- Fink 🧠

- Posts

- 🔔 Taxes, inequality & generational games

🔔 Taxes, inequality & generational games

Demographics are BACK, baby!

This huge macro driver (that has been consistently ignored by financial media) is finally starting to take hold...

Noticing these intergenerational inequalities is step one...

FT

The focus is now shifting to what this could signify in the future (and what could be done about it...)

The FT has been inspired:

'The economic cost of the pandemic has been borne disproportionately by the young'

And they are even running a series this week: 'A New Deal for the Young'

This divide is not new, and certainly hasn't been caused by the pandemic...

What IS new is a recession that saw U.S. household wealth GROW...

Whilst this sounds wonderful on the surface (why can't we just have more of THOSE recessions?), this wealth is unevenly distributed between those who own assets and those who do not...

Generally speaking, this divide is cross-generational: the older generations have more assets, and the younger generations... don't

(Somehow this has received far less coverage than the gender wage-gap, even as the gender wealth gap is closing rapidly without fanfare: By 2030, there will be more female millionaires in the world than male)

OK, back to the point...

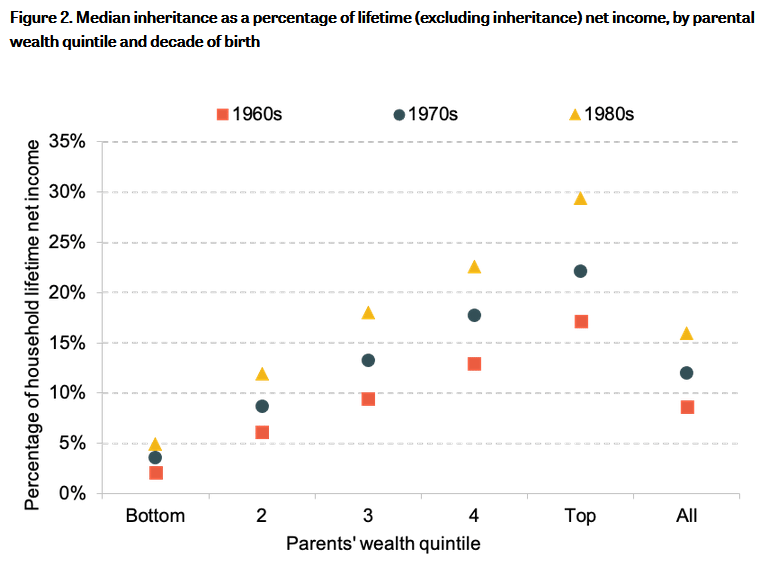

Like everything, this intergenerational inequality later compounds into intra-generational inequality...

If you had wealthy parents, you win the inheritance lottery...

Remember the 'American Dream'?

'...freedom includes the opportunity for prosperity and success, as well as an upward social mobility for the family and children, achieved through hard work in a society with few barriers'

Much of modern society was modelled on this ideal.

But is this true now?

To expand, an excerpt from an excellent Vincent Deluard note back in April 2020:

The great political divide of the 2020s will not be between conservative and liberal, rich and poor, urban and rural, “somewhere” and “anywhere”, minority and WASPs, globalists and nationalists, but the young versus the old.

For now, older generations have kept their hold on political power thanks to their higher turnout at the voting booth.

The next election will be disputed between two ageing boomers, but it will be this generation’s last gasp: the frail health and increasingly obvious cognitive decline of the Presidential candidates and Congressional leaders painfully illustrate the twilight of the boomer generation.

As a predominantly rentier class, boomers adopted policies designed to boost asset prices and suppress inflation, and they cut all social programs that were not exclusively spent on the elderly.

The interests of Millennials and Gen Z-ers who will seize power in this decade are antithetical to boomers’ priorities: asset prices must drop so that houses can be bought and families started.

Inflation will be required to cancel burdensome college debt.

Government spending will be redirected towards the new generations’ priorities, such as childcare, Medicare for all, and the environment, and away from the entitlement programs which benefit the old.

It looks like the old policies have run their course...

At some point in the next decade, something different will need to be tried...

Developed economies are on the Japanification path: High debt, low economic growth/stagnation, job insecurity, increasing suicide rates among young adults, it's a depressing prospect...

Policymakers seem to be roughly aware of the problem (which is why there is so much focus on higher taxation currently) but don't hold out hope for revolutionary policies until it is absolutely unavoidable (and I don't think we're quite there yet...)

What will this mean for markets?

Tomorrow's note will look at exactly this, starting with Mrs Watanabe's son:

Mr Yolo Beeches