- Fink 🧠

- Posts

- How Will Inflation Impact Gold & Oil?

How Will Inflation Impact Gold & Oil?

And can we start talking seriously about inflation yet?

Everyone's already started actually...

Apparently inflation is making a return and it's probably Joe Biden's fault...

Renowned economists Olivier Blanchard and Larry Summers gave their opinions...

Let me double down and go through some numbers. I agree that too much is better than too little and we should aim for some overheating. The question is how much. Much too much is both possible and harmful. I think this package is too much.— Olivier Blanchard (@ojblanchard1) February 6, 2021

The Biden plan is a vital step forward, but we must make sure that it is enacted in a way that neither threatens future inflation and financial stability nor our ability to build back better through public investment.https://t.co/h1ebAM82Xr— Lawrence H. Summers (@LHSummers) February 5, 2021

Blanchard & Summers are renowned.... for being wrong

The next time Olivier Blanchard is right about macroeconomic theory or projections will be the first time. https://t.co/0eA42emi1T— Ben Hunt (@EpsilonTheory) February 7, 2021

On Summers...

"In terms of judgment, in forecasting his record has been atrocious"

- Joseph Stiglitz

“Why would we listen to the economist who admits he went too small last time if he’s warning us to go small again? I swear this town is nuts. It’s like people can only remember thirty names and so they just keep going back to the same people.” - Sen Brian Schatz

The big question - Are we opening Pandora's (Inflation) Box?

Enormous fiscal spending and a Federal Reserve willing to run it hot...

Surely things will overheat, and the Fed will send the liquidity addicts to rehab, right?

Ignoring those economists track record, these comments do bring the inflation debate back to centre stage...

ING

Nonetheless, the risks are looking more and more skewed to a longer period of above-target inflation, particularly given additional fiscal stimulus is in the offing

Nordea

We see a clear risk that Powell and the Fed starts sounding a bit like Summers and Blanchard as soon as inflation is actually running above target, which could lead to an internal Fed debate on the appropriate balance sheet policy already before summer.

It is after all much easier to talk about average inflation targeting, as long as you are not tested on actual inflation that runs hotter than the target

There's plenty more along these lines...

So...

Let's run with the idea and presume that inflation IS coming.

Will the Fed shit the bed at the first signs of inflation, start tapering in a blind panic and hike interest rates as soon as humanly possible?

Mr Mcgregor says the Federal Reserve will do "fookin nuttin"

Conor makes a great argument, but maybe we should ask Fed Chair Powell himself.

'Hey JP - are you and the gang scared of too much inflation?'

…it helps to look back at the inflation dynamics that the United States has had for some decades and notice that there has been, you know, significant disinflationary pressure for some time for a couple of decades.

Inflation has averaged less than two percent for a quarter of a century and the inflation dynamics from the flat Phillips curve and low persistence of inflation changes over time.

It evolves constantly over time but doesn’t change rapidly. It’s very unlikely anything we see now would result in troubling inflation.

Of course if we did get sustained inflation level that was uncomfortable, we have tools for that.

It’s far harder to deal with too low inflation.

As Tim Duy notes, in his excellent Fed Watch...

The Fed is not afraid of inflation getting out of control.

The Fed is more afraid of making the mistakes of the last recovery and withdrawing support for the economy too early.

The Fed will not hike rates until inflation exceeds 2% on a sustained basis. This is not the forecast of inflation, this is actual inflation.

The Fed expects us to take these promises seriously and stop worrying about rate hikes until something interesting happens on the inflation story.

And stop worrying about tapering until we see some data confirming the growing optimism for this year’s outlook.

Vice Chair Clarida backed this up in mid-January...

“We are not going to lift off until we get inflation at 2% for a year.

We are trying to tie our hands.

We are saying we are not going to hike until we get to 2%,”

There's also the employment equation...

Back to JayPow...

In a world where almost a year later we’re still almost 9 million jobs (at least) short of maximum employment, people out of the labor force, it’s very much appropriate that monetary policy be highly accommodative to support maximum employment and averaging two percent over time.

