- Fink 🧠

- Posts

- uk equities to make comeback?

uk equities to make comeback?

And do I switch from ignoring them to getting involved?

Maybe.

Traditionally I have always said UK equities should be left well alone.

Those of you that have been reading for long enough will know that.

But there are some factors building up that might be worth taking a look at.

Check out Leverage Shares. They offer leveraged and inverse ETPs based on popular stocks, ETFs, and custom indices - alongside unleveraged tracker ETPs and exchange traded commodities (ETCs).

All products are physically backed and listed on Europe’s largest exchanges.

There are three key components that stand out for me.

UK equities are considerably undervalued versus US peers

I think most are very aware of this.

We can look at this chart for more detail here.

On TikTok I just used the PE ratio to keep things simple.

This is a crude measure, namely because the US is so tech heavy with so many growth names, and so they command a higher P/E.

However, the UK therefore has a sectoral gap.

Where are they able to fill this gap?

Well, we have a HUGE high tech manufacturing sector as well as having some of the smartest minds globally (yes, surprising).

Let’s explore some other measures which shows the discount to US equities.

We can see that on every measure, UK equities are undervalued relative to US counterparts.

Now it might be possible to make the argument that US equities are overvalued, but as I said above, this is largely a function of the US being growth and tech heavy, implying people are really looking at pricing earnings growth far into the future.

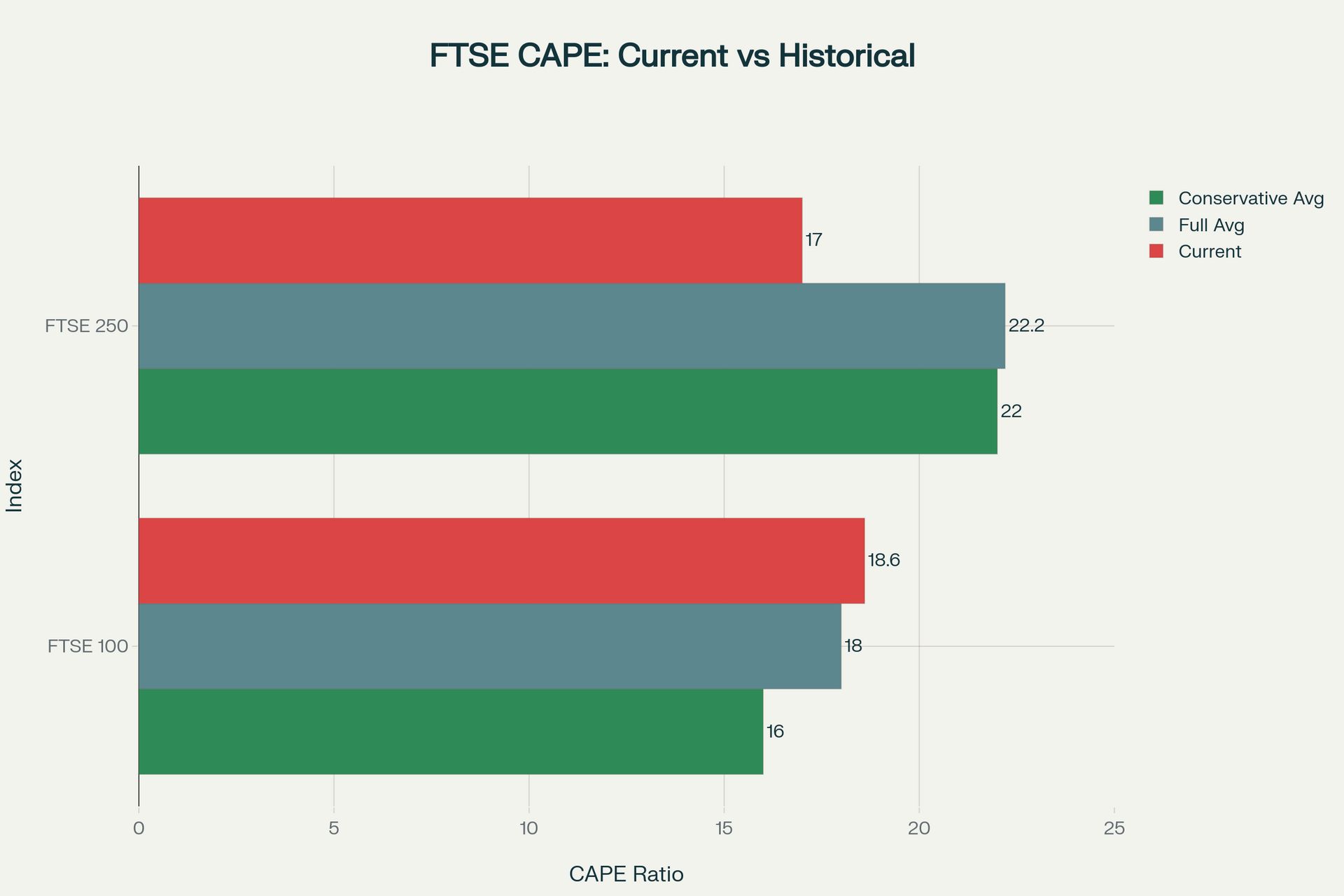

What’s really interesting is looking at CAPE (cyclically adjusted price to earnings ratio).

