- Fink 🧠

- Posts

- 🔔 Things are getting more expensive

🔔 Things are getting more expensive

Today's Opening Belle is brought to you by our partners, Equos and Utrust.

Looking for a crypto exchange? Give Equos a try (they've also just released an exchange token too, similar to BNB and FTT

Driven by the launch of $EQO, @EQUOS_IO's first exchange token, and a significant increase in major institutional clients, EQUOS has recorded daily volumes in excess of US$100 million and total volume of over US$1 billion in April to date.

Learn more: https://t.co/gENcYi6M89— Diginex (@DiginexGlobal) April 19, 2021

And want to incorporate crypto payments into your business? Definitely use Utrust

utrust.com/business

History in the making! For the first time merchants will get additional profit for their payments instead of losing on fees. Reverse Staking & Compound Yield are coming soon! 🚀 Read more: https://t.co/enTNxssX6Q pic.twitter.com/LgeVaZc7JU— Utrust (@UTRUST) April 14, 2021

We only work with partners we know, trust and have a strong product.

No exceptions.

Right, there's been a load more coverage of inflation lately, headlines that companies are increasing prices, chatter about pricing power and so on...

Let's take a look at what the inflation boogeyman actually impacts...

BBG

one, two, inflation's coming for you...

🙄

We've made our thoughts pretty clear regarding inflation: it's coming, but continual price increases aren't on the cards - prices will most likely increase then stabilise at the new levels...

Inflation is already filtering through...

JP Morgan

And everyone sees it coming...

Naturally, it follows that companies cannot just absorb price increases, they will try to pass them on to customers...

Procter & Gamble announced on Tuesday it will hike prices on baby care, feminine care and adult incontinence products in September to respond to higher commodity costs

“This is one of the bigger increases in commodity costs that we’ve seen over the period of time that I’ve been involved with this, which is a fairly long period of time,” Chief Operating Officer Jon Moeller told analysts.

After the price increases go into effect, P&G is planning to hold onto market share by trying to increase consumers’ perception of the value of its products and introducing new or upgraded items.

My sources suggest we should look beyond the headlines 👇

They want to keep revenue up, so obviously the easiest way to do so is to increase the price on something that is pretty demand inelastic.

You need baby formula.

And they have pushed to introducing more premium products too.

Read the fucking details.— David Belle (@davidbelle_) April 21, 2021

So I did....

In P&G's earnings call, CEO Moeller said:

our overall objective is to cover cost increases. It's important.

I want to emphasize that because I didn't say cover or restore margin.

It's covering cost increases, which is inherently a little bit margin dilutive. But we think that strikes the right balance...

We've mentioned before just how much of this inflationary pressure is down to the dramatic increase in shipping costs:

It's a delicate balancing act...

Whilst it's obvious that those costs are going to decrease at some point businesses need to strike the balance between increasing prices enough to cover the extra input costs, but not too much that the customer brand loyalty is put in jeopardy...

This is going to be a headwind for earnings growth, something Citi noted after the call yesterday:

CITI: " .. we came away from the call feeling that the next several couple quarters will likely see incremental pressure and that results could be bumpy. Consequently, we are stepping to the side and downgrading $PG to a Neutral rating."— Carl Quintanilla (@carlquintanilla) April 21, 2021

Taking it a step further: the winners will be the companies who can successfully pass some of the cost increase onto customers...

The BIG winners will be those who can maintain that higher pricing even as freight costs normalise...

Every crisis gives birth to a wave of innovation, and freight is a very obvious target...

Global airlines are pushing deeper into the frontier of digital transactions for cargo, aiming to strengthen a financial lifeline while the pandemic continues to ravage passenger revenue.

The latest example is Turkish Cargo, which soon will connect with freight forwarders to offer real-time bookings online through WebCargo, a part of the Freightos platform for air, ocean and trucking markets.

Unlike passenger travel, air cargo has been much slower to digitize pricing and booking. The pandemic is changing that. With the addition of Turkish Cargo, airlines representing about 22% of global air-cargo capacity will be online, up from less than 10% at the end of 2019.

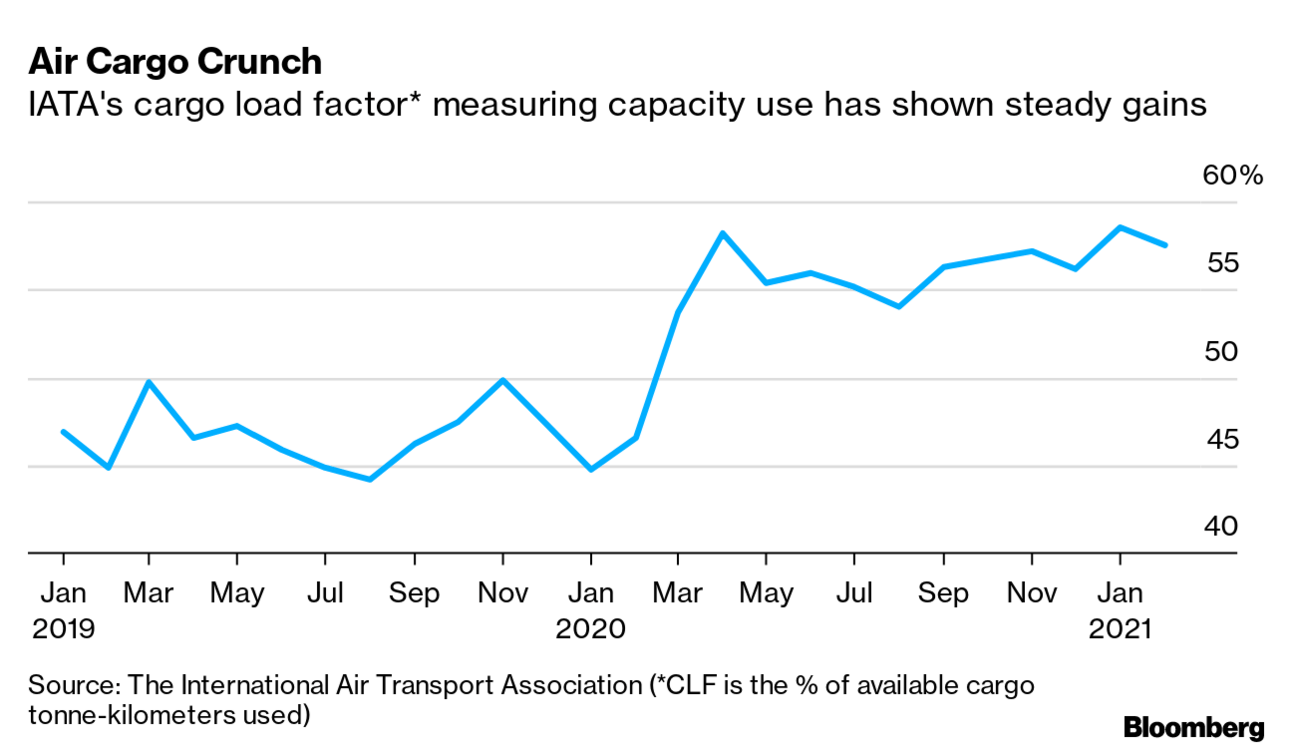

There are still big efficiency gains to be made. A gauge of capacity in use compiled by the International Air Transport Association has steadily risen over the past 14 months to levels that are high by industry standards, but it still was less than 60% in February.

We will be diving deeper into this trend for premium members: don't miss out, go premium 👇