If you think this sounds in ANY way like the Fed standing ready to withdraw support then reply to this e-mail NOW with your credit card details and we'll send you a FREE SAMPLE of our LIFE-CHANGING RANGE OF HOMOEOPATHIC PRODUCTS (flexible payment plans available).

Summing up...

The most-impacted sectors haven't even 'reopened' yet

Actual Inflation readings (not expectations or forecasts) need to be sustainably above 2% for a YEAR before rate hikes

9 million (at least) people need to find employment again

January's NFP showed an increase of 49k jobs - only 8.951,000 to go

Morgan Stanley don't expect the Fed to even talk about withdrawing stimulus this year...

I think the earliest we'll hear any talk of tapering is August, depending how the employment picture evolves.

Goldman recently upgraded their forecasts across the board.

They now see Q2 GDP at 11% instead of 10%, with additional fiscal measures at $1.5 trillion up from $1.1 trillion...

Their conclusion?

Fed taper QE early in 2022, and rate hikes begin early 2024.

They're not alone in this thinking...

A recent Bloomberg survey found that 72% of economists expect the Federal Reserve to apply a first taper by Q1 '22, about 35% expect it before then, and 100% of economists expect a first taper by Q2 '22.

The current bet is that the Fed will allow the economy to run hot (inflation in 2 to 3% range) but not too hot (so no rate hikes).

It's another Goldilocks scenario...

Traders are generally backing up such a view in light of the steepening of the US Treasury curve and rising market-based measures of inflation expectations.

Given that Chair Powell has said the FOMC will provide plenty of heads-up, market participants will be looking for guidance fairly soon.

'Fairly soon' is unlikely to be Wednesday when Powell speaks on the State of the U.S. Labor Market for the Economic Club of New York.

Keep an ear out for any comments on 'upside risks' to the Fed's forecasts though...

Powell has promised to give advance guidance to avoid a 'taper tantrum' - and has repeatedly said that the Fed will need to see 'substantial progress' towards their goals before doing so...

@GregDaco

The employment picture is still ugly (as you would expect), and if we take the Fed at face value, we will need to see 'substantial progress' back towards 4.5% unemployment before they will even signal easing...

What does that mean?

Let's say end-22 (23 more jobs reports) = 435k/mo NFPs(!!!)

The problem is that it’s over 20 million jobs so these numbers would need to be doubled. Unemployment is going to destroy any economic recover. @Halsrethink— Live Monitor (@amlivemon) February 8, 2021

Let's go back to Powell's quote...

In a world where almost a year later we’re still almost 9 million jobs (at least) short of maximum employment, people out of the labor force, it’s very much appropriate that monetary policy be highly accommodative to support maximum employment...

What qualifies as substantial progress towards that goal?

4. 5 million jobs recovered?

5 million?

Definitely something to watch intently in the coming months - at some point the improving employment data could become a drag on equities.

Improving employment = Fed will remove the punchbowl = party over (oops out of time)

As for inflation, we may well get a temporary shift due to transient factors: pent-up demand, stimulus cheques (they're not checks you heathens), and supply chain disruption.

All of this should settle down fairly quickly, then we will return to 'normal'... 👇

We could see a consumer credit cycle led by housing but without wage inflation I think we still see muted inflation pressures. Japan has an unemployment rate near 2% and still hasn’t seen any. Technology, imports and remote workers will all help to work against DM wage growth.— The Long View 🍥 (@HayekAndKeynes) February 7, 2021

We (David & Tim) had a chat about inflation and some other stuff yesterday - Listen (and follow us) on Stereo where we'll be doing this more often:

But first...

Bloomberg's Julian Lee makes the case that 'Oil’s Recovery Is Too Fast for Its Own Good'...

Recent increases in crude prices and the rapid drawing down of visible stockpiles will undoubtedly lead to calls for a more rapid raising of production targets than was envisaged in December.

That may well reignite tensions between the co-leaders of the group, Saudi Arabia and Russia, with the potential for more brinkmanship that could undermine the price recovery.

The amendment agreed to in December allows for monthly changes in the collective target of up to 500,000 barrels a day until a total of 2 million barrels has been added back.

The first such increase came into effect last month.

