- Fink 🧠

- Posts

- 🔔 What is a Zombie Company?

🔔 What is a Zombie Company?

Today's Opening Belle is brought to you by our partners, Equos and Utrust.

Looking for a crypto exchange?

Give Equos a try (they've just released an exchange token, similar to BNB and FTT)...

...and exceeded $200M of daily volume, a new record, after increasing volumes by more than 40% in just a month, driven by their exchange token, $EQO 👇

EQUOS is part of Diginex $EQOS. Find out more here.

AND the UK's FCA has just approved Digivault, which provides institutional investors with a solution that makes digital asset custody simple and secure.

Want to incorporate crypto payments into your business? Definitely use Utrust.

utrust.com/business

✅ Reverse Staking;

✅ Compound yield;

✅ #Crypto Settlements;

✅ New markets;

✅ More crypto currencies;

✅ @HoldHQ Tier2

✅ $UTK

✅ Invoicing

We got it all covered in our most recent community AMA!

Have you missed it?

Read the recap -› https://t.co/LHO1XxslaV pic.twitter.com/FPGuJysKf9— Utrust (@UTRUST) May 10, 2021

Economic commentators LOVE to talk about zombies.

Zombie companies, the zombie economy, even zombification crops up every so often...

But it's not always clear what a zombie is, or why anyone should care...

Let's try and clear things up.

First up, a zombie company is basically defined as follows:

a company that needs bailouts in order to operate, or an indebted company that is able to repay the interest on its debts but not repay the principal.

They have no 'spare' capital to invest and grow, so exist as the Walking Dead, close to insolvency, making just enough to service debts/refinance but with no real hope of recovering.

This brief post by Daniel Lacalle highlights all of the negative associations.

Basically...

A “zombified” economy rewards the unproductive and taxes the productive

Destruction of savings through financial repression and the collapse of real wage growth.

Savers pay for zombification through low interest rates, under the mirage that it “keeps” jobs.

This limits the positive impact of creative destruction (industrial mutation that continuously revolutionizes the economic structure from within, incessantly destroying the old one, incessantly creating a new one)

Perhaps the simplest way of thinking of this is to imagine a zombie landscape.

The living dead are slowly shuffling about, getting in everyone's way.

They don't eat brains. Instead they consume all of the same resources as other humans, so there's less to go around the healthy population.

Want a loan?

Gave it to the zombie firm. Reached our lending limit for the month.

Want a government work contract?

Gave it the zombie firm, they need the work or they can't pay their debts

Want a table at the restaurant?

Fully booked. Zombie special tonight

Over time, too many zombies consume too many resources without providing sufficient value to society to compensate.

Many economists argue that central banks should load higher interest rates into their monetary shotguns, kill off the zombies and build a more productive economy/society.

It's a solid argument, but there are tradeoffs...

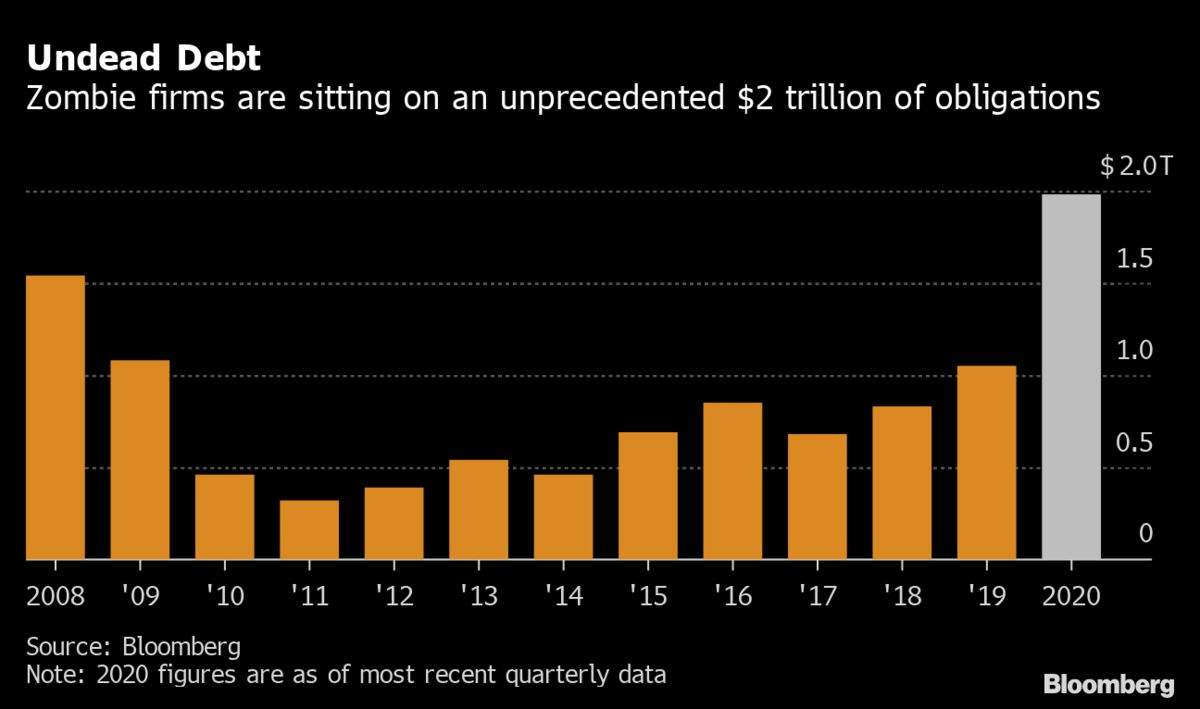

~20% of U.S firms are considered to be zombies...

And they've racked up some pretty sizeable debts

In Europe, a similar picture emerges...

Hiking rates does not solve this problem without a tradeoff.

The idea of creative destruction is based on growth.

Innovative businesses drive the weakest out of the market.

So what if firms fail?

They are being replaced AND society benefits from the higher overall productivity and prosperity.

Hike rates now and kill the zombies.

What replaces them?

Where will people work?

Europe already has high unemployment...

That's not creative destruction, it's just destruction.

Now, developed economies are at the bottom of the monetary barrel.

Japanification is a genuine prospect.

Who survives the zombie apocalypse?

The innovators! 👇

Central banks can take a back seat. Their work is done.

The spotlight is on governments now.

Those who remove barriers and foster environments for innovation and entrepeneurial spirit will prosper.

Those who don't...?