- Fink 🧠

- Posts

- 🔔 Team Transitory: Doing A Newcastle

🔔 Team Transitory: Doing A Newcastle

Team transitory lost the great inflation battle of 2021 to the inflationistas. TT's about to make a comeback.

Inflation IS Transitory, OK?

I'm only half-joking. Although the best jokes are the ones you don't have to explain so maybe it's not a joke at all. Annnnyywaaaay.

We were caught out by the increase in inflation last year. We didn't expect it to last as long as it has, and it'll probably remain high and way above central bank targets for some time yet.

BUT....

Some of the things the transitoristas (yes, I just made that word up) were waiting for are starting to quietly surface. 👇

Apple cutting production of the iPhone SE by 20% (approx. 3 million units) due to weak demand

If it was just that alone, it could be dismissed. More noise than signal. Analysts point out that this is typically a slower sales period.

But there's this too... 👇

The slowdown is emerging in areas "such as smartphones, PCs, and TVs, especially in China, the biggest consumer market," TSMC Chairman Mark Liu said.

"Despite the slowdown in some areas, we still see robust demand in automotive applications and high-performance computing as well as internet of things-related devices," he said.

"We still cannot meet our customers' demand with our current capacity. We will reorganize and prioritize orders for those areas that still see healthy demand."

That last line caught my eye. One of the reasons given for the automotive chip shortage was the difficulty in switching production from one type of chip to another.

If TSMC anticipated this being a temporary phenomenon would they reorganize?

Next...

Analyst Tristan Gerra (Baird) noted that GPU inventories have risen in the supply chain after speaking to those in the industry, due to a number of factors, including weaker Asian demand, the Russian embargo and cryptocurrency miners selling hardware.

As a result, graphic card resellers have seen "below seasonal" revenue since December, with GPU prices having fallen 25% month-over-month this month, back to early 2021 prices.

"Current ASP (Average Selling Price) trends reflect softening demand as card availability improves,"

That's electronics covered. On the broader level, US wholesale inventories are increasing...

@LizAnnSonders

BBG

Time for the Bullwhip Effect to (finally) appear? 👇

Shipping and transport costs

We've been tracking the freight costs via Drewry for a while (as they were a big driver of the initial surge in supply chain costs). They're still way above pre-pandemic levels, but heading back down... 👇

It's not just shipping. This thread highlights the rejection rate on the trucking side too 👇

Tender rejections are the best indicator into realtime supply/demand in the trucking. A high rejection rate = trucking cos have more options in freight to pick from. (more options = more rejections; less options = less rejections). Why are rejections falling? Thread 1/n pic.twitter.com/2R8Bp2exnr— Craig Fuller 🛩🚛🇺🇦 (@FreightAlley) March 29, 2022

