- Fink 🧠

- Posts

- Stocks higher, Suez Canal cleared, infrastructure bill, NFPs

Stocks higher, Suez Canal cleared, infrastructure bill, NFPs

👆 These are all on my markets bingo card for the shortened trading week ahead...

Spring has sprung, the clocks have jumped forward in Europe and we're back to the 5 hour time difference again - Good Friday cuts this week short.

Stock futures aren't higher to start the week, but they ARE ticking up from the lows 🤔

Three trading days to settle month and quarter end...

Unless it's already settled?

David already covered the 'rebalancing thingy' in this piece 👇

...and JPM quant Marko Kolanovic added some depth in a note on Thursday:

Over the past few days, the equity market was fairly weak despite no real change in the macro fundamental outlook.

The Fed has remained dovish, the US stimulus was released as planned, and the pandemic and vaccination in the US are steadily improving.

The European COVID-19 situation is lagging behind that of the US

and UK, which was broadly expected and well understood due to vaccination delays.

Yet, if one looks at, for example, the Russell 2000, it has sold off more

than 10% (market correction) in the last 10 days, and there is broad weakness across both cyclical and growth stocks.

Many investors still like equities, but are afraid of month- and quarter-end rebalances that are broadly advertised as an event that will lead to equity selling.

In fact, many investors stated they are looking to buy equities in April under this pretext.

Here we explain why there will be no monthly selling, and indeed there could be buying of equities into month end.

A lack of these flows, and broad anticipation of ‘month/quarter-end’ effect,

could result in the market moving higher near term, all else equal.

Think I need a coffee after that, let me grab my mug...

Basically what Marko's saying (big fan of the candlestick detail)

The end of the week saw strong buying across all sectors, especially into Friday's close:

So... just buy everything, right?

Probably, although this Archegos fund situation seems to have weighed on markets a little...

Little is known about Archegos because of its family office status. And despite billions of dollars at stake, neither Archegos nor Teng Yue has filed a 13F quarterly disclosure listing the public U.S. equities they own.

They get around that requirement by using swaps, which also allow them to avoid regulatory limits on leverage for stocks, market participants explain.

For context:

@davidinglesTV

And it looks like Credit Suisse are going to be in the same boat...

CREDIT SUISSE IN PROCESS OF EXITING POSITIONS

CS: US-BASED HEDGE FUND DEFAULT COULD BE MATERIAL TO 1Q RESULTS

CREDIT SUISSE EXITING POSITIONS AFTER U.S. HEDGE FUND DEFAULT

CREDIT SUISSE: PREMETURE TO QUANTIFY EXACT SIZE OF LOSS— The_Real_Fly (@The_Real_Fly) March 29, 2021

Unconfirmed speculation that Credit Suisse will book losses in the region of $4bn on this...

More exposure to unwind before markets get the all-clear? Companies are already taking the opportunity to buy back their stock at a massive discount here...

There don't seem to be concerns of widespread contagion, which suggests markets will probably return to the path of least resistance sooner rather than later...

Oil lower as the Ever Given floats again

#OOTT | Egypt's Suez Canal Authority: Ever Given Has Begun To Be Floated Successfully

- Path Rectified By Up To 80%— LiveSquawk (@LiveSquawk) March 29, 2021

The OPEC meeting should be a non-event - OPEC sources did the heavy lifting last week...

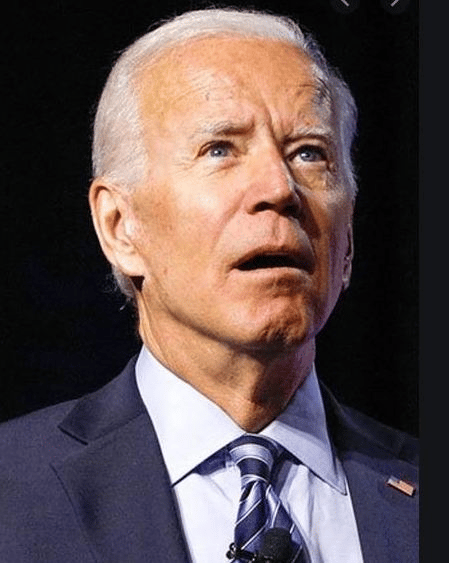

Biden's Big Plans

Biden's up again on Wednesday to announce the next phase of the Build Back Better initiative.

$3 trillion, maybe $4 trillion - What's a trillion or two between friends?

Away from the headline numbers and exactly what they're going to be spent on, we've got some politics to do...

If Dems want to push this agenda through this year, they only have one crack at doing it through the budget reconciliation route (without Republican support)...

The latest plan is to do the infrastructure part first and push for a bipartisan agreement on this

Sensible, get it out of the way first then move on to the things the parties disagree on - Politico noted the flaw in this plan...

That strategy raises an obvious question: Can Biden get 10 Republican senators to cooperate on “concrete and steel” when they know the tax and social welfare stuff they oppose is coming next via reconciliation?

"Shit"

NFP's

Not much to say on this other than the absolute insanity of the US Department of Labor insisting that the release goes ahead on Good Friday while the markets are closed!

Four day weekend

Anyway, the consensus is for 650-700k jobs to be added, and some are speculating that it could be as high as a million 🤯