- Fink 🧠

- Posts

- 🔔 Will the chip shortage become a chip crisis?

🔔 Will the chip shortage become a chip crisis?

Today's Opening Belle is brought to you by our partners, Equos and Utrust.

Looking for a crypto exchange? Give Equos a try (they've also just released an exchange token, similar to BNB and FTT 👇

https://t.co/PTBZFEmyzN exceeded $2 billion in volumes over the last 30 days—a 300% increase driven by a strong interest in $EQO and an increase in onboarding and trading volumes from both retail and institutional traders.

EQUOS is part of Diginex $EQOS.https://t.co/LLotgFiJ1f pic.twitter.com/BozKYBZrZR— EQUOS (@EQUOS_io) May 4, 2021

AND the UK's FCA has just approved Digivault, which provides institutional investors with a solution that makes digital asset custody simple and secure.

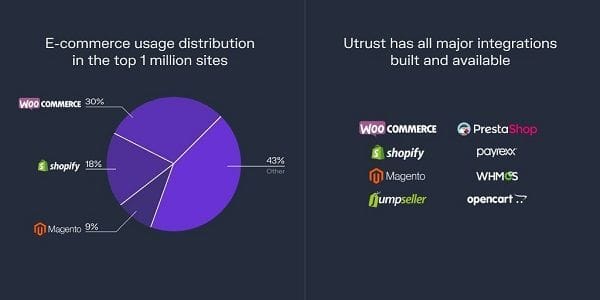

Want to incorporate crypto payments into your business? Definitely use Utrust.

utrust.com/business

✅ Reverse Staking;

✅ Compound yield;

✅ #Crypto Settlements;

✅ New markets;

✅ More crypto currencies;

✅ @HoldHQ Tier2

✅ $UTK

✅ Invoicing

We got it all covered in our most recent community AMA!

Have you missed it?

Read the recap -› https://t.co/LHO1XxslaV pic.twitter.com/FPGuJysKf9— Utrust (@UTRUST) May 10, 2021

We only work with partners we know, trust and have a strong product.

No exceptions.

Unless you've been living under a rock, you will have seen stories of the global chip shortage.

The general premise? We all bought loads of stuff while we were locked in our homes, and this excessive demand combined with Covid-driven production and shipping constraints caused a big supply-demand imbalance that is proving difficult to fix.

It should be fine soon though because we'll all stop buying so much stuff and will instead enjoy experiences like getting p*ssed in the pub or getting p*ssed on holiday or...

You get the idea...

It's the transition from a 'stay at home' economy to a 'where do I even live' economy and we'll all be out (out out) enjoying ourselves far too much to buy electronics.

This drop in electronics demand is a window for supply to catch up, then everything goes back to normal again. Simples.

That was the theory.

Expectations and reality don't have the greatest relationship.

It looks increasingly likely that the chip shortage will be with us into next year...

The chip manufacturing industry is heavily dominated by Taiwan 👇

TrendForce

And wouldn't you know it?

Just when Taiwan are supposed to be catching up on production while everyone goes on holiday, they're suffering the worst drought in 56 years 👇

The announcement on water restrictions comes as Taiwan on Wednesday raised its COVID-19 alert level for the whole island.

Previously it had just been Taipei City and New Taipei under level three restrictions -- one step below a de facto lockdown.

The island has also suffered two major blackouts in less than a week as demand spiked amid the drought and a power plant malfunction.

For Hsinchu, the government plans to suspend the use of water two days a week and reduce daily consumption by 17% compared to normal levels in its science park, where chipmakers of Taiwan Semiconductor Manufacturing Co. and United Microelectronics are based, if the situation worsens toward the end of this month.

The daily water reduction plan in New Taipei and Taoyuan -- home of the island's print circuit board manufacturing hub -- will increase to 15% from 13%. Large industrial water users in Tainan and Kaohsiung will face a cut to 13% from the current 11% from Friday.

Covid restrictions, power blackouts and a drought...

Suck it up and get on with it lads, I mean, how much water can it take to make a microchip?

Ah...

Chipmakers use water to clean wafers throughout the production process, as well as keep factories and the air inside them clean.

In 2019, the latest year for which data is available, TSMC’s daily water consumption in Taiwan was 156,000 tons per day

My precious...

Simple problems need simple solutions.

Why don't competitors just make MORE?

They're already operating at, or near full capacity.

Whilst major chip manufacturers are investing big sums in new facilities, they'll take between 3 & 5 years to complete...

Foundry Wars will see demand met over the medium-term:

In March, Intel re-entered the foundry business, positioning itself against Samsung and TSMC at the leading edge, and against a multitude of foundries working at older nodes.

Intel announced plans to build two new fabs with a capital spending budget set at $20 billion in 2021.

Earlier this month, TSMC responded by raising the ante, increasing its capital spending budget to $30 billion, up from $28 billion in its previous forecast.

In total, TSMC plans to spend $100 billion over the next three years. TSMC, Samsung and others also are building new fabs.

But this doesn't solve the short-term shortage.

ING's Iris Pang thinks this could either lead to an increase in global inflation or force the world to go backwards as far as technological needs are concerned 👇

Goldman Sachs estimate that 169 US industries are impacted and assume a 20% supply shortfall that lasts three quarters (based on East Asian export data and company commentary) :

Some computer chips have no available substitute, and if output of every product that uses chips were to decline proportionately, the drag on 2021 GDP would be around 1%.

But in practice the drag will likely be smaller, because chips will be allocated to the highest-value uses and some firms will find ways to reconfigure production (modify designs in order to swap in available chips, produce nearly-finished products and store them until chips becomes available, or simply produce other products).

As a result, we think a downside risk of ½pp is more realistic if firms find themselves unable to adapt

Auto-production will continue to be impacted for the rest of the year. Used car sales were already through the roof last month...

Hertz played their part 👇

Overall, it looks as though these transitory Covid effects will be with us for a while longer, especially if the drought conditions persist in Taiwan.

Something to keep a very close eye on.