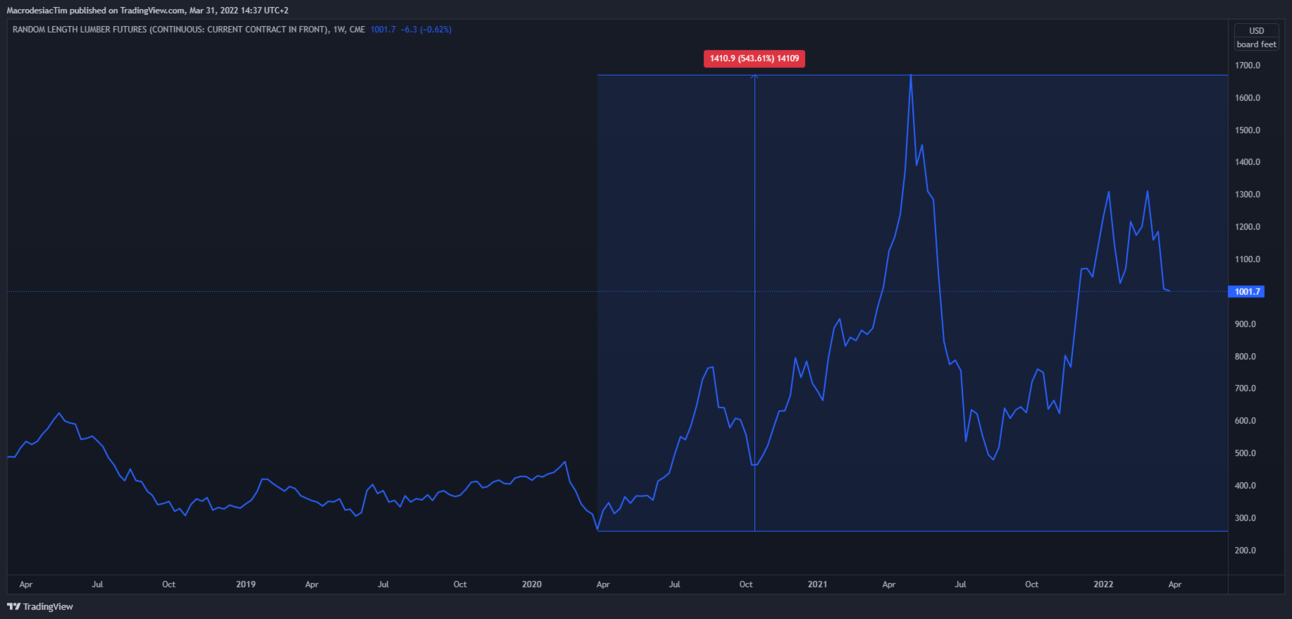

Remember The Great Lockdown Lumber Rally of 2020?

That's probably not happening again.

Canfor Mills are cutting production due to "unsustainable inventory levels" 👇

aka we are running out of room to put inventory.

Looking for May:July spread to collapse to confirm this. https://t.co/miljqtJBor pic.twitter.com/0Jda97PGEF— Stinson 🌲🪓 🏠 (@LumberTrading) March 31, 2022

UBS' Paul Donovan noted today that "It's all about demand" (emphasis is mine) 👇

US fourth quarter GDP was revised yesterday. It is pre-war data, and will be revised again. Nonetheless, there was a big shift down in consumer spending.

Lower income US households have spent their pandemic savings, and demand has to normalize.

The supply of goods was hitting all-time highs (Korean February production data, released overnight, was stronger than expected).

In the US the excess supply ended up in warehouses.

US household spending is income driven as it normalizes—but real wages are negative, at levels normally seen in recessions.

Today’s US personal income and spending data is for February (again, pre-war) but worth looking at.

While the inflation component will attract headlines, the trends in demand are ultimately more important.

And that data came in mixed.

While personal incomes printed bang in line with expectations (at 0.5% MoM), spending in February was below expectations (although there were significant revisions higher for January's data).

And the transition from goods to services spending is well underway. 👇

The $34.9 billion increase in current-dollar PCE in February reflected an increase of $93.8 billion in spending for services that was partly offset by a $58.9 billion DECREASE in spending for goods.

Within services, the largest contributor to the increase was spending for food services and accommodations.

Now, none of this implies an imminent crash, recession or whatever the doomsters latest thing is.

Inflation is a rate of change. There's a load of things pointing to an oversupply of goods just as demand normalises AND the comparisons to last year get harder to beat. 👇

Slowerflation seems likely. But it's hard to see inflation settling back at 2% any time soon.

It's still worth monitoring though. As inflation starts to slow, central banks could feel braver in reminding us of their original transitory call, and reuce the speed of tightening cycles.

What's the "Doing a Newcastle" about?

Newcastle United were rock bottom of the Premier League, winless after 14 matches. They won the 15th, then lost the next three and drew two.

One win in twenty matches.

The media were falling over themselves to pronounce them dead and buried. No team had ever lost so many games and not been relegated.

They won six of the next seven matches and now sit 14th, nine points clear of the relegation zone.

The data hints it could be the same for Team Transitory, turning it around & avoiding disaster (albeit a lot later than anyone reasonably expected).

Macrodesiac Premium members know our views on inflation. Short version: Debt and demographic issues aren't solved which means these levels of inflation are unsustainable.

Don't know what financial news stories are important and what's complete bullsh*t? Hop onto our filtered news channel.

It's completely free 👇👇👇

Subscribe to our YouTube Channel and stay up to date with all of our videos as they're posted. We'll keep expanding and adding more formats as we go!

Check out our reviews on TrustPilot 👇👇👇