Because that shows a genuine discount - however, it is trading at roughly its historical average…

What is VERY interesting to me is that the FTSE 250 is currently very undervalued to its own historical average.

What does this mean?

Well, given the rally in the FTSE 100 this year, all eyes are on it and many are suggesting that UK equities are back based off that — a very fair assumption.

But the more domestically concentrated FSTE250 is the one now to look at.

See, the FTSE100 has beasts like AstraZeneca, GSK, Shell, BP etc shifting it higher.

All well and good.

But if we want to lift UK equities, we need more innovative firms getting a bid.

One thing I have always said is that real money (pension funds) need to enter the market, and we might be on the cusp of that happening…

The Pension Story

Despite me having some loathing from IFAs who constantly talk about saving for retirement (I’d actually like to enjoy my money when my knees are still working, actually), pensions are important, especially when it comes to the market.

What many don’t know is defined benefit pension schemes have been a key driver of UK gilt demand.

Not anymore — they closed in the early 2000s but are still running off. Check this chart.

What we’re seeing here is that gilt demand is falling from pension funds and will continue to fall for many decades going forward.

Why is this important?

Well pension funds have a duty to allocate capital as best possible — and it’s a lot of capital too.

Where might they end up putting the money?

Well, portfolio managers tend to be a little lazy and use a lot of modelling.

Since 2008, the regulations have caused them to shift to bonds over equities, and now UK pension funds have the lowest amount of holdings of domestic UK equities relative to history.

I want you to imagine an elastic band in your head.

When the band gets stretched so far and you give it a bit of relief, it tends to want to spring back.

That’s what I reckon happens here…

The band springs back in favour of UK equities and that real money bid comes back.

Whenever you see data outliers like this, you need to pay attention.

Because guess what % of assets are allocated to UK equities in DB and DC pension schemes currently…

Go on, guess.

That’s a joke.

Australia has FORTY PERCENT.

So in short, there is a lot of room for this to grow — there just needs to be retail investor buy in.

Side note, I had a meeting with the CEO of Edison Investment this morning, a massive research provider for listed equities.

Fraser told me one of the issues is that these corproates do not think it is worth interacting with UK retail investors, which is largely why we don’t have rockstar CEOs.

We can change that.

Precedent

One of the things that I love about the Rolls Royce stock, other than being long it from 2020 and still long it, is it sets the right precedent.

Do cool things, things that will change the world, and you will be rewarded with a higher share price.

I kinda like that system too — if you thought Nvidia would become the key player behind AI in 2020, you could be a millionaire a few years later.

But more importantly, despite everyone, including me, saying the UK is a crap place to list, it shows there is actually the potential for a mammoth share price growth, in spite of everyone going to the US for their momentum and home run trades.

More companies should be looking at the Rolls Royce way of doing things.

Not necessarily inventing a revolutionary way of making energy, but innovating then shouting about it almost every day.

Shove what you’re doing in our faces and someone will come knocking with more and more money.

It’s the US way of doing things.

Here we have a stiff upper lip over money though, and I think we do ourselves a huge disservice.

Rounding off

There are opportunities in the UK market.

Fraser and I spoke about a client of theirs today called HG Capital Trust.

They are a private equity trust which invests in private tech companies across Europe in the SaaS space.

Have you heard of them? Me neither, but look at their chart.

They only invest in profitable private firms, and their chart does the talking.

So I think I’ve been ignorant of the UK, mainly because there is simply the opportunity cost issue.

But largely because US firms market themselves in a better way.

We can do the same, and I feel us at Fink can be a good champion for them.

I will still mainly be US focused, but the UK market is garnering more and more of my attention, especially since US capital flows are strong right now whilst many are still ignoring potential momentum opportunities.

Before I go, watch our latest YouTube video on why day trading is complete BULLSHIT, and like, subscribe and comment.

PS. I do not look like this anymore and need to get new thumbnail pictures. The bulk was brutal.

Access 600+ CFDs across a wide range of asset classes. Or trade Futures and Options through leading global exchanges.

And if you’re a busy professional interested in simplifying & systemising your investing approach, check out our Investment Assessment - we created The Fink Academy for people like you.