a permanent fixture, and there's every chance we see over a million jobs recovered in a single month before the end of the year.

Bottom line: Don't listen to Dr Doom and the stagflation scaremongers.

There's some more juice in this recovery yet 👇

Have an awesome weekend!