- Fink 🧠

- Posts

- The election playbook

The election playbook

What will happen to markets after the vote is in?

There is so much chat about what will happen after the election but no one really coming out and saying where the market will go.

Here’s our take.

We’ll take the complicated view from Charlie MgEligot from Nomura first (click to read full note — very wordy and a bit complex but good to read)…

‘But outside of my repeated “Over-Hedged for Left-Tail, Under-Owning the Right-Tail” performance chase - thesis on Equities Index Options –positioning as a likely catalyst for a post Election rally in US Stocks, where we clear clustered event-risks and Volatility resets LOWER (see VIX / iVol / VVIX “Pre / Post -Election Path” -analogs below)—which then leads to a large “Positive $Delta” surge in the weeks ahead, as bleeding Downside Hedges which have slipped deeply OTM at that point, and are simply dragging performance to the point where they must be unwound (Dealers / MMs buy back Futures Delta), as simultaneously then Upside Hedges either pick-up Delta as Spot rallies, with an “under- capturing” Investor-base then being incentivized to “FOMO Chase” in 3 of 4 Election scenarios (everything -ex the low Delta shocker that would be “Blue Sweep”)— it is the “Systematic” flows from VRP universe (QIS Vol Carry, Prem Income ETFs, Overwriter / Underwriter Funds, Dispersion) which are then amplified in their market impact, and annihilating SPX realized Volatility through stuffing Dealers and MMs on ATM (Long) Gamma as a distribution suppressor—SPX 20d rVol is 9.3, 10d is 6.2, and 5 day realized Vol is 2.1!

I’ve also been speaking to one other likely contributor of massive $notional Equities demand in coming-weeks...that being “Vol Control” / “Target Volatility” –strategies who are imminently reallocating’

What does this all mean?

Well, we distilled it to three main points for you.

Event risks will be cleared and volatility is expected to decrease.

Many investors have been overly cautious, holding protective positions against market drops. These positions may become unnecessary and be closed out, leading to buying pressure in the market.

If the market starts to rise, investors who haven't fully participated might rush to buy in, fearing they'll miss out on gains.

Verdict: any election outcome is bullish.

We have to look at macro events and geopolitical risk as numbers.

Right now, there is over demand for downside protection because of the geopolitical risk.

It doesn’t matter what the risk is, it’s just herd behaviour.

If we examine the market via a function of numbers and decisions being made based on balance of supply and demand, right now there is EXCESS demand for puts, protecting the downside…

And excess demand for calls on the upside…

SOLELY BECAUSE OF THE ELECTION.

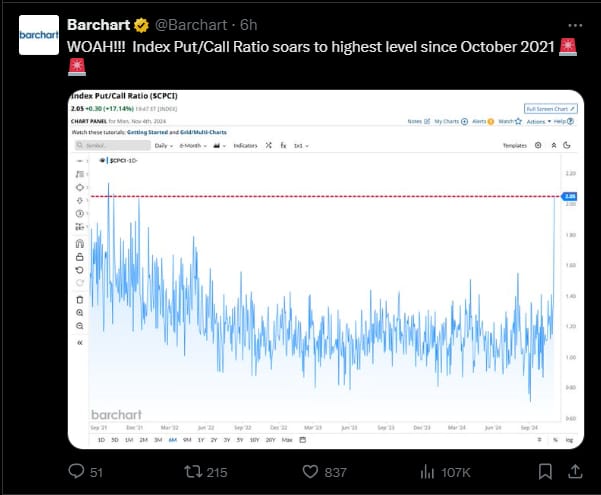

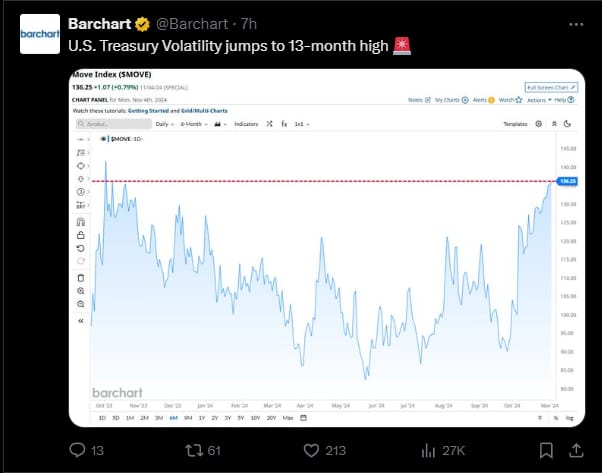

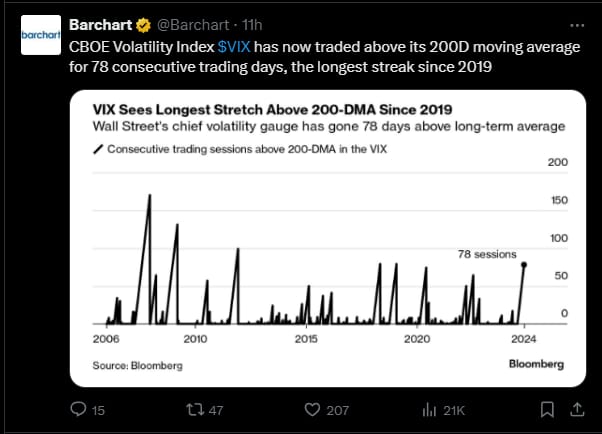

Just look at the evidence…

There are a few things we can take from this, some sentiment and some technical aspects.

If we look at provenance/sentiment, we can see that Barchart is going for the outrage and fear angle.

Barchart is a tech firm with media as awareness.

You get more coverage when you talk about negative stuff — but the doomer narrative as we know is not how markets function, which leads into the more technical aspects.

Look at the pictures relating to the VIX.

We are looking at a market where traders are uncomfortable with the default, which is a lower VIX price and selling volatility.

So right now, they are dislocated — they do not want to be long volatility.

But they are long volatility as a protection of their underlying portfolio of stocks, bonds, and whatever other assets they might be comprised of (remember, hedge funds have to hedge rather than unwind, because hedging is more cost effective than selling down their portfolios, and a lot of the time, they can actually make money from the hedge too).

If we as degen gamblers understand that all this behaviour is due to one event — the current uncertainty of one event — but then when that event is cleared we have certainty, then we have a thesis.

This is effectively what McEligot is saying in his piece — currently we are out of whack with excess demand for protection and an unwind of this excess demand will send stocks the other way!

But it could also send a very underloved asset the other way too.

I’ve been keeping my eye on Ethereum recently and as a contrarian bet, I like it for a long hold.

In pink is the 200 weekly moving average and in my view, there is no reason for it to be down here for this long given the fact BTC is likely to rally, pulling other cryptos up with it.

All we are focused on is clearing big risks.

The next one will be the Fed’s cutting cycle into year end, coupled with the next NFP — which if good, will SERIOUSLY catalyse risk for another leg up, all but confirming 6k by year end on the SPX.