Given that Russia and Kazakhstan received their shares of the next increase spread over February and March, any output increases for April should, by rights, exclude them. I can’t see that going down well in Moscow.

Moscow may well want to claw back market share relinquished through the supply cuts more quickly than is comfortable for Saudi Arabia and others.

The rest of OPEC+ may have little alternative but to accede to its demands. They remember only too well what happened last time they failed to keep Russia on board — a production free-for-all that saw prices tumble below $20 a barrel. Nobody wants that.

Something we mentioned previously - the possibility for OPEC+ tensions to rise again and the unattractive Risk/Reward of getting long at these levels.

We now find ourselves at the inflection point...

ING

...while the market outlook continues to improve, there remain demand risks in the near term. Until vaccination rates pick up around the world, it is difficult to be overly bullish on oil demand, with it still held back by lockdowns in certain regions and restrictive international travel.

Meanwhile speculators continue to increase their net long in ICE Brent. Over the last reporting week, speculators increased their net long by 7,900 lots to leave them with a net long of 346,053 lots as of last Tuesday, with the bulk of the buying over the reporting week being fresh longs rather than short covering.

Clearly given the move in the market since last Tuesday, it is very likely that the current net long is somewhat larger.

Obviously if there was to be another demand wobble, the risk is that you do see a sizeable amount of these longs liquidating.

If we stick with positioning data, but focus on WTI, it does seem that higher prices are attracting more producer hedging, with the gross producer/merchant/user short increasing by 69,808 lots over the last week, and leaving this gross short at the highest level since June.

Further strength in the market would likely only attract further producer hedging, which should start to provide some resistance to the market.

U.S. shale drilling activity is picking up too, the Baker Hughes Rig count hit 299 last week (vs the low of 172 in August last year.)

Still nowhere near pre-pandemic levels, mind you...

The EIA forecasts that U.S. production will increase by ~800,000 bpd between February 2021 and December 2022.

Russia would much rather that didn't happen, sensing an opportunity to secure more market share...

Saudi Arabia would prefer to limit output and push prices higher...

This is exactly what the disagreement was about last March (and around the same price level)...

The next OPEC+ meeting isn't until the start of next month, but the rumblings often start well in advance...

Keep an ear out in the coming weeks...

Here's the latest output data via S&P/Platts...

My Shiny Pet Rock & Inflation

Revisiting this post from mid-January...

and taking this from Westpac...

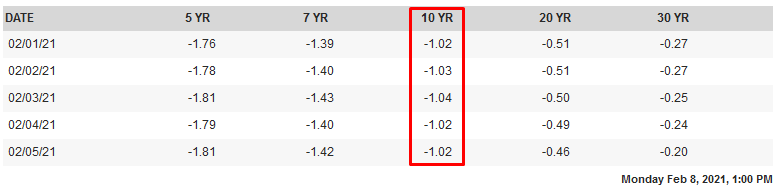

Why does this matter for gold?

Gold and real yields are tightly linked.

Gold is permanently at zero yield.

The (very) simple version - With real yields at -1.02%, gold offers an inflation-adjusted return of +1.02%.

If that black line (real yields) heads back towards zero, gold will take a hit and lose appeal vs bonds.

If this comes at the same time as U.S. out-performance/a strengthening dollar, gold should get absolutely smashed...

What to watch?The US 10Y yield keeps topping out at 1.2%, while the breakeven inflation rate keeps edging higher (currently at 2.22%).

10Y yields have quite a bit of headroom - most analysts see yields at 1.5% to 1.75% by year end.

Inflation expectations have less room to continue higher from here.

If we see 10Y yields move higher while inflation expectations top out (~2.3% is my best guess for now), then real yields will begin their ascent and gold should fall...

Track real yields via the 10 Year TIPS or here.

For me, gold has been in a downtrend since the peak in August last year (coincided with US 10y yields bottoming at 0.5%)...

Real yields up = downwards pressure on gold

Real yields down/flat = upwards pressure on gold...

These themes should drift in and out of focus for the next few months so we will keep revisiting them...

Ping us back any questions by e-mail or in the discord...!