- Fink 🧠

- Posts

- U.S. yields resume rise, yen weakens

U.S. yields resume rise, yen weakens

Yields are on the up again...

USDJPY is hammering on the door of (and now through) that 110 handle too...

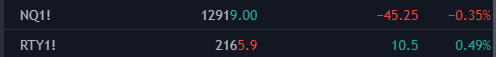

Yesterday, Nasdaq (NQ -0.02%) 'outperformed' Russell (RTY -2.84%) and we're seeing the opposite so far today...

Yields rising, Russell recovering - are we doing the value thing again?

European Opening Calls:#FTSE 6768 +0.47%#DAX 14887 +0.47%#CAC 6040 +0.40%#AEX 700 +0.37%#MIB 24531 +0.45%#IBEX 8530 +0.45%#OMX 2189 +0.32%#STOXX 3899 +0.42%#IGOpeningCall— IGSquawk (@IGSquawk) March 30, 2021

News Clippings

Traders expect OPEC+ to hold output cuts: Reuters reported that Russia will support broadly stable oil output by the Organization of the Petroleum Exporting Countries and allies including Russia (OPEC+) in May, while seeking a relatively small output hike for itself to meet the rising seasonal demand.

Saudi Arabia is prepared to accept an extension of the production cuts through June, and is also ready to prolong voluntary unilateral curbs amid the latest wave of coronavirus lockdowns, a source briefed on the matter said on Monday.

Suez Canal reopens after giant stranded ship is freed: Egyptian officials say the backlog of ships waiting to transit through should be cleared in around three days, but experts believe the knock-on effect on global shipping could take weeks or even months to resolve.

Crypto Firm Ripple to Take 40% Stake in Asia Payments Specialist Triango: Ripple said in a statement Tuesday that the tie-up will help meet demand for the use of its affiliated token XRP in transactions. The announcement comes about a week after Brooks Entwistle, a former executive at Goldman Sachs and Uber Technologies, became Ripple’s managing director of Southeast Asia.

Erdogan fires central bank deputy governor in latest shake-up: names local Morgan Stanley executive as replacement. Other senior economy officials have left posts this month. The chief executive of the stock exchange’s operator and the general manager of Turkey’s biggest lender, state-run Ziraat Bank, both stepped down, and Erdogan fired the head of the Turkish wealth fund.

The Turkish wealth fund

Little of interest in the news, nothing exciting on the calendar either: German CPI, European sentiment/consumer confidence and Fed's Quarles, Bostic & Williams the only things of mild interest.