If you’ve ever felt like the stock market is rigged for the big players, you’re sort of half right.

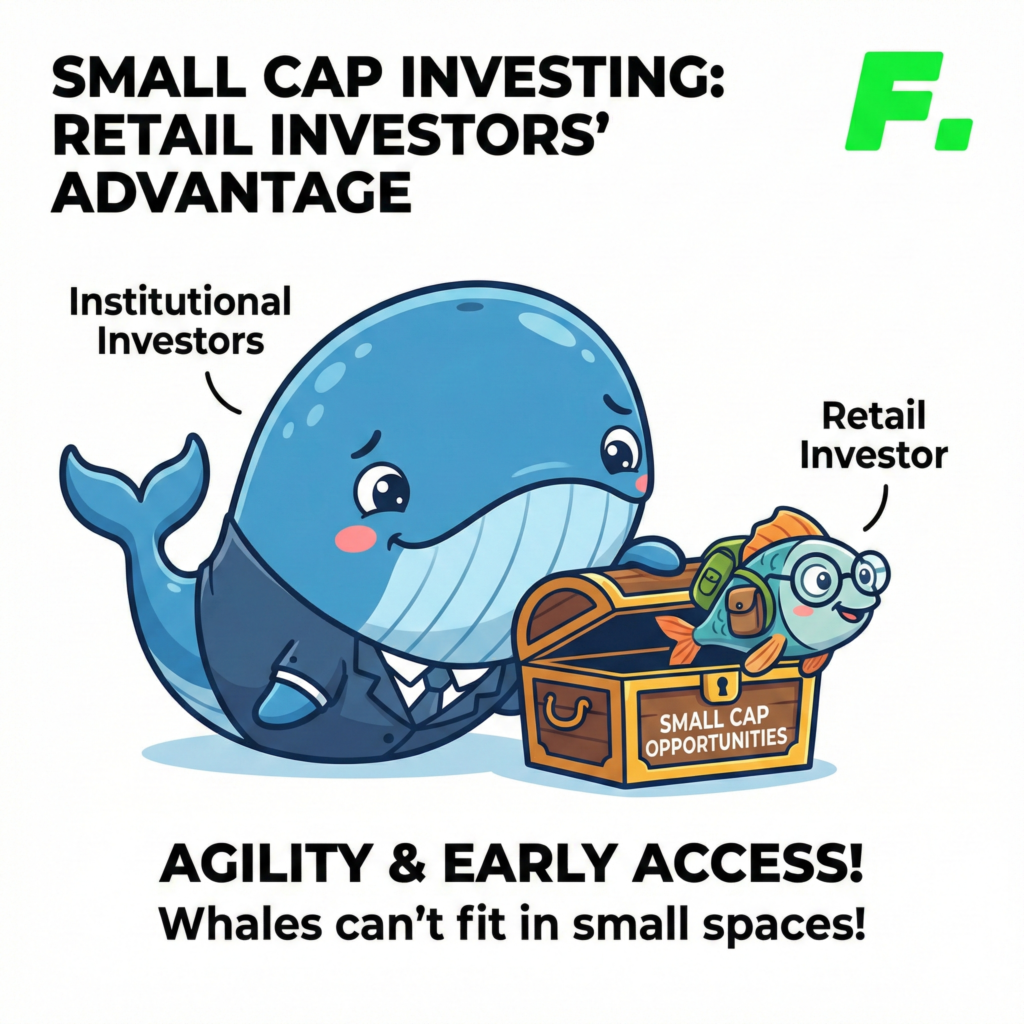

The giants – pension funds, sovereign wealth funds, massive asset managers – run the show in the S&P 500. But down in small-caps? Those guys just can’t compete.

You’ve got an advantage when your account size is a small fish in a big pond…

The usual story is that retail investors are dumb money meant to lose. But in small cap momentum investing, you have one massive advantage money can’t buy…

Speed.

Here’s how to use that speed, filter out the junk, and catch some outsized gains.

The Size Trap: Why Whales Can’t Swim Here

To get why you have the edge, imagine being a fund manager for a minute.

You run a growth fund with £5 billion. To move the needle, you need to bet at least £50 million on a stock.

Now, look at a hot small company worth £300 million.

If you try to buy £50 million of that stock, you’re trying to buy 16% of the whole company. You can’t just click buy.

- You’d wreck the price: trying to buy that much would shoot the price to the moon before you even got your shares.

- Too much paperwork: buying that much triggers strict SEC/FCA etc rules. Everyone sees your move, and you get locked in.

- The Trap: even if you get in, you can’t get out. If bad news hits, you can’t sell 16% of a company without crashing it to zero.

This is your edge. You can drop £10k or £50k into that stock instantly. You can get out just as fast.

The big funds literally cannot touch these stocks until they get much bigger. By the time they show up, the 300% gain has already happened.

The Filter: Sorting the Gold from the Shite

Let’s be real.

The small-cap world is full of traps. For every winner, there are ten losers waiting to take your cash. The UK AIM market is notorious for dogshit stocks. You need a filter to spot the real deals from the rug pulls.

At Fink, we ignore the hype and check the plumbing.

1. The Survival Check (Cash Burn)

We don’t expect these companies to make a profit yet. But they must be able to survive.

- The Check: look at their cash. Do they have enough money in the bank to survive 12 months without asking for more?

- The Red Flag: if a company is worth £50m, has £2m in the bank, and burns £1m a quarter, they will dilute you. They’ll issue new shares, and your stock price will tank. Avoid them.

2. Is Anyone Watching? (Relative Volume)

Momentum is simple physics. Mass x Velocity.

In markets, mass is volume.

- The Signal: we want small cap stocks trading at 2x to 5x their normal volume on green days. This means something big happened and a crowd has arrived.

- The Pocket Pivot: look for days where the buying volume is huge compared to the selling volume from the last few weeks.

3. Skin in the Game (Insider Buying)

Big funds check the balance sheet but we check the incentives.

- The Screener: look for insiders buying with cash. We don’t care about free shares they got as a bonus. We want to see the CFO reaching into their own pocket to buy shares at $4.00. That tells you they don’t think the company is going bust.

The Drivers: The 2026 Hot Sectors

Stocks don’t move in a vacuum.

Right now, the money is pouring into these three areas.

1. The AI Plumbers (Industrials)

The Buy Nvidia trade is crowded. Smart money is now buying the physical stuff needed to keep AI running.

- The Driver: data centres are overheating. The power grid is struggling.

- The Small Cap Play: look for boring companies doing liquid cooling, wiring, or AC upgrades. They are seeing tech-like growth because Microsoft and Google are desperate for their hardware.

- The Signal: watch for breakouts in Industrial ETFs that trickle down to the parts makers.

2. Biotech: The Post-Ozempic Trade

The weight-loss drug boom changed everything. Now, the money is chasing the side effects.

- The Driver: as people get thinner, they worry about looking older or losing strength.

- The Small Cap Play: companies fixing muscle loss and loose skin. As millions lose weight fast, demand for muscle-preserving drugs is exploding.

- The Signal: clinical trial results. Good news here creates massive price spikes because big pharma companies are desperate to buy these smaller labs.

3. Energy: The Nuclear Comeback

The world realised wind and solar can’t power AI alone. We need consistent power.

- The Driver: governments are finally making it easier to build Small Modular Reactors (SMRs).

- The Small Cap Play: junior uranium miners and parts suppliers for these new reactors. These stocks move fast when the price of uranium moves.

- The Signal: watch the spot price of uranium. If it jumps, these miners usually follow a few weeks later.

The Execution: Don’t Bet the Farm

Finding the stock is just step one. Trading it without blowing up your account is how you actually make money.

Because small caps are a bit mad, we recommend putting only a small chunk of your portfolio here. Think of it as your juice. Keep the rest of your money safe(r).

To do this right – to read the charts and manage risk – you need a solid system. You can’t just wing it.

Join the Fink Academy

We’ve packed this entire strategy into a proper training course.

For £1499.99, The Fink Academy gives you the professional playbook to trade these like a pro (without the institutional handcuffs).

Note: the community is separate, but you can join that later when you’re ready.

Get the knowledge first. The market isn’t going anywhere.

Stop gambling and start managing (click here)

Summary: Your Playbook

The advantage is yours, but only if you stay disciplined. The big guys move slow. You move fast.

- Screen for huge volume and low supply of shares.

- Filter for enough cash and insiders buying.

- Target the hot stories: AI Plumbing, Muscle Biotech, and Nuclear.

- Execute with a small part of your cash and strict rules.

The market talks. It’s telling you that being small is your superpower. Stay agile, and hunt where the whales can’t swim.

Frequently Asked Questions (FAQ)

What’s the biggest risk with small caps?

The main danger is liquidity risk when things go wrong. Entering is easy, but if a small-cap stock gets hit with bad news (like a failed drug trial or an SEC probe), the buyers can vanish. This leads to gaps where the price drops 50% instantly, blowing right past your stop-loss. Always size your positions assuming the worst could happen.

How is this different from value investing?

Value investors look for $1.00 of assets selling for $0.50 and are willing to wait years for the market to agree. Small cap momentum investing doesn’t care about intrinsic value – it cares about price action and demand. We’re buying stocks because they’re likely to be priced higher next week because institutions are chasing the float, not because the P/E ratio is low.

Why do Hot Sectors matter so much?

Small caps rarely move on their own. They move in sympathy with the big dogs. If Nvidia rallies, small-cap chip equipment makers rally. If a large biotech gets bought out, the whole small-cap biotech sector bids up, speculating on who’s next. Being in the right sector gives you a tailwind that can lift even mediocre stocks.

What is a Float and why should I care?

The Float is the number of shares actually available for the public to trade (Total Shares minus whatever insiders are holding).

- Low Float (< 10 Million shares): extremely volatile. A tiny amount of buying can send the price up 100%, but selling crashes it just as fast. These are pure momentum vehicles.

- High Float (> 50 Million shares): much harder to move. It takes massive institutional volume to get these moving.

Can I do this in my pension or retirement account?

Technically, yes, but it’s not really meant for your core nest egg. Small cap momentum is a high-turnover, high-risk strategy. It needs active management and tight stop-losses. It’s best suited for a dedicated active trading pot, not the money you need to pay the rent next month.

What tools do I need to find these stocks?

You don’t need a Bloomberg terminal to do this.

- Stock Screener: tools like Finviz or TradingView to filter by Market Cap ($50M – $2B), Relative Volume, and Performance.

- News Feed: a real-time news squawk (like Benzinga Pro or a Twitter/X list of breaking news) to spot catalysts the second they happen.

- Charting Software: to visualise those moving averages (9EMA, 20SMA) and Volume